Accel's Valuation Adjustment Highlights Complex Financial Health and Market Dynamics

2025-04-03 08:01:53Accel, a microcap IT hardware company, has experienced a change in its valuation grade, reflecting a reassessment of its financial metrics. Key indicators include a PE ratio of 30.37, a price-to-book value of 1.51, and a high debt-to-EBITDA ratio of 4.65, alongside notable sales growth.

Read More

Accel's Valuation Shift Highlights Financial Challenges Amid Strong Sales Growth

2025-04-02 08:05:57Accel, a microcap in the IT Hardware sector, has experienced a recent evaluation adjustment, reflecting changes in its financial metrics. Despite a challenging quarter, the company reported an impressive annual net sales growth of 83.21% and a Return on Capital Employed of 7.73%, indicating a complex financial landscape.

Read MoreAccel's Valuation Grade Change Highlights Stability Amid Competitive IT Hardware Landscape

2025-04-02 08:00:38Accel, a microcap player in the IT hardware sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 28.71, while its price-to-book value is recorded at 1.43. Additionally, Accel's enterprise value to EBITDA ratio is 10.54, and its enterprise value to sales ratio is 0.95, indicating a competitive stance in its industry. The company also boasts a PEG ratio of 0.44 and a dividend yield of 1.85%. Return on capital employed (ROCE) is at 7.73%, and return on equity (ROE) is 6.47%, showcasing its operational efficiency. In comparison to its peers, Accel's valuation metrics appear favorable, particularly when contrasted with companies like TVS Electronics and Spel Semiconductors, which are currently facing challenges. While some competitors are categorized as risky or do not qualify for evaluation, Accel's standi...

Read More

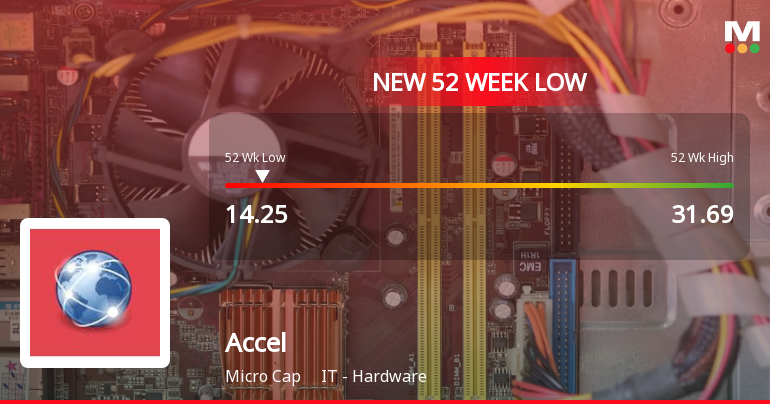

Accel Hits New Low Amid Broader Market Decline and Debt Concerns

2025-03-28 10:07:48Accel, a microcap in the IT hardware sector, reached a new 52-week low today, continuing a bearish trend despite a recent uptick. Over the past year, the company has seen a significant decline, facing challenges with high debt levels and low profitability, although it has demonstrated strong long-term sales growth.

Read More

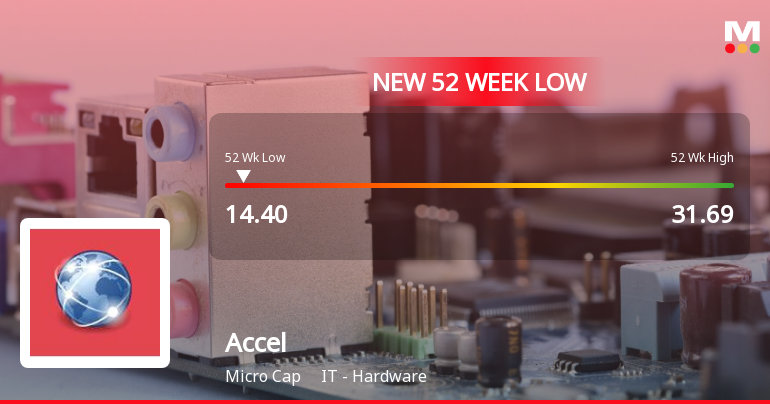

Accel Faces Significant Volatility Amidst Declining Financial Performance and High Debt Levels

2025-03-27 14:06:13Accel, a microcap in the IT-Hardware sector, has faced notable volatility, reaching a new 52-week low. The company has struggled with high debt levels and declining operating profits, despite a long-term growth in net sales. Technical indicators currently reflect a bearish trend in its market performance.

Read More

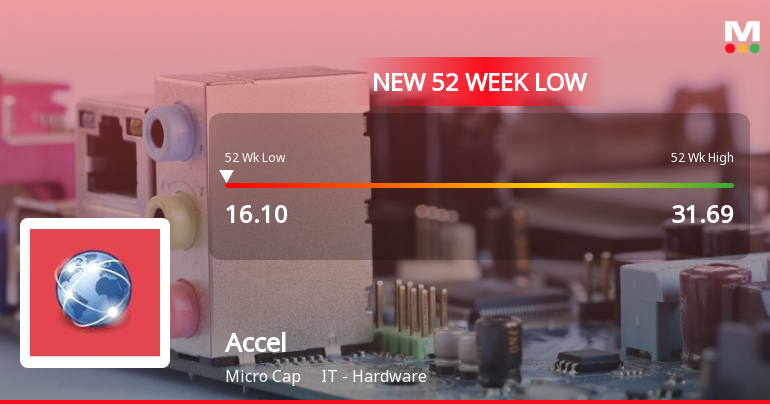

Accel Faces Significant Volatility Amidst Declining Financial Performance and High Debt Levels

2025-03-26 12:36:01Accel, a microcap in the IT-Hardware sector, reached a new 52-week low today after significant volatility. The company has faced a challenging year, with a notable decline in performance metrics and financial results. Despite some long-term growth potential, its stock shows a bearish trend.

Read More

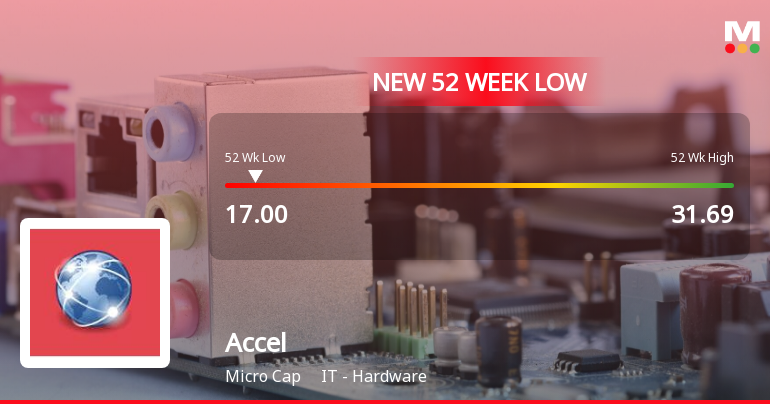

Accel Faces Financial Struggles Amid High Debt and Low Profitability Concerns

2025-03-18 12:35:51Accel, a microcap in the IT hardware sector, has faced notable volatility, reaching a new 52-week low. The company struggles with a high Debt to EBITDA ratio and low profitability, as reflected in its recent financial results. Despite long-term growth potential, its annual performance has been disappointing compared to broader market trends.

Read More

Accel Faces Financial Struggles Amid IT Hardware Sector Decline and High Debt Levels

2025-03-11 10:06:32Accel, a microcap in the IT Hardware sector, has reached a new 52-week low amid ongoing volatility. The company faces financial challenges, including a high Debt to EBITDA ratio and low profitability. Despite recent downturns in sales and profit, Accel has shown strong long-term growth potential.

Read More

Accel Reaches 52-Week Low Amid Broader IT Hardware Sector Trends

2025-02-19 09:35:53Accel, a microcap in the IT Hardware sector, has reached a new 52-week low, reflecting a 29.69% decline over the past year. Despite this, it has outperformed its sector slightly. The stock is currently trading below its moving averages, indicating a challenging market environment.

Read MoreCONFIRMATION REGARDING NOT FALLING UNDER LARGE CORPORATE CRITERIA.

05-Apr-2025 | Source : BSEAccel Limited is to inform the BSE that the Company is not falling under Large Corporate Criteria.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPursuant to Regulation 74(5) of SEBI (DP) Regulations 2018 the certificate received from Registrar and Share Transfer Agent for the quarter ended 31st March 2025 is hereby enclosed.

Closure of Trading Window

25-Mar-2025 | Source : BSEAccel Limited is to inform the Stock Exchange that the Trading Window for dealing in securities of the Company shall be closed with effect from 01st April 2025 till the end of 48 hours after the declaration of Audited Financial Results of the Company for the Quarter and Financial year ended 31st March 2025. The date of Board Meeting to consider the financial results shall be intimated separately in the due course.This is for your kind information.

Corporate Actions

No Upcoming Board Meetings

Accel Ltd has declared 15% dividend, ex-date: 13 Sep 24

No Splits history available

No Bonus history available

No Rights history available