Aditya Birla Real Estate Shows Mixed Technical Trends Amid Strong Long-Term Performance

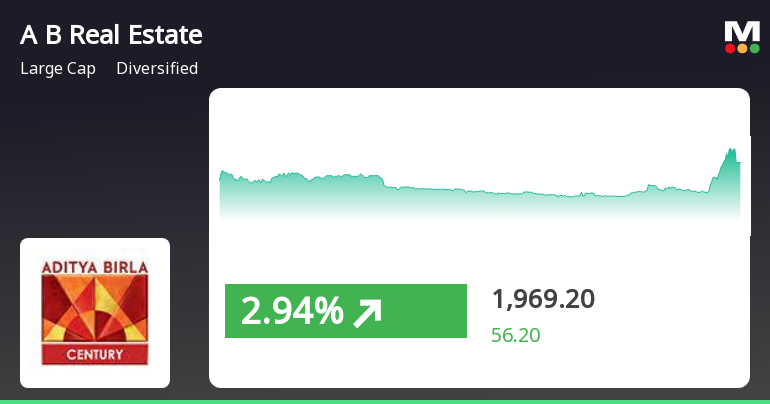

2025-04-03 08:05:27Aditya Birla Real Estate, a prominent player in the diversified sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1955.00, showing a slight increase from the previous close of 1953.65. Over the past year, the stock has demonstrated a return of 16.93%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly readings show a mildly bearish trend. The Bollinger Bands indicate a sideways movement on a monthly basis, suggesting some stability in price action. Notably, the On-Balance Volume (OBV) metrics are bullish on both weekly and monthly scales, indicating positive trading volume trends. The stock's performance over various time frames highlights its resilience, particularly over the long term, wit...

Read MoreAditya Birla Real Estate Faces Technical Challenges Amid Market Volatility

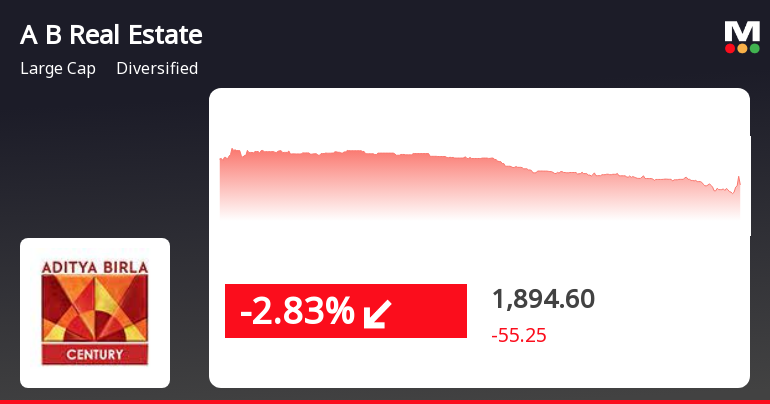

2025-04-02 08:08:10Aditya Birla Real Estate, a prominent player in the diversified sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1953.65, slightly down from the previous close of 1969.20. Over the past year, the stock has seen a high of 3,141.95 and a low of 1,630.25, indicating significant volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also reflect a bearish stance, with no clear signals from the RSI and other momentum indicators. This technical summary highlights the challenges the company faces in the current market environment. When examining the company's performance relative to the Sensex, Aditya Birla Real Estate has shown varied returns. Over the past week, the stock returned -0.79%, while t...

Read More

Aditya Birla Real Estate Shows Resilience Amid Broader Market Decline

2025-03-28 15:35:27Aditya Birla Real Estate has rebounded after three days of decline, showing notable activity with a significant intraday high. The stock has outperformed its sector and is trading above several moving averages, despite broader market challenges. Over the past year, it has appreciated substantially compared to the Sensex.

Read More

Aditya Birla Real Estate Faces Continued Decline Amid Broader Market Resilience

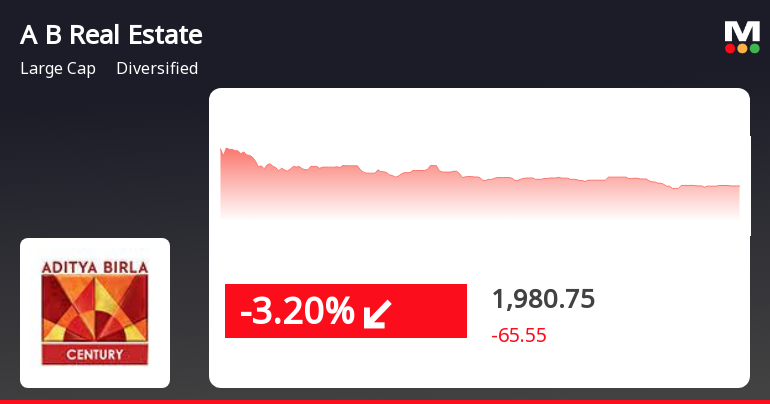

2025-03-27 14:50:27Aditya Birla Real Estate's stock has declined for three consecutive days, totaling a 7.97% drop. Currently trading below key moving averages, the stock contrasts with the broader market's resilience, as the Sensex has gained 6.12% over the past three weeks. Long-term performance remains strong with a 576.14% increase over the last decade.

Read More

Aditya Birla Real Estate Faces Decline Amid Broader Market Resilience and Long-Term Gains

2025-03-25 12:05:26Aditya Birla Real Estate saw a decline on March 25, 2025, after five days of gains, underperforming its sector. The stock is above its short-term moving averages but below longer-term ones. Despite today's drop, it has shown significant growth over the past year and five years compared to the Sensex.

Read MoreAditya Birla Real Estate Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-24 08:02:24Aditya Birla Real Estate, a prominent player in the diversified sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2045.10, showing a notable increase from the previous close of 1935.00. Over the past year, the stock has reached a high of 3,141.95 and a low of 1,385.00, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the KST and OBV metrics align with a bearish and mildly bearish stance, respectively. When comparing the company's performance to the Sensex, Aditya Birla ...

Read More

Aditya Birla Real Estate Shows Strong Short-Term Gains Amid Mixed Market Signals

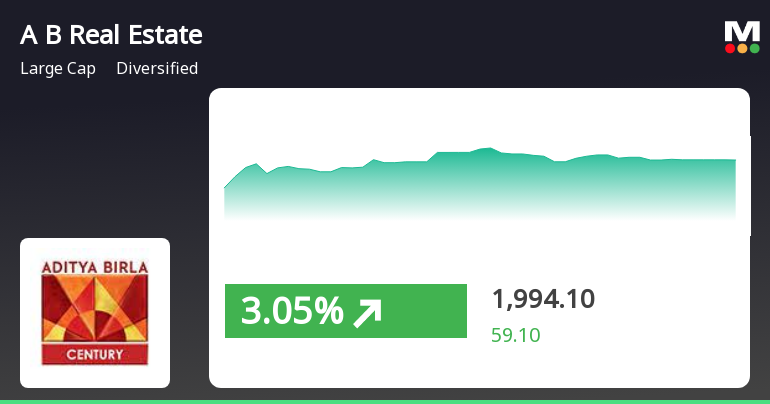

2025-03-21 09:50:24Aditya Birla Real Estate has experienced notable gains, marking its fourth consecutive day of increases and outperforming its sector. The stock's performance over the past year has been strong, significantly exceeding the broader market's growth, despite a year-to-date decline contrasting with the Sensex's smaller drop.

Read More

Aditya Birla Real Estate Shows Resilience Amid Fluctuating Market Conditions

2025-03-19 09:35:25Aditya Birla Real Estate has demonstrated notable performance, gaining 4.2% and outperforming its sector. The stock has seen consecutive gains over two days, totaling 9.63%. While it is above its 5-day moving average, it remains below longer-term averages, reflecting mixed short to medium-term performance amid broader market trends.

Read More

Aditya Birla Real Estate Shows Signs of Potential Trend Reversal Amid Market Challenges

2025-03-18 09:35:25Aditya Birla Real Estate experienced a notable increase today, breaking a five-day decline. The stock outperformed its sector and reached an intraday high, although it remains below key moving averages. Despite recent short-term declines, it has shown strong annual growth, significantly exceeding broader market gains.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSEConfirmation Certificate from MUFG Intime India Private Limited (RTA) to the Company

Certificate from CEO/CFO

01-Apr-2025 | Source : BSEPursuant to Chapter XVII of Operational Circular dated 10th August 2021 certificate issued by Chief Financial Officer for the quarter ended March 2025

Board Meeting Outcome for Outcome Of The Board Meeting Of The Company- Disclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

31-Mar-2025 | Source : BSEOutcome of the Board Meeting of the Company- Disclosure under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 and SEBI Circular SEBI/HO/CFD/PoD2/CIR/P/0155 dated 11th November 2024 as amended

Corporate Actions

No Upcoming Board Meetings

Aditya Birla Real Estate Ltd has declared 50% dividend, ex-date: 11 Jul 24

No Splits history available

No Bonus history available

No Rights history available