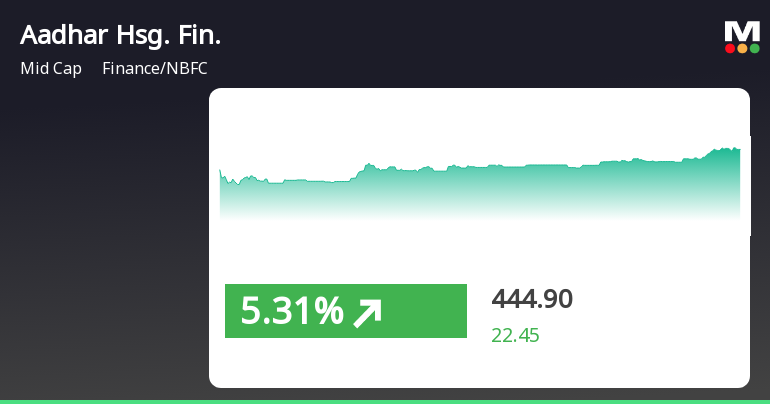

Aadhar Housing Finance Outperforms Sector Amid Broader Market Gains and Positive Momentum

2025-04-02 14:35:28Aadhar Housing Finance has experienced notable stock activity, outperforming its sector and showing a positive trend with recent gains. It is trading above key moving averages, indicating strong momentum. In the broader market, the Sensex continues to rise, with mid-cap stocks leading the gains.

Read More

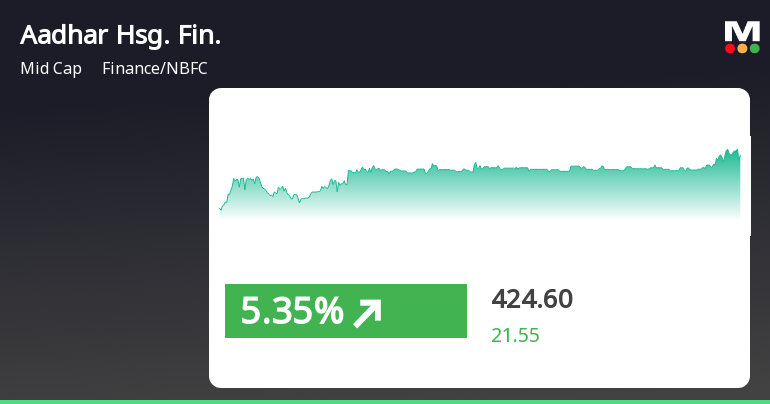

Aadhar Housing Finance Shows Strong Rebound Amid Broader Market Recovery Trends

2025-03-27 15:20:36Aadhar Housing Finance experienced a notable rebound on March 27, 2025, reversing a five-day decline with a significant intraday high. The stock outperformed its sector and is trading above multiple moving averages, while the broader market, represented by the Sensex, also showed recovery and gains in small-cap stocks.

Read MoreAadhar Housing Finance Adjusts Valuation Grade Amid Competitive NBFC Landscape

2025-03-26 08:00:54Aadhar Housing Finance has recently undergone a valuation adjustment, reflecting its current financial standing within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 23.51, while its price-to-book value is recorded at 3.00. Additionally, Aadhar's enterprise value to EBITDA ratio is 31.36, and its enterprise value to EBIT is 32.04, indicating a robust valuation framework. In terms of profitability, Aadhar Housing Finance has a return on equity (ROE) of 12.75% and a return on capital employed (ROCE) of 5.05%. These metrics suggest a solid performance relative to its operational efficiency. When compared to its peers, Aadhar Housing Finance's valuation metrics present a competitive landscape. For instance, while Aadhar's PE ratio is higher than that of Manappuram Finance, which stands at 10.19, it is notably lower than KFin Technologies, whi...

Read MoreAadhar Housing Finance Shows Mixed Technical Indicators Amid Market Consolidation

2025-03-25 08:06:42Aadhar Housing Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 413.30, down from the previous close of 422.25. Over the past week, the stock has experienced a decline of 1.08%, contrasting with a 5.14% gain in the Sensex during the same period. In terms of technical metrics, the Moving Averages indicate a mildly bearish sentiment on a daily basis, while the MACD shows a mildly bullish trend on a weekly basis. The Relative Strength Index (RSI) and Bollinger Bands are signaling no significant movement, suggesting a period of consolidation. The On-Balance Volume (OBV) reflects no trend on a weekly basis but is bullish on a monthly scale. Looking at the company's performance over various time frames, Aadhar Housing Finance has seen a 12.71% return over the past month, significantly ou...

Read MoreAadhar Housing Finance Shows Mixed Technical Trends Amid Market Volatility

2025-03-20 08:04:24Aadhar Housing Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 442.90, showing a notable increase from the previous close of 428.40. Over the past week, the stock has reached a high of 444.70 and a low of 430.75, indicating some volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the daily moving averages indicate a different perspective. The Bollinger Bands on a weekly basis are bullish, contrasting with the bearish signals from the KST indicator. The On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, suggesting a positive accumulation trend. When comparing the stock's performance to the Sensex, Aadhar Housing Finance has shown resilience. Over the past week, it recorded a return of 4%, significantly outper...

Read MoreAadhar Housing Finance Shows Mixed Technical Trends Amid Strong Short-Term Performance

2025-03-13 08:02:56Aadhar Housing Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 425.85, slightly down from the previous close of 431.55. Over the past week, Aadhar Housing Finance has shown a notable stock return of 9.61%, significantly outperforming the Sensex, which returned only 0.41% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the daily moving averages suggest a mildly bearish trend. The Bollinger Bands indicate a mildly bullish stance on a weekly basis, contrasting with the overall bearish sentiment reflected in the KST and Dow Theory metrics. The On-Balance Volume (OBV) remains bullish on both weekly and monthly assessments, suggesting a positive accumulation of shares. Looking at the broader performance, Aadhar Housing Finance has achieved a return ...

Read MoreAadhar Housing Finance Shows Mixed Technical Trends Amid Strong Short-Term Performance

2025-03-13 08:02:56Aadhar Housing Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 425.85, slightly down from the previous close of 431.55. Over the past week, Aadhar Housing Finance has shown a notable stock return of 9.61%, significantly outperforming the Sensex, which returned only 0.41% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the daily moving averages suggest a mildly bearish trend. The Bollinger Bands indicate a mildly bullish stance on a weekly basis, contrasting with the overall bearish sentiment reflected in the KST and Dow Theory metrics. The On-Balance Volume (OBV) remains bullish on both weekly and monthly assessments, suggesting a positive accumulation of shares. Looking at the broader performance, Aadhar Housing Finance has achieved a return ...

Read MoreAadhar Housing Finance Shows Mixed Technical Trends Amid Strong Recent Performance

2025-03-12 08:03:36Aadhar Housing Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 431.55, showing a slight increase from the previous close of 426.15. Over the past week, Aadhar Housing Finance has demonstrated a notable performance, with a return of 12.68%, significantly outpacing the Sensex, which returned just 1.52% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the moving averages indicate a mildly bearish trend on a daily basis. The Bollinger Bands are signaling bullish momentum, and the On-Balance Volume (OBV) reflects a bullish stance as well. However, the KST and Dow Theory metrics present a mixed outlook, with some indicators leaning bearish on a monthly basis. The stock has shown resilience with a 52-week high of 516.65 and a l...

Read MoreAadhar Housing Finance Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-10 08:01:05Aadhar Housing Finance has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position. The company currently reports a price-to-earnings (P/E) ratio of 24.58 and a price-to-book value of 3.14. Its enterprise value to EBITDA stands at 32.17, while the enterprise value to EBIT is slightly higher at 32.87. The return on capital employed (ROCE) is noted at 5.05%, and the return on equity (ROE) is 12.75%. In comparison to its peers in the finance and non-banking financial company (NBFC) sector, Aadhar Housing Finance's valuation metrics indicate a competitive stance. For instance, while Nuvama Wealth is positioned at a higher valuation level, other companies like Angel One and IIFL Finance exhibit lower P/E ratios, suggesting a varied landscape in terms of market valuation. The company's stock performance has shown resilience, with a one-week return of 12.56%, s...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSESubmission of Compliance certificate under 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Board Meeting Intimation for To Consider And Approve The Audited Financial Statements Along With Statutory AuditorS Report For The Year Ended 31St March 2025 And The Modification Or Revalidation Of Borrowing Powers/Limits Issuance Of Debentures & Approval

28-Mar-2025 | Source : BSEAadhar Housing Finance Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/05/2025 inter alia to consider and approve Pursuant to Regulation 29(1) and 50(1) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we would like to inform you that the Meeting of the Board of Directors of the Company will be held on Tuesday 06th May 2025 inter alia to consider and approve the following agenda item:- a. To consider and approve the Standalone and Consolidated Audited Financial Statements along with Statutory Auditors Report for the year ended 31st March 2025. b. To consider and approve the modification &/or revalidation of Borrowing powers/limits for the Company issuance of Debentures and approval to create charge by way of mortgage and/or Hypothecation on various assets of the Company.

Closure of Trading Window

27-Mar-2025 | Source : BSEDear All Please note that trading window of the Company will be closed from 01st April 2025 till 48 hours after the publication of financial results for quarter ended 31st March 2025. All designated persons and their immediate relatives has been advised to not trade into the securities of the Company during the aforesaid trading window closure period.

Corporate Actions

06 May 2025

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available