Aarti Industries Sees Significant Open Interest Surge Amid Increased Derivatives Activity

2025-03-25 15:00:30Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a significant increase in open interest today. The latest open interest stands at 37,098 contracts, reflecting a rise of 6,116 contracts or 19.74% from the previous open interest of 30,982. This uptick coincides with a trading volume of 44,403 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Aarti Industries has underperformed its sector by 0.91%, with the stock recording a 1D return of -2.31%. The stock reached an intraday low of Rs 398.25, marking a decline of 2.49%. The weighted average price suggests that more volume was traded closer to this low price, while the stock remains above its 5-day and 20-day moving averages but below its longer-term moving averages of 50, 100, and 200 days. Additionally, delivery volume has decreased by 3.31% compared to the 5-day average, ind...

Read MoreSurge in Open Interest for Aarti Industries Signals Increased Market Activity Amid Price Challenges

2025-03-25 14:00:19Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a notable increase in open interest today. The latest open interest stands at 36,674 contracts, reflecting a rise of 5,692 contracts or 18.37% from the previous open interest of 30,982. This surge in open interest comes alongside a trading volume of 39,324 contracts, indicating active market engagement. In terms of price performance, Aarti Industries has underperformed its sector by 0.61%, with the stock recording a 1D return of -1.97%. The stock reached an intraday low of Rs 398.25, marking a decline of 2.49%. Despite this, the stock's weighted average price suggests that more volume was traded closer to this low price point. Additionally, the stock's moving averages indicate that it is currently above the 5-day and 20-day averages but below the 50-day, 100-day, and 200-day averages. Notably, delivery volume has decreased b...

Read MoreAarti Industries Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-25 13:00:16Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 35,550 contracts, up from the previous 30,982, marking a change of 4,568 contracts or a 14.74% increase. The trading volume for the day reached 30,838 contracts, contributing to a total futures value of approximately Rs 27,986.78 lakhs. In terms of price performance, Aarti Industries has underperformed its sector by 0.51%, with the stock experiencing a decline after two consecutive days of gains. The stock touched an intraday low of Rs 399, representing a decrease of 2.3%. The weighted average price indicates that more volume was traded closer to this low price point. While the stock's moving averages are higher than the 5-day and 20-day averages, they remain below the 50-day, 100-day, and 200-day moving av...

Read MoreAarti Industries Sees Significant Open Interest Surge Amid Increased Derivatives Activity

2025-03-25 12:00:09Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a significant increase in open interest (OI) today. The latest OI stands at 35,182 contracts, reflecting a rise of 4,200 contracts or 13.56% from the previous OI of 30,982. This uptick in OI comes alongside a trading volume of 24,270 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Aarti Industries has underperformed its sector by 0.45%, with the stock experiencing a decline of 2.19% today. The stock reached an intraday low of Rs 399.95, marking a decrease of 2.07%. Despite this, the stock's weighted average price suggests that more volume was traded closer to this low price point. Additionally, while the stock remains above its 5-day and 20-day moving averages, it is currently below its 50-day, 100-day, and 200-day moving averages. Notably, delivery volume has decreased by ...

Read MoreAarti Industries Sees Surge in Open Interest Amidst Performance Challenges

2025-03-10 15:00:07Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a significant increase in open interest (OI) today. The latest OI stands at 30,620 contracts, reflecting a rise of 5,261 contracts or 20.75% from the previous OI of 25,359. This uptick comes alongside a trading volume of 32,132 contracts, indicating heightened activity in the derivatives market. Despite this surge in OI, Aarti Industries has underperformed its sector, with a decline of 3.12% today. The stock has faced consecutive losses over the past two days, resulting in a total drop of 4.22% during this period. The stock reached an intraday low of Rs 392.65, down 3.36% from the previous close. In terms of moving averages, the stock is currently above its 5-day moving average but below the 20-day, 50-day, 100-day, and 200-day averages. Additionally, delivery volume has decreased significantly, falling by 55.82% compared to...

Read MoreSurge in Open Interest Signals Increased Market Activity for Aarti Industries

2025-03-10 14:00:06Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a notable increase in open interest (OI) today. The latest OI stands at 28,741 contracts, reflecting a rise of 3,382 contracts or 13.34% from the previous OI of 25,359. This surge in OI comes alongside a trading volume of 21,857 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Aarti Industries has underperformed its sector by 1.74%, with a 1D return of -1.13%. The stock has been on a downward trend, recording a consecutive fall over the last two days, resulting in a total decline of 2.21% during this period. While the stock is currently trading above its 5-day moving averages, it remains below the 20-day, 50-day, 100-day, and 200-day moving averages. Investor participation appears to be waning, as evidenced by a delivery volume of 2.96 lakh on March 7, which has decreased by ...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Aarti Industries

2025-03-10 13:00:07Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a notable increase in open interest today. The latest open interest stands at 28,572 contracts, reflecting a rise of 3,213 contracts or 12.67% from the previous open interest of 25,359. This surge coincides with a trading volume of 20,218 contracts, indicating active participation in the derivatives market. Despite this uptick in open interest, Aarti Industries has underperformed its sector, with a decline of 0.22% in its stock price today, compared to a slight gain of 0.23% in the sector. The stock has been on a downward trend, losing 1.39% over the past two days. Currently, the stock price is higher than its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages. Investor participation has also seen a decline, with delivery volume dropping by 55.82% against the 5-day average. The liq...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Aarti Industries

2025-03-10 12:00:07Aarti Industries Ltd., a mid-cap player in the chemicals sector, has experienced a notable increase in open interest today. The latest open interest stands at 27,914 contracts, reflecting a rise of 2,555 contracts or 10.08% from the previous open interest of 25,359. This surge in open interest is accompanied by a trading volume of 15,815 contracts, indicating active market participation. In terms of price performance, Aarti Industries has outperformed its sector, recording a 1.18% return compared to the sector's 0.70% and the Sensex's 0.38% return for the day. The stock is currently trading above its 5-day moving average but remains below its 20-day, 50-day, 100-day, and 200-day moving averages. Notably, the delivery volume has seen a decline, with a reported 2.96 lakh shares delivered on March 7, down 55.82% from the 5-day average. With a market capitalization of Rs 14,903.19 crore, Aarti Industries cont...

Read More

Aarti Industries Shows Short-Term Gains Amid Long-Term Challenges in Chemicals Sector

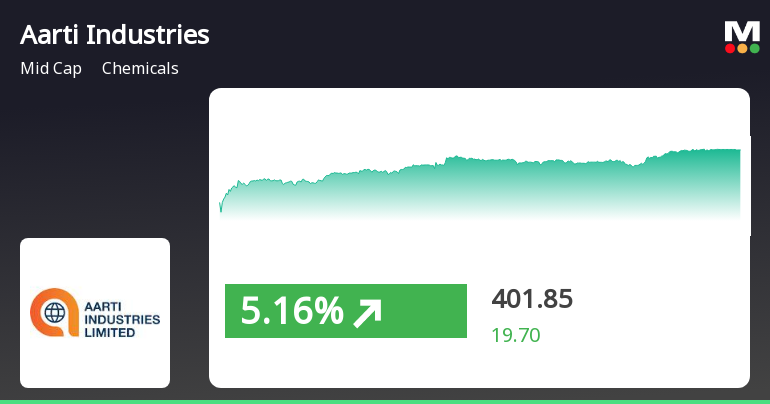

2025-03-05 15:50:30Aarti Industries Ltd. has experienced significant activity, gaining 5.19% on March 5, 2025, marking its third consecutive day of gains. Despite recent short-term improvements, the company has faced challenges over the past year, with a notable decline compared to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Updates on Acquisition

05-Mar-2025 | Source : BSEUpdate on Acquisition

Corporate Actions

No Upcoming Board Meetings

Aarti Industries Ltd. has declared 20% dividend, ex-date: 26 Jul 24

No Splits history available

Aarti Industries Ltd. has announced 1:1 bonus issue, ex-date: 22 Jun 21

No Rights history available