Advani Hotels Adjusts Valuation Grade Amid Competitive Market Landscape and Strong Financial Metrics

2025-03-28 08:00:19Advani Hotels & Resorts (India) has recently undergone a valuation adjustment, reflecting its current financial standing within the hotel, resort, and restaurant industry. The company exhibits a price-to-earnings (P/E) ratio of 20.60 and a price-to-book value of 7.80, indicating its market valuation relative to its earnings and assets. Additionally, the enterprise value to EBITDA stands at 14.14, while the enterprise value to EBIT is recorded at 15.58. The company showcases a robust return on capital employed (ROCE) of 140.47% and a return on equity (ROE) of 37.87%, highlighting its efficiency in generating profits from its capital and equity. Advani Hotels also offers a dividend yield of 3.16%, which may appeal to income-focused investors. In comparison to its peers, Advani Hotels maintains a competitive position, with Kamat Hotels rated as very attractive and Viceroy Hotels categorized as very expensive...

Read MoreAdvani Hotels Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-26 08:01:46Advani Hotels & Resorts (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 59.28, down from a previous close of 61.58, with a 52-week high of 90.00 and a low of 52.57. Today's trading saw a high of 62.75 and a low of 59.00. The technical summary indicates a bearish sentiment in various indicators, including MACD and Bollinger Bands on both weekly and monthly scales. The moving averages also reflect a bearish trend, while the Dow Theory shows a mildly bullish stance on a weekly basis. The Relative Strength Index (RSI) presents a bullish signal weekly, but no signal is noted monthly. In terms of performance, Advani Hotels has faced challenges compared to the Sensex. Over the past year, the stock has returned -22.81%, while the Sensex has gained 7.12%. Year-to-date, th...

Read MoreAdvani Hotels Shows Mixed Technical Trends Amidst Market Challenges and Resilience

2025-03-21 08:01:10Advani Hotels & Resorts (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 62.00, showing a slight increase from the previous close of 61.70. Over the past year, the stock has experienced a decline of 18.15%, contrasting with a 5.89% gain in the Sensex, indicating a challenging performance relative to broader market trends. In terms of technical indicators, the weekly MACD and KST are bearish, while the monthly readings show a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish stance on both weekly and monthly bases. Notably, the On-Balance Volume (OBV) presents a mildly bullish outlook on a weekly basis, suggesting some positive trading momentum despite the overall bearish sentiment. When examining the company's return compared to the Sensex, A...

Read MoreAdvani Hotels Faces Technical Challenges Amidst Long-Term Resilience in Market Dynamics

2025-03-17 08:00:40Advani Hotels & Resorts (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.60, slightly down from the previous close of 62.45. Over the past year, Advani Hotels has faced challenges, with a return of -18.19%, contrasting with a modest gain of 1.47% in the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators, including the MACD and moving averages, which suggest a cautious outlook. The Bollinger Bands and KST also reflect a mildly bearish trend, while the Dow Theory presents a mixed view with a mildly bullish weekly signal. Despite these technical indicators, Advani Hotels has shown resilience in longer-term performance, particularly over the past five years, where it achieved a remarkable return of 206.85%, sig...

Read MoreAdvani Hotels Faces Mixed Technical Trends Amid Market Volatility and Performance Challenges

2025-03-12 08:01:03Advani Hotels & Resorts (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 62.99, showing a slight increase from the previous close of 62.60. Over the past year, the stock has experienced significant volatility, with a 52-week high of 90.00 and a low of 52.57. In terms of technical indicators, the company shows a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands and On-Balance Volume (OBV) also reflect mildly bearish conditions. Conversely, the Dow Theory suggests a mildly bullish outlook on a weekly basis, although it turns bearish on a monthly basis. The Relative Strength Index (RSI) remains neutral, indicating no strong momentum in either direction. When comparing the company's performance to the Sensex,...

Read More

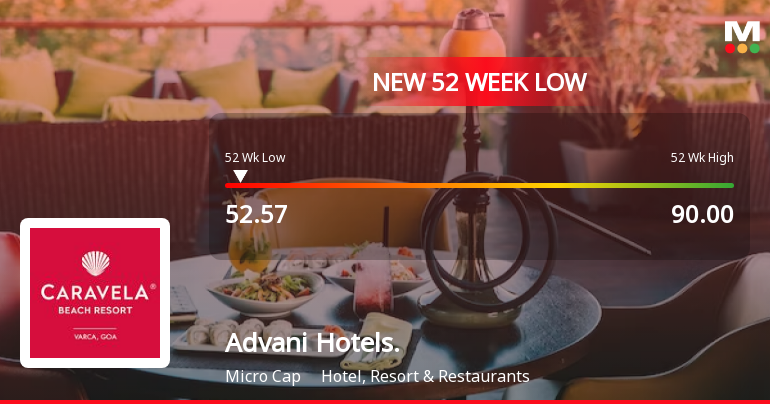

Advani Hotels Hits 52-Week Low Amidst Declining Stock Performance and Market Activity

2025-03-04 14:35:36Advani Hotels & Resorts (India) has reached a new 52-week low, experiencing a notable decline over the past four days. The stock is trading below all major moving averages and has seen a significant year-over-year drop. However, the company reported positive financial results and maintains a low debt-to-equity ratio.

Read More

Advani Hotels & Resorts Faces Significant Stock Volatility Amidst Industry Challenges

2025-03-03 10:35:42Advani Hotels & Resorts (India) has faced significant trading volatility, hitting a new 52-week low. The stock has underperformed over the past three days, with a notable decline in value. Despite these challenges, the company offers a high dividend yield, reflecting ongoing struggles in a competitive market.

Read MoreAdvani Hotels & Resorts Adjusts Valuation Amid Competitive Hospitality Market Dynamics

2025-03-01 08:00:38Advani Hotels & Resorts (India), a microcap player in the hotel, resort, and restaurant industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 20.58 and a price-to-book value of 7.79, indicating its market positioning relative to its assets. Additionally, the enterprise value to EBITDA stands at 14.12, while the enterprise value to EBIT is recorded at 15.57. The company's return on capital employed (ROCE) is notably high at 140.47%, and its return on equity (ROE) is also strong at 37.87%. These metrics suggest a robust operational efficiency and profitability profile. In comparison to its peers, Advani Hotels maintains a competitive stance, with several companies in the sector also rated attractively. For instance, Royal Orchid Hotels and Sayaji Hotels share similar valuation standings, while others like Viceroy Hotels are positioned diff...

Read More

Advani Hotels & Resorts Hits 52-Week Low Amid Persistent Bearish Trend

2025-02-28 09:36:27Advani Hotels & Resorts (India) has reached a new 52-week low, continuing a downward trend with a notable decline over the past two days. The stock is trading below multiple moving averages and has decreased significantly over the past year, contrasting with the overall market performance. The company offers a high dividend yield.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEPFA intimation on Closure of Trading Window

Corporate Action-Board approves Dividend

11-Feb-2025 | Source : BSEInterim Dividend

Announcement under Regulation 30 (LODR)-Newspaper Publication

11-Feb-2025 | Source : BSEPFA published Un-audited Financial Results for the quarter and nine months ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

Advani Hotels & Resorts (India) Ltd has declared 50% dividend, ex-date: 14 Feb 25

Advani Hotels & Resorts (India) Ltd has announced 2:10 stock split, ex-date: 22 Oct 07

Advani Hotels & Resorts (India) Ltd has announced 1:1 bonus issue, ex-date: 20 Mar 24

No Rights history available