5Paisa Capital's Technical Indicators Reflect Mixed Market Sentiment Amid Performance Fluctuations

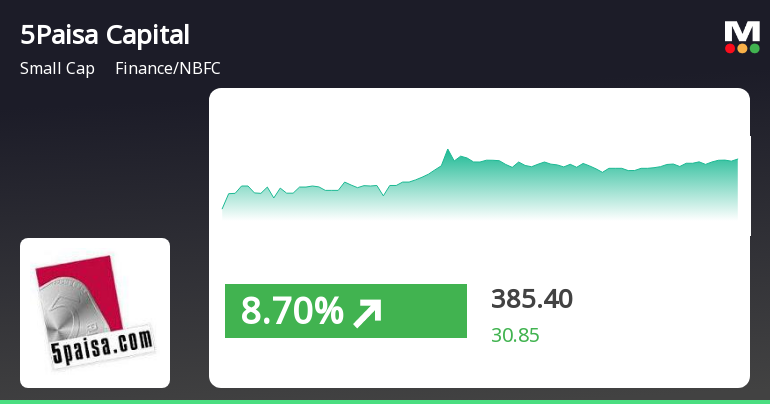

2025-04-02 08:09:175Paisa Capital, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 372.55, showing a notable change from its previous close of 355.20. Over the past year, 5Paisa has faced challenges, with a return of -29.83%, contrasting sharply with the Sensex's gain of 2.72% during the same period. In terms of technical indicators, the weekly MACD and KST remain bearish, while the monthly RSI indicates a bullish signal. The Bollinger Bands and moving averages suggest a mildly bearish stance on both weekly and monthly bases. Notably, the stock's performance over the last month has been more favorable, with a return of 6.41%, compared to the Sensex's 3.86%. 5Paisa Capital's performance over longer periods shows resilience, particularly in the five-year span, where it has returned 216.79%, significantly outp...

Read More5Paisa Capital Experiences Valuation Grade Change Amidst Market Challenges and Mixed Metrics

2025-04-01 08:00:435Paisa Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 355.20, reflecting a notable shift from its previous close of 373.00. Over the past year, 5Paisa has faced challenges, with a stock return of -29.56%, contrasting sharply with a 5.11% gain in the Sensex during the same period. Key financial metrics for 5Paisa Capital include a PE ratio of 17.35 and a price-to-book value of 1.93. The company's return on equity (ROE) is reported at 10.92%, while its return on capital employed (ROCE) is at -13.51%. These figures highlight the company's current performance landscape. In comparison to its peers, 5Paisa Capital's valuation metrics present a mixed picture. While it maintains a competitive PE ratio, other companies in the sector, such as Indus Inf. Trust and Indostar Capital, exhibi...

Read More5Paisa Capital Faces Technical Trend Shifts Amid Mixed Market Performance

2025-03-27 08:03:455Paisa Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 365.70, down from a previous close of 378.40, with a notable 52-week high of 607.40 and a low of 313.65. Today's trading saw a high of 383.95 and a low of 361.05. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly metrics present a mildly bearish outlook. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish on a monthly scale. Moving averages are bearish on a daily basis, contributing to the overall technical summary. When comparing the stock's performance to the Sensex, 5Paisa Capital has shown varied returns over different periods. Over the past week, the stock returned 8.89%, significantly outperformin...

Read More5Paisa Capital Shows Mixed Technical Trends Amidst Market Volatility and Strong Returns

2025-03-25 08:05:495Paisa Capital, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 395.30, showing a notable increase from the previous close of 354.55. Over the past week, the stock has reached a high of 398.30 and a low of 353.00, indicating some volatility in trading. In terms of technical indicators, the MACD suggests a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands and KST also reflect a similar mildly bearish trend on a monthly basis. The Dow Theory presents a mixed picture, indicating a mildly bullish stance weekly but a bearish outlook monthly. The On-Balance Volume shows no clear trend weekly, with a mildly bearish indication monthly. When comparing the stock's performance to the Sensex, 5Paisa Capital has shown a strong return of 24.92% over th...

Read More5Paisa Capital Experiences Valuation Grade Change Amidst Competitive Market Dynamics

2025-03-25 08:01:005Paisa Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 395.30, reflecting a notable increase from its previous close of 354.55. Over the past week, 5Paisa Capital has shown a stock return of 24.92%, significantly outperforming the Sensex, which returned 5.14% in the same period. Key financial metrics for 5Paisa Capital include a price-to-earnings (PE) ratio of 19.31 and a return on equity (ROE) of 10.92%. However, the company also reported a negative return on capital employed (ROCE) of -13.51%, indicating challenges in generating returns from its capital investments. In comparison to its peers, 5Paisa Capital's valuation metrics present a mixed picture. While it maintains an attractive valuation, competitors like Indus Inf. Trust and Indostar Capital are positioned at higher v...

Read More

5Paisa Capital Experiences Notable Gains Amid Broader Market Positivity and Volatility

2025-03-24 10:05:285Paisa Capital has demonstrated notable performance, gaining 8.43% on March 24, 2025, and outperforming its sector. The stock has risen 22.31% over the past five days, with significant intraday volatility. Despite recent gains, it remains down 21.60% over the past year compared to the Sensex's increase.

Read More

5Paisa Capital Hits 52-Week Low Amidst Mixed Financial Performance and Market Resilience

2025-03-18 09:57:175Paisa Capital has reached a new 52-week low amid a challenging year, with its stock down significantly while the Sensex has gained. Despite this, the company shows resilience, outperforming its sector slightly. Strong long-term fundamentals and high institutional holdings suggest potential for recovery in the future.

Read More

5Paisa Capital Hits 52-Week Low Amidst Mixed Financial Performance and Institutional Interest

2025-03-18 09:57:165Paisa Capital has reached a new 52-week low amid a recent decline, despite a slight recovery today. The stock is trading below key moving averages and has underperformed over the past year. However, it shows strong long-term fundamentals and significant institutional ownership, indicating ongoing interest.

Read More

5Paisa Capital Hits 52-Week Low Amidst Mixed Financial Performance and Market Trends

2025-03-18 09:57:125Paisa Capital has reached a new 52-week low amid a challenging year, with a notable decline compared to the broader market. Despite a brief intraday gain, the stock remains below key moving averages. The company reports flat net sales but shows strong long-term fundamentals and healthy institutional support.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificates under Regulation 74(5) of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation for closure of trading window

Shareholder Meeting / Postal Ballot-Scrutinizers Report

25-Mar-2025 | Source : BSESubmission of Scrutinizers Report

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

5Paisa Capital Ltd has announced 1:1 rights issue, ex-date: 28 May 19