AAA Technologies Adjusts Valuation Grade Amidst Challenging Stock Performance and Market Dynamics

2025-03-20 08:01:06AAA Technologies, a microcap player in the IT software sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 35.74, while its price-to-book value is recorded at 3.20. Additionally, the enterprise value to EBITDA ratio is 27.13, indicating a robust valuation relative to its earnings before interest, taxes, depreciation, and amortization. Despite the recent valuation revision, AAA Technologies has faced challenges in stock performance, with a year-to-date return of -30.61%, contrasting with a modest -3.44% return from the Sensex. Over the past month, the stock has declined by 16.29%, while the Sensex has remained relatively stable. In comparison to its peers, AAA Technologies maintains a higher PE ratio than several competitors, such as Ksolves India and InfoBeans Tech, which have lower valuations....

Read More

AAA Technologies Faces Significant Volatility Amid Declining Performance and Market Challenges

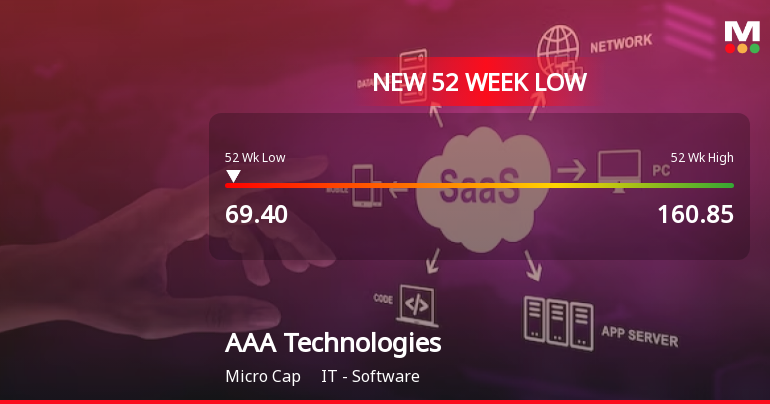

2025-03-18 15:39:19AAA Technologies, a microcap IT software firm, reached a new 52-week low amid significant volatility, underperforming its sector. Over the past year, the company has seen a notable decline in performance and operating profit, while trading below key moving averages, indicating ongoing challenges in a competitive market.

Read More

AAA Technologies Faces Significant Stock Volatility Amid Broader IT Sector Challenges

2025-03-13 09:50:33AAA Technologies, a microcap IT software firm, has hit a new 52-week low, reflecting significant volatility and underperformance compared to sector peers. The company has faced a 20.59% decline in stock price over the past year and a notable drop in operating profit, indicating ongoing challenges in the market.

Read More

AAA Technologies Faces Significant Challenges Amidst Broader Market Recovery

2025-03-13 09:50:32AAA Technologies, a microcap IT software firm, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The company has faced a substantial annual profit decline and is trading below key moving averages, indicating ongoing challenges despite a low debt-to-equity ratio.

Read More

AAA Technologies Faces Significant Volatility Amid Declining Financial Performance and Valuation Concerns

2025-03-13 09:50:28AAA Technologies, a microcap IT software firm, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The company has faced a substantial annual profit decline and is trading below key moving averages, indicating a bearish trend amid concerns over its valuation and profitability.

Read More

AAA Technologies Faces Significant Challenges Amidst Declining Financial Performance and Market Volatility

2025-03-13 09:50:28AAA Technologies, a microcap IT software firm, has hit a new 52-week low amid significant volatility, reflecting a 20.59% decline over the past year. The company's financial performance is concerning, with declining operating profits and a high price-to-book ratio, indicating challenges in profitability and market competitiveness.

Read MoreAAA Technologies Experiences Valuation Grade Change Amidst Competitive IT Software Landscape

2025-03-12 08:00:50AAA Technologies, a microcap player in the IT software industry, has recently undergone a valuation adjustment. The company's current price stands at 71.02, reflecting a notable decline from its previous close of 79.12. Over the past year, AAA Technologies has experienced a stock return of -26.63%, contrasting with a slight gain of 0.82% in the Sensex during the same period. Key financial metrics for AAA Technologies include a PE ratio of 34.77 and an EV to EBITDA ratio of 26.17. The company also reports a return on capital employed (ROCE) of 47.66%, indicating strong operational efficiency. However, its price-to-book value stands at 3.11, suggesting a premium over its book value. In comparison to its peers, AAA Technologies' valuation metrics reveal a mixed landscape. For instance, Blue Cloud Software and NINtec Systems exhibit higher PE ratios, while Ksolves India presents a more favorable EV to EBITDA ...

Read More

AAA Technologies Faces Significant Volatility Amid Broader Sector Challenges

2025-03-11 15:37:57AAA Technologies, a microcap IT software firm, has faced notable volatility, reaching a 52-week low. The stock has underperformed its sector, with significant declines over the past year. Financial metrics indicate a concerning trend, including negative profit growth and high valuation relative to peers, amid broader market challenges.

Read More

AAA Technologies Faces Significant Volatility Amidst Underperformance in IT Sector

2025-02-20 09:36:10AAA Technologies, a microcap IT software firm, reached a new 52-week low today amid significant volatility, with an intraday high of Rs. 89.31 followed by a sharp decline. The stock has underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges in the market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the Quarter ended 31st March 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation for Closure of Trading Window

Disclosure under Regulation 30A of LODR

28-Feb-2025 | Source : BSEDisclosure of Material Event Under Regulation 30 of SEBI (Listing Obligation And Disclosure Requirements) Regulation 2015.

Corporate Actions

No Upcoming Board Meetings

AAA Technologies Ltd has declared 5% dividend, ex-date: 06 Sep 24

No Splits history available

AAA Technologies Ltd has announced 1:2 bonus issue, ex-date: 14 Sep 22

No Rights history available