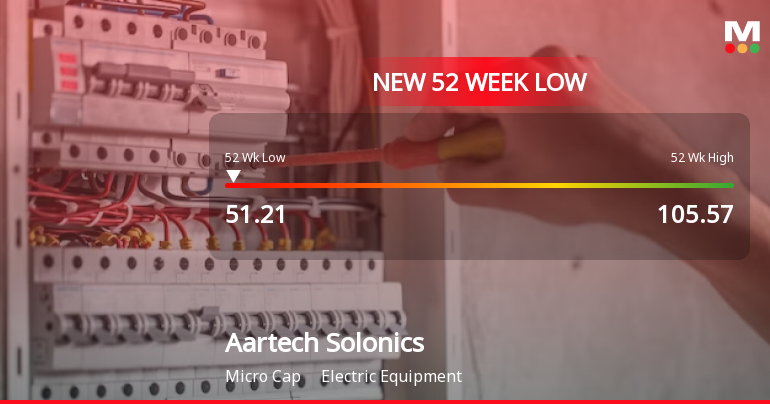

Aartech Solonics Hits 52-Week Low Amid Broader Market Decline and Mixed Performance Signals

2025-04-01 12:00:09Aartech Solonics, a microcap in the electric equipment sector, reached a new 52-week low amid a broader market decline. Despite this, it outperformed its sector today. The company has faced declining operating profits and high valuations, though it maintains a low debt-to-equity ratio and positive quarterly results.

Read More

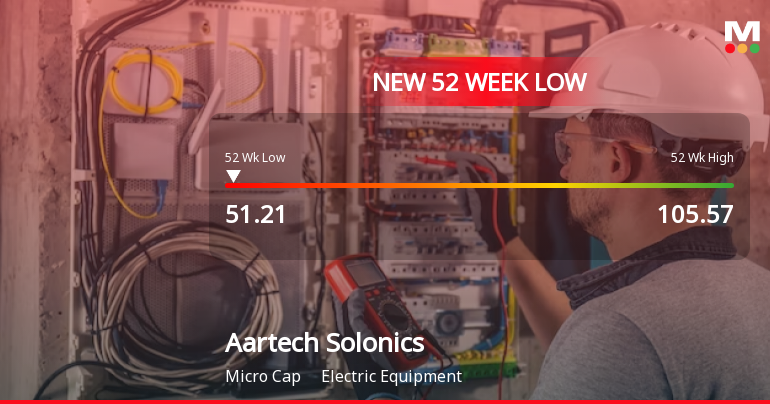

Aartech Solonics Faces Challenges Amidst Market Decline and Resilience Indicators

2025-04-01 12:00:04Aartech Solonics, a microcap in the electric equipment sector, has reached a new 52-week low after three consecutive days of losses. Despite this, the stock has outperformed its sector today. The company faces valuation concerns due to declining operating profits but has maintained a low debt-to-equity ratio and reported positive quarterly results.

Read More

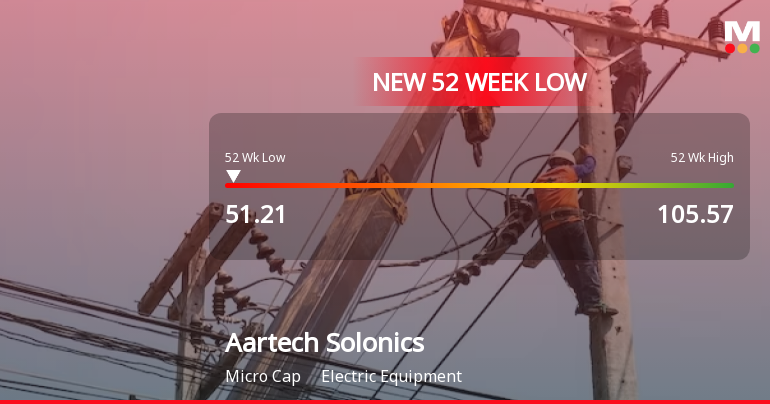

Aartech Solonics Hits 52-Week Low Amid Broader Market Decline and Mixed Financial Signals

2025-04-01 12:00:02Aartech Solonics, a microcap in the electric equipment sector, reached a new 52-week low amid a broader market decline. Despite recent losses, the company has shown a slight year-over-year decline and maintains a low debt-to-equity ratio, though its long-term growth outlook raises concerns due to declining operating profits.

Read More

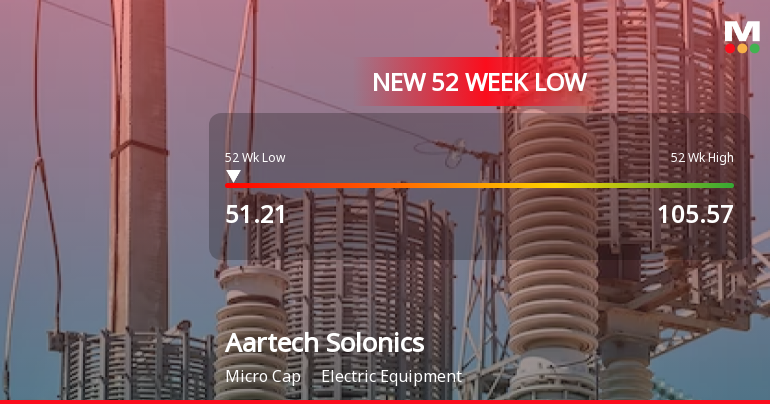

Aartech Solonics Hits 52-Week Low Amid Broader Market Downturn and Mixed Performance Indicators

2025-04-01 12:00:02Aartech Solonics, a microcap in the electric equipment sector, reached a new 52-week low amid a broader market decline. Despite this, the company outperformed its sector today and has shown consistent quarterly profits. However, it faces challenges with declining operating profit and high valuation metrics.

Read MoreAartech Solonics Faces Declining Investor Engagement Amidst Significant Trading Activity

2025-03-28 10:01:22Aartech Solonics Ltd, a microcap company in the Electric Equipment industry, experienced significant trading activity today, hitting its lower circuit limit. The stock closed at a last traded price of Rs 53.80, reflecting a decline of Rs 2.84 or 5.01% from the previous session. The stock's performance was marked by a price band of 5%, with an intraday high of Rs 56.35 and a low of Rs 53.80. In terms of trading volume, Aartech Solonics saw a total traded volume of approximately 0.41855 lakh shares, resulting in a turnover of Rs 0.225975145 crore. The stock has been trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a downward trend in its price performance. Investor participation appears to be declining, with delivery volume dropping by 44.31% compared to the 5-day average. Despite outperforming its sector by 1.06% today, the overall market sentiment remains cautious,...

Read MoreAartech Solonics Faces Increased Selling Pressure Amid Declining Investor Participation

2025-03-27 15:00:07Aartech Solonics Ltd, a microcap company in the Electric Equipment industry, experienced significant trading activity today, hitting its lower circuit limit. The stock closed at Rs 54.1, reflecting a decline of Rs 2.54 or 4.48% from the previous trading session. Notably, the stock reached an intraday low of Rs 53.8, marking a decrease of 5.01% during the day. The total traded volume stood at approximately 0.22187 lakh shares, with a turnover of Rs 0.119965109 crore. The performance today indicates that Aartech Solonics underperformed its sector by 4.06%, following a trend reversal after two consecutive days of gains. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a bearish trend. Investor participation has notably decreased, with delivery volume dropping by 90.78% compared to the 5-day average. Despite the liquidity being sufficient for tra...

Read MoreAartech Solonics Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-26 09:50:17Aartech Solonics Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive days of losses, reflecting a troubling trend in its performance. Over the past week, Aartech Solonics has declined by 2.12%, while the Sensex has gained 3.26%. This underperformance is even more pronounced over the past month, with the stock down 10.15% compared to a 4.43% increase in the Sensex. In the last three months, Aartech Solonics has seen a staggering decline of 30.04%, while the Sensex has only dipped by 0.72%. Year-to-date, the stock is down 30.11%, contrasting sharply with the Sensex's slight decline of 0.30%. The price summary indicates that Aartech Solonics is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, further highlighting the stock's struggles. Potential contributing factors to this selling pressure may...

Read MoreAartech Solonics Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-17 15:15:14Aartech Solonics Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company, operating in the electric equipment sector, has experienced a notable decline, with a performance drop of 6.26% in just one day, contrasting sharply with the Sensex's modest gain of 0.46%. Over the past week, Aartech Solonics has lost 9.29%, while the Sensex remained nearly flat at 0.07%. The stock has now recorded consecutive losses for three days, accumulating a total decline of 12.25% during this period. In terms of longer-term performance, Aartech Solonics has fallen 15.94% over the past month and 27.37% over the last three months, significantly underperforming the Sensex, which has seen a decline of only 8.08% in the same timeframe. Today's trading saw the stock hit an intraday low of Rs 56.15, and it is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day ...

Read MoreAartech Solonics Faces Intense Selling Pressure Amid Ongoing Price Declines

2025-03-13 09:50:22Aartech Solonics Ltd is currently facing significant selling pressure, with the stock showing only sellers today. This trend marks a continuation of consecutive days of losses, raising concerns among market observers. Over the past week, Aartech Solonics has declined by 1.31%, while the Sensex has experienced a slight drop of 0.23%. The stock's performance over the last month reveals a more pronounced decline of 4.75%, compared to the Sensex's decrease of 2.58%. In the longer term, Aartech Solonics has seen a substantial drop of 22.20% over the past three months, while the Sensex has fallen by 9.69%. Year-to-date, the stock is down 21.35%, contrasting with the Sensex's decline of 5.08%. Despite a positive annual performance of 25.47%, the recent trends indicate a shift in market sentiment. The price summary indicates that Aartech Solonics has outperformed its sector by 0.36% today. However, it remains bel...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window for the quarter and year ended 31st March 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2025 | Source : BSESubmission of Newspaper clippings of un-audited financial results for the quarter and nine-months period ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

Aartech Solonics Ltd has declared 5% dividend, ex-date: 23 Sep 24

Aartech Solonics Ltd has announced 5:10 stock split, ex-date: 09 Aug 24

Aartech Solonics Ltd has announced 1:2 bonus issue, ex-date: 09 Aug 24

No Rights history available