Aarti Pharmalabs Outperforms Sector Amid Broader Market Volatility and Gains

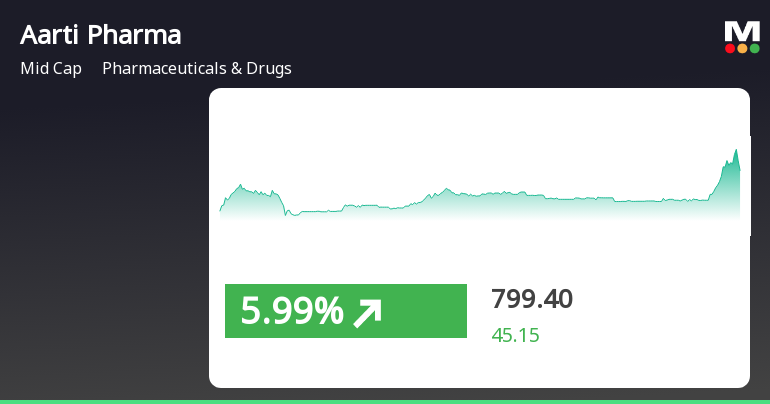

2025-04-03 13:50:28Aarti Pharmalabs has demonstrated strong performance, gaining 5.2% on April 3, 2025, and outperforming its sector. Over the past six days, the stock has accumulated a total return of 9.45%. It is trading above all key moving averages and has increased 78.39% over the past year.

Read More

Aarti Pharmalabs Faces Consecutive Losses Amid Broader Market Rebound

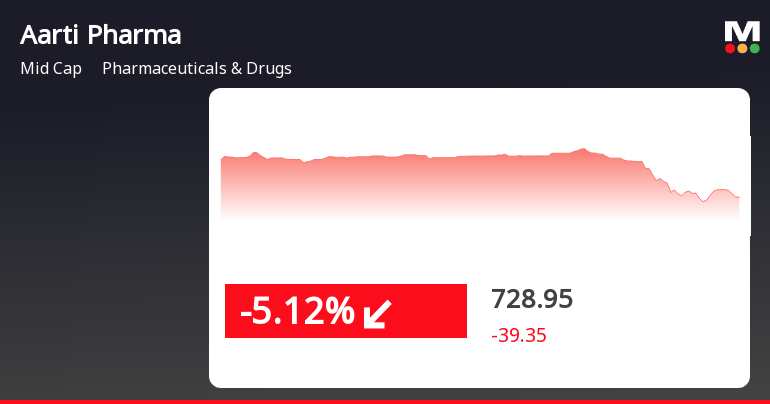

2025-03-21 11:35:28Aarti Pharmalabs has faced a decline for the second consecutive day, with its stock showing significant intraday fluctuations. Despite recent losses, the company has performed well over the past three months and year. The broader market has rebounded, contrasting with Aarti's current performance.

Read More

Aarti Pharmalabs Faces Mixed Signals Amid Flat Performance and Decreased Promoter Confidence

2025-03-18 08:24:46Aarti Pharmalabs has recently adjusted its evaluation, reflecting its current market position amid flat financial performance for the quarter ending December 2024. The company maintains a strong debt servicing capability and shows healthy long-term growth, although promoter confidence has decreased slightly, indicating cautious sentiment about future prospects.

Read More

Aarti Pharmalabs Demonstrates Strong Market Momentum Amid Sector Challenges

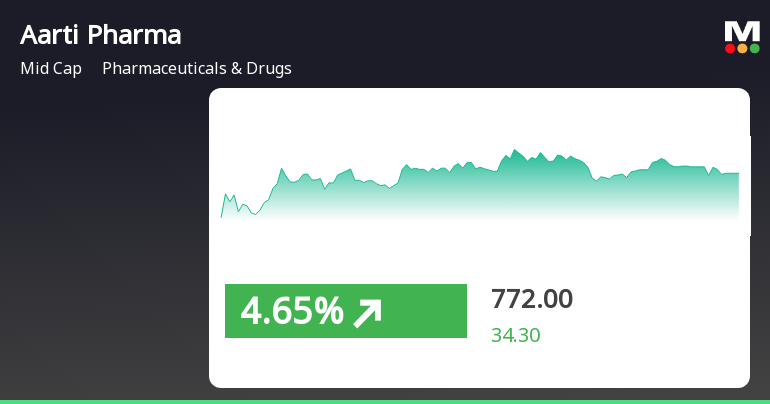

2025-03-17 10:05:26Aarti Pharmalabs has demonstrated strong market performance, gaining 5.19% on March 17, 2025, and outperforming its sector. The stock has consistently risen over the past two days and is trading above key moving averages. Year-to-date, it has delivered a solid return, with a remarkable one-year performance of 74.16%.

Read MoreAarti Pharmalabs Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-12 08:03:31Aarti Pharmalabs, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 739.30, slightly down from the previous close of 749.95. Over the past year, Aarti Pharma has demonstrated a significant return of 60.23%, contrasting sharply with the Sensex's modest gain of 0.82% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly RSI shows no signal, indicating a mixed sentiment in the market. The Bollinger Bands suggest a mildly bullish trend on a weekly basis, complemented by bullish daily moving averages. However, the Dow Theory and On-Balance Volume (OBV) indicators reflect no clear trend, suggesting a period of consolidation. Aarti Pharma's performance over various time frames highlights its resilience, particularly in the one-week and ...

Read More

Aarti Pharmalabs Shows Strong Financials Amidst Promoter Stake Reduction Concerns

2025-03-11 08:22:10Aarti Pharmalabs has recently experienced an evaluation adjustment, reflecting its stable financial performance in the third quarter of FY24-25. The company demonstrates effective debt management and healthy long-term growth, with significant operating profit increases and strong market returns, despite a slight decline in promoter confidence.

Read MoreAarti Pharmalabs Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-05 08:03:43Aarti Pharmalabs, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 727.00, showing a slight increase from the previous close of 719.20. Over the past year, Aarti Pharmalabs has demonstrated a robust performance with a return of 51.03%, significantly outperforming the Sensex, which recorded a mere 1.19% return in the same period. The technical summary indicates a mixed outlook, with the MACD and Bollinger Bands signaling bullish trends on both weekly and monthly charts. However, the Relative Strength Index (RSI) presents a bearish signal on the weekly timeframe, while the daily moving averages suggest a bullish stance. The On-Balance Volume (OBV) reflects a mildly bearish trend on a weekly basis, indicating some selling pressure. In terms of price movement, Aarti Pharmalabs has seen ...

Read More

Aarti Pharmalabs Faces Evaluation Adjustment Amid Strong Growth and Stakeholder Concerns

2025-03-03 19:02:53Aarti Pharmalabs has recently adjusted its evaluation, highlighting its stable financial performance with a notable annual operating profit growth. Despite outperforming the broader market, concerns arise from a decline in promoter confidence and the stock's premium valuation compared to peers, reflecting a complex market outlook.

Read More

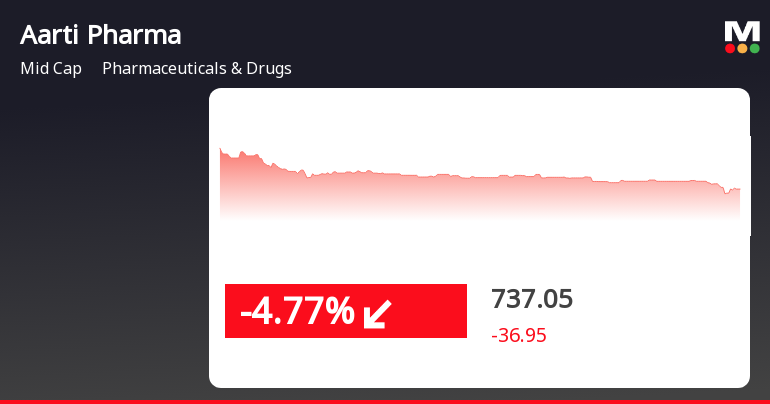

Aarti Pharmalabs Faces Short-Term Decline Amidst Strong Monthly Recovery Trend

2025-02-27 13:50:27Aarti Pharmalabs, a midcap pharmaceutical company, saw a decline today, closing at Rs 731.6, underperforming its sector. However, it has gained 23.46% over the past month, contrasting with a slight dip in the broader market. Its technical indicators reflect mixed market sentiment, prompting interest from investors.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Joint Venture

01-Apr-2025 | Source : BSEEntering into addendum to the Subscription and Shareholders agreement

Closure of Trading Window

20-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Aarti Pharmalabs Ltd has declared 50% dividend, ex-date: 14 Feb 25

No Splits history available

No Bonus history available

No Rights history available