ADC India Communications Faces Mixed Technical Trends Amidst Market Volatility

2025-03-25 08:01:44ADC India Communications, a microcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1235.90, showing a notable increase from the previous close of 1174.35. Over the past week, the stock has demonstrated significant volatility, reaching a high of 1289.00 and a low of 1122.80. In terms of technical indicators, the MACD signals a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish stance for both weekly and monthly assessments. The daily moving averages align with this trend, indicating a mildly bearish sentiment. Notably, the Dow Theory presents a mildly bullish perspective on a weekly basis, contrasting with the monthly bearish outlook. When comparing ADC India's performance to the Sensex, the company has shown ...

Read MoreADC India Communications Adjusts Valuation Amid Strong Performance in Telecom Sector

2025-03-24 08:00:19ADC India Communications has recently undergone a valuation adjustment, reflecting its current standing in the telecommunication equipment sector. The company, categorized as a microcap, has reported a price-to-earnings (PE) ratio of 18.99 and an EV to EBITDA ratio of 14.06. Its PEG ratio stands at a notably low 0.16, while the dividend yield is recorded at 2.55%. In terms of return metrics, ADC India has shown a strong performance over various periods, with a one-year return of 33.41%, significantly outperforming the Sensex, which returned 5.87% in the same timeframe. Over the past three years, the company has achieved a remarkable return of 274.95%, compared to the Sensex's 34.23%. When compared to its peers, ADC India maintains a competitive position, particularly against companies like Suyog Telematics and Valiant Communications, which are currently valued higher. However, several peers are categori...

Read MoreADC India Communications Ltd Sees 19.83% Surge Amid Strong Buying Activity

2025-03-21 15:05:06ADC India Communications Ltd is witnessing significant buying activity, with the stock surging by 19.83% today, notably outperforming the Sensex, which recorded a modest gain of 0.71%. Over the past week, ADC India has achieved a remarkable 22.47% increase, while the Sensex rose by only 4.14%. This trend of consecutive gains marks the fourth day of upward movement for ADC India, accumulating a total return of 21.87% during this period. The stock reached an intraday high of Rs 1168, reflecting a 19.18% increase, amidst high volatility of 9.11%. Despite a challenging three-month performance, where the stock declined by 34.76%, its one-year performance shows a robust gain of 33.41%, compared to the Sensex's 5.85%. Factors contributing to the current buying pressure may include positive sentiment in the telecommunications equipment sector, which has gained 2.06%, and the stock's attractive dividend yield of ...

Read MoreADC India Communications Adjusts Valuation Grade Amid Competitive Telecommunications Landscape

2025-03-07 08:00:45ADC India Communications has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics within the telecommunication equipment sector. The company currently exhibits a price-to-earnings (P/E) ratio of 16.40 and a price-to-book value of 6.42. Its enterprise value to EBITDA stands at 11.95, while the enterprise value to EBIT is recorded at 12.03. Notably, ADC India boasts a robust return on capital employed (ROCE) of 154.66% and a return on equity (ROE) of 39.13%, indicating strong operational efficiency. In comparison to its peers, ADC India maintains a competitive position, particularly when evaluating its PEG ratio of 0.13 against others in the industry. For instance, Valiant Communications is noted for its significantly higher P/E ratio of 35.13, while companies like GTL and Punjab Communications are categorized as risky, with varying financial challenges. This context ...

Read More

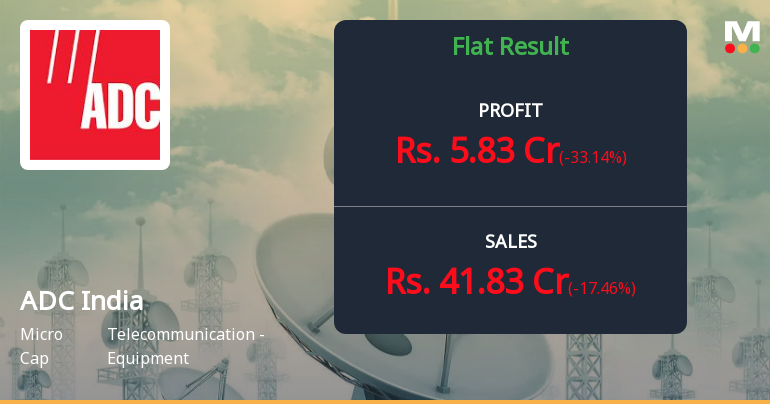

ADC India Communications Reports Mixed Financial Results for December Quarter, Highlighting Liquidity Gains and Operational Challenges

2025-02-07 17:24:14ADC India Communications has announced its financial results for the quarter ending December 2024, showcasing a mix of strengths and challenges. While cash and cash equivalents reached a six-period high, key metrics such as profit before tax, profit after tax, and net sales have declined, indicating operational difficulties.

Read More

ADC India Communications Reports Strong Q2 Profit Growth Amid Market Challenges

2025-01-27 18:49:06ADC India Communications, a microcap in the telecommunications sector, recently experienced an evaluation adjustment following strong financial results for Q3 2024, including a 25.29% net profit increase. However, long-term growth may be limited due to a bearish technical outlook and a high percentage of pledged promoter shares.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | ADC India Communications Ltd- |

| 2 | CIN NO. | L32209KA1988PLC009313 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | 0 |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: ganesh.r@adckcl.com

Designation: Chief Financial Officer

EmailId: anadu.nayak@commscope.com

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSENewspaper Advertisement regarding dispatch of Postal Ballot Notice

Corporate Actions

No Upcoming Board Meetings

ADC India Communications Ltd has declared 250% dividend, ex-date: 02 Apr 25

No Splits history available

No Bonus history available

No Rights history available