Aditya Vision Shows Mixed Technical Trends Amid Strong Historical Performance in Retail Sector

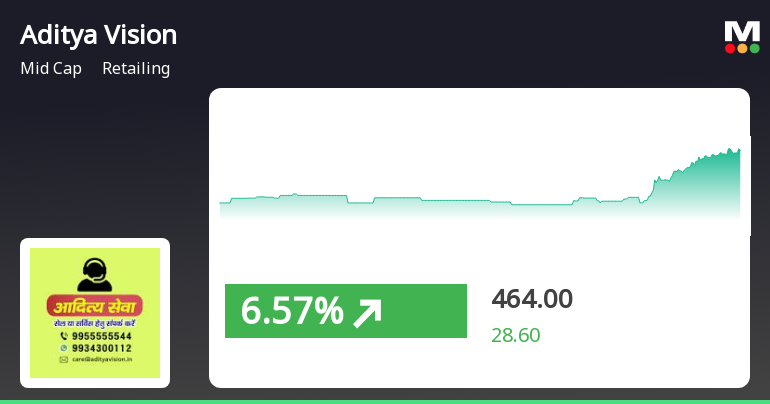

2025-04-03 08:05:46Aditya Vision, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 455.00, showing a notable increase from the previous close of 440.80. Over the past year, Aditya Vision has demonstrated a robust performance with a return of 43.13%, significantly outperforming the Sensex, which recorded a return of 3.67% during the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly readings show a mildly bearish trend. The Relative Strength Index (RSI) presents a bullish signal on a monthly basis, indicating some underlying strength. Additionally, Bollinger Bands and moving averages reflect a mildly bearish stance on a daily basis, suggesting a cautious outlook in the short term. The company's performance over various time frames highlights its resilie...

Read MoreAditya Vision Faces Bearish Technical Trends Amid Market Volatility and Mixed Performance

2025-04-02 08:08:57Aditya Vision, a midcap player in the retailing sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 440.80, down from a previous close of 447.80, with a 52-week high of 574.95 and a low of 283.75. Today's trading saw a high of 448.25 and a low of 439.35, indicating some volatility within the session. The technical summary for Aditya Vision reveals a bearish sentiment in various indicators. The MACD shows bearish trends on a weekly basis, while the monthly outlook is mildly bearish. Additionally, Bollinger Bands indicate a bearish trend weekly, with a sideways movement monthly. The moving averages also reflect a bearish stance on a daily basis, and the KST aligns with this sentiment on a weekly level. In terms of performance, Aditya Vision has shown a mixed return profile compared to the Sensex. Over the past week, the stock returne...

Read MoreAditya Vision's Technical Indicators Show Mixed Signals Amid Strong Yearly Performance

2025-03-28 08:03:37Aditya Vision, a midcap player in the retailing sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 442.00, showing a slight increase from the previous close of 435.40. Over the past year, Aditya Vision has demonstrated a notable return of 31.26%, significantly outperforming the Sensex, which recorded a return of 6.32% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly but is bullish monthly, suggesting some underlying strength. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish stance monthly. Daily moving averages indicate bearish conditions, while the KST and On-Balance Volume (OBV) metrics als...

Read More

Aditya Vision's Stock Surges Amid Broader Market Recovery and Strong Performance Trends

2025-03-27 15:05:28Aditya Vision, a midcap retail player, experienced notable activity on March 27, 2025, outperforming its sector. The stock is currently above its short-term moving averages, reflecting a broader market recovery. Despite recent challenges, it has shown substantial long-term growth over three and five years.

Read MoreAditya Vision Experiences Technical Trend Shift Amid Strong Long-Term Performance

2025-03-25 08:05:36Aditya Vision, a midcap player in the retailing industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 430.10, slightly down from the previous close of 432.35. Over the past year, Aditya Vision has shown a notable return of 23.57%, significantly outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly readings show a mildly bearish trend. The Bollinger Bands indicate a bearish stance on the weekly chart, contrasting with a mildly bullish outlook on the monthly chart. Moving averages also reflect a bearish trend on a daily basis. Despite the recent evaluation revision, Aditya Vision has demonstrated impressive long-term performance, particularly over three and five years, with returns of 492.14% and 24,905.8%, respectively, compared t...

Read MoreAditya Vision's Technical Indicators Signal Mixed Trends Amid Market Evaluation Revision

2025-03-19 08:04:32Aditya Vision, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 437.95, showing a notable increase from the previous close of 420.40. Over the past week, the stock has demonstrated a return of 3.93%, outperforming the Sensex, which returned 1.62% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands present a mildly bearish trend weekly, contrasting with a mildly bullish stance monthly. Moving averages reflect a bearish sentiment on a daily basis, while the KST indicates a bearish trend weekly and mildly bearish monthly. Aditya Vision's performance over v...

Read MoreAditya Vision Opens Strong with 6.47% Gain, Signaling Market Trend Reversal

2025-03-18 10:05:43Aditya Vision, a midcap player in the retailing sector, has shown significant activity today, opening with a gain of 6.47%. This uptick marks a trend reversal after two consecutive days of decline, positioning the stock as a notable performer in the market. The stock reached an intraday high of Rs 447.6, outperforming its sector by 2.68%. In terms of performance metrics, Aditya Vision has demonstrated a 1-day increase of 2.52%, compared to the Sensex's 1.05% rise. Over the past month, the stock has gained 10.83%, while the Sensex has seen a decline of 1.34%. From a technical perspective, the stock's moving averages indicate a mixed outlook, being higher than the 20-day moving average but lower than the 5-day, 50-day, 100-day, and 200-day averages. The stock is classified as high beta, with an adjusted beta of 1.20, suggesting it tends to experience larger fluctuations than the broader market. Overall, ...

Read MoreAditya Vision Faces Technical Trend Shifts Amidst Strong Historical Performance

2025-03-13 08:02:24Aditya Vision, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 425.95, showing a slight increase from the previous close of 421.40. Over the past year, Aditya Vision has demonstrated a notable return of 20.41%, significantly outperforming the Sensex, which recorded a return of just 0.49% in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly indicators show a mildly bearish trend. The Bollinger Bands indicate a bearish stance on a weekly basis, with a sideways trend observed monthly. Daily moving averages also reflect a bearish sentiment, suggesting a cautious outlook in the short term. Despite recent challenges, Aditya Vision has shown resilience over longer periods, with an impressive 528.24% return over three years and a stagge...

Read MoreAditya Vision Faces Technical Trend Shifts Amidst Strong Historical Performance

2025-03-13 08:02:24Aditya Vision, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 425.95, showing a slight increase from the previous close of 421.40. Over the past year, Aditya Vision has demonstrated a notable return of 20.41%, significantly outperforming the Sensex, which recorded a return of just 0.49% in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly indicators show a mildly bearish trend. The Bollinger Bands indicate a bearish stance on a weekly basis, with a sideways trend observed monthly. Daily moving averages also reflect a bearish sentiment, suggesting a cautious outlook in the short term. Despite recent challenges, Aditya Vision has shown resilience over longer periods, with an impressive 528.24% return over three years and a stagge...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

07-Apr-2025 | Source : BSEPursuant to the Regulation 30(6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we would like to inform you that the officials of the Company will be meeting Investors/Analysts (Participants) as per the details below.

Announcement Under Regulation 30 Of SEBI LODR (Opening Of Showroom)

31-Mar-2025 | Source : BSEOpening of showroom

Announcement Under Regulation 30 Of SEBI LODR (Opening Of Showroom)

27-Mar-2025 | Source : BSEOpening of Showroom.

Corporate Actions

No Upcoming Board Meetings

Aditya Vision Ltd has declared 90% dividend, ex-date: 26 Jul 24

Aditya Vision Ltd has announced 1:10 stock split, ex-date: 27 Aug 24

No Bonus history available

No Rights history available