ADF Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:03:52ADF Foods, a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 232.70, showing a slight increase from the previous close of 228.00. Over the past year, ADF Foods has demonstrated a notable return of 23.38%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, but lacks a clear signal on a monthly scale. Bollinger Bands suggest a mildly bearish outlook weekly, contrasting with a bearish stance monthly. Moving averages indicate a bearish trend on a daily basis, while the KST shows a mixed picture with a bearish weekly trend and a bullish monthly trend. Nota...

Read MoreADF Foods Faces Bearish Technical Trends Amid Market Volatility and Mixed Indicators

2025-03-11 08:04:04ADF Foods, a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 233.90, down from a previous close of 238.65, with a notable 52-week high of 352.50 and a low of 178.55. Today's trading saw a high of 240.00 and a low of 226.20, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance weekly, with moving averages indicating a bearish trend. The KST presents a mixed picture, being bearish weekly but bullish monthly. Other indicators such as the RSI and OBV show no significant trends. In terms of performance, ADF Foods has experienced varied returns compared to the Sensex. Over the past week, the stock returned 0.88%, wh...

Read MoreADF Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-05 08:02:37ADF Foods, a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 241.30, showing a notable increase from the previous close of 231.85. Over the past year, ADF Foods has demonstrated a return of 14.01%, significantly outperforming the Sensex, which recorded a return of -1.19% during the same period. In terms of technical metrics, the MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) remains neutral, with no signals detected for both weekly and monthly evaluations. Bollinger Bands present a mildly bearish outlook weekly, contrasting with a bullish monthly trend. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a bearish trend weekly but a bullish stance monthly. Notabl...

Read MoreADF Foods Shows Resilience Amid Market Decline, Highlights Long-Term Growth Potential

2025-03-04 18:00:38ADF Foods, a small-cap player in the FMCG sector, has shown significant activity in today's trading session, rising by 4.08%. This uptick stands in contrast to the broader market, as the Sensex experienced a slight decline of 0.13%. Over the past year, ADF Foods has outperformed the Sensex, delivering a return of 14.01% compared to the index's drop of 1.19%. Despite today's positive movement, ADF Foods has faced challenges in the short term, with a 1-month decline of 11.27% and a year-to-date performance down by 18.26%. However, the company's long-term performance remains robust, with a remarkable 5-year growth of 386.88% and a staggering 10-year increase of 1771.99%, significantly surpassing the Sensex's respective gains. In terms of valuation, ADF Foods has a price-to-earnings (P/E) ratio of 33.42, which is notably lower than the industry average of 50.01. This metric, along with the company's market ca...

Read More

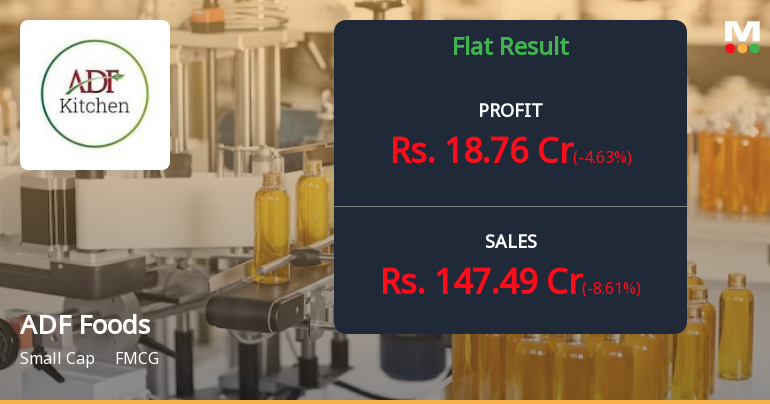

ADF Foods Reports Flat Financial Performance Amid Declining Profit Before Tax

2025-03-03 18:54:39ADF Foods, a small-cap FMCG company, recently experienced a change in its evaluation following flat financial performance in Q3 FY24-25, marked by a decline in profit before tax. Despite this, the company maintains a low debt-to-equity ratio and strong institutional holdings, reflecting investor confidence.

Read MoreADF Foods Experiences Technical Trend Adjustments Amid Strong Long-Term Performance

2025-02-28 08:01:23ADF Foods, a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 234.00, down from a previous close of 238.60. Over the past year, ADF Foods has shown a notable return of 22.35%, significantly outperforming the Sensex, which recorded a return of 2.08% in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish outlook, while the monthly MACD indicates bullish momentum. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Moving averages present a mildly bullish trend on a daily basis, contrasting with the bearish signals from the weekly KST and Dow Theory metrics. The company's performance over various time frames highlights its resilience, particularly over the long term, with a remarkable 310.60% return...

Read More

ADF Foods Reports Flat Financial Performance Amidst Stable Debt Levels and Positive Market Momentum

2025-02-24 18:34:04ADF Foods, a small-cap FMCG company, recently experienced a change in evaluation amid flat financial performance for Q3 FY24-25, reporting a profit before tax of Rs 21.01 crore. The company maintains a low debt-to-equity ratio and has shown positive momentum, outperforming the broader market over the past year.

Read More

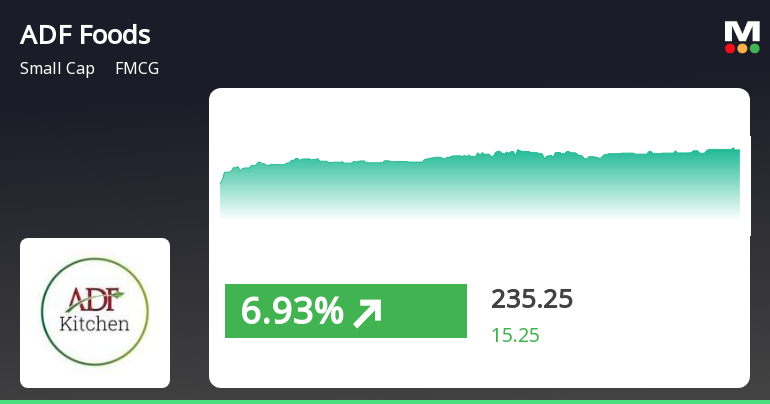

ADF Foods Experiences Significant Rebound Amid Broader Market Challenges

2025-02-19 13:35:21ADF Foods, a small-cap FMCG company, experienced a notable rebound on February 19, 2025, gaining 7.05% after three days of decline. Despite this uptick, the stock remains below key moving averages, indicating ongoing long-term challenges, while outperforming the broader market's slight decline.

Read More

ADF Foods Reports Mixed Financial Results, Highlighting Sales Growth and Profitability Challenges in December 2024

2025-02-15 10:22:37ADF Foods has announced its financial results for the quarter ending December 2024, showing a year-on-year net sales growth of 21.48% to Rs 308.88 crore. However, profit before tax declined to Rs 21.01 crore, indicating potential challenges in profitability despite strong sales performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEIntimation of certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window pursuant to the Companys Code of Conduct for Prohibition of Insider Trading under SEBI (PIT) Regulations 2015.

Disclosures under Reg. 10(7) of SEBI (SAST) Regulations 2011

21-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(7) in respect of acquisition under Regulation 10(1)(a)(i)of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Prisha Bhavesh Thakkar

Corporate Actions

No Upcoming Board Meetings

ADF Foods Ltd has declared 30% dividend, ex-date: 06 Nov 24

ADF Foods Ltd has announced 2:10 stock split, ex-date: 11 Sep 23

No Bonus history available

No Rights history available