Dashboard

Poor Management Efficiency with a low ROCE of 8.29%

- The company has been able to generate a Return on Capital Employed (avg) of 8.29% signifying low profitability per unit of total capital (equity and debt)

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.27 times

The company has declared negative results in Dec'2024 after 2 consecutive positive quarters

Stock is technically in a Bearish range

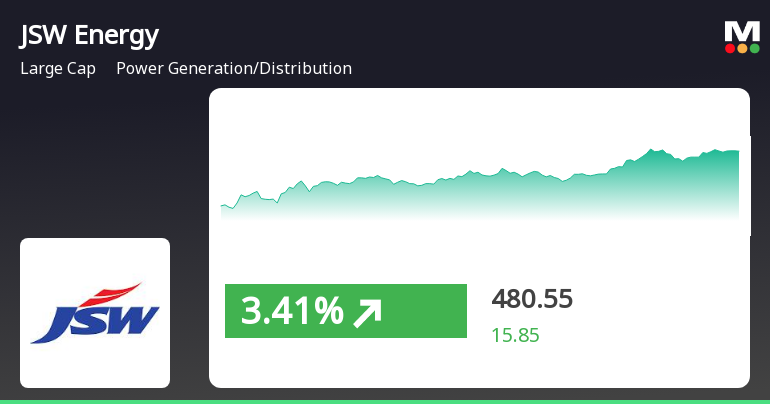

Price Summary - 04:51 PM on 02-May

Performance Today

Underperformed Sector by -0.74%

Day's Low

Stock touched an intraday low of Rs 468.25 (-2.26%)

Weighted Average Price

More Volume traded close to Low Price

Moving Averages

JSW Energy is trading lower than 5 day, 20 day, 50 day, 100 day and 200 day moving averages

Stock DNA

Power Generation/Distribution

Rs 84,181 Cr (Large Cap)

43.00

22

0.42%

0.87

7.00%

2.99

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: May-31-2024

Risk Adjusted Returns v/s Sensex

Returns Beta

News

JSW Energy Shows Signs of Recovery Amid Broader Market Mixed Signals

JSW Energy saw a rebound on April 30, 2025, after six days of decline, reaching an intraday high. Despite this uptick, the stock remains below key moving averages, indicating ongoing performance challenges. In the broader market, the Sensex opened higher, with mixed signals observed in market trends.

Read MoreJSW Energy Faces Mixed Technical Signals Amidst Market Underperformance

JSW Energy, a prominent player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock price is currently at 464.70, down from a previous close of 477.40. Over the past year, JSW Energy has experienced a decline of 22.95%, contrasting with a 7.52% return from the Sensex, indicating a notable underperformance relative to the broader market. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but leans towards a mildly bearish stance monthly. Meanwhile, the Bollinger Bands and daily moving averages indicate bearish conditions. The KST presents a mildly bullish outlook weekly, yet monthly trends suggest a bearish sentiment. In terms of stock performance, JSW Energy has faced challenges, particularly in the short term, with a significant ...

Read MoreJSW Energy Sees Surge in Open Interest Amidst Ongoing Stock Decline

JSW Energy Ltd, a prominent player in the power generation and distribution sector, has experienced a notable increase in open interest (OI) today. The latest OI stands at 40,487 contracts, reflecting a rise of 3,965 contracts or 10.86% from the previous OI of 36,522. This uptick in OI comes alongside a trading volume of 15,383 contracts, indicating active market engagement. Despite this increase in OI, JSW Energy's stock has underperformed its sector, declining by 2.39% today. Over the past five days, the stock has faced consecutive losses, accumulating a total decline of 9.08%. The weighted average price suggests that more volume has been traded closer to the stock's low price, and it is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. Additionally, delivery volume has decreased significantly, with a reported 11.45 lakh shares delivered on April 25, marking a 36.5...

Read More Announcements

Pumped Hydro Storage Power Procurement Agreement With Uttar Pradesh Power Corporation Limited

01-May-2025 | Source : BSEPumped Hydro Storage Power Procurement Agreement with Uttar Pradesh Power Corporation Limited

Credit Rating Affirmation - JSW Energy (Utkal) Limited

23-Apr-2025 | Source : BSECredit Rating Affirmation - JSW Energy (Utkal) Limited

Acquisition Of O2 Power Midco Holdings Pte. Limited And O2 Energy SG Pte. Limited By JSW Neo Energy Limited - Update

09-Apr-2025 | Source : BSEAcquisition of O2 Power Midco Holdings Pte. Limited and O2 Energy SG Pte. Limited by JSW Neo Energy Limited - Update

Corporate Actions

No Upcoming Board Meetings

JSW Energy Ltd has declared 20% dividend, ex-date: 31 May 24

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Tecnicals key factors

Shareholding Snapshot : Mar 2025

Shareholding Compare (%holding)

Promoters

None

Held by 33 Schemes (2.45%)

Held by 429 FIIs (13.43%)

Jsw Investments Private Limited (17.82%)

Life Insurance Corporation Of India (6.57%)

3.58%

Quarterly Results Snapshot (Consolidated) - Dec'24 - QoQ

QoQ Growth in quarter ended Dec 2024 is -24.67% vs 12.44% in Sep 2024

QoQ Growth in quarter ended Dec 2024 is -80.33% vs 63.53% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'24

Growth in half year ended Sep 2024 is -1.13% vs 14.29% in Sep 2023

Growth in half year ended Sep 2024 is 20.61% vs 11.10% in Sep 2023

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -1.99% vs 13.94% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 12.50% vs 13.74% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'24

YoY Growth in year ended Mar 2024 is 11.17% vs 26.50% in Mar 2023

YoY Growth in year ended Mar 2024 is 16.58% vs -14.51% in Mar 2023