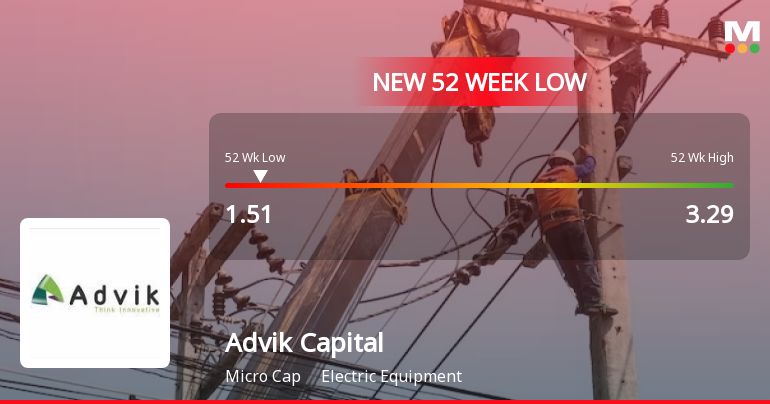

Advik Capital Faces Significant Challenges Amidst Declining Stock Performance and Flat Financial Results

2025-03-27 12:38:40Advik Capital, a microcap in the electric equipment sector, has reached a new 52-week low and has underperformed its sector recently. The company reported flat net sales for December 2024, with rising interest expenses. Despite a significant year-over-year decline, it shows potential for long-term growth and attractive valuation metrics.

Read MoreAdvik Capital Adjusts Valuation Grade Amid Competitive Positioning in Electric Equipment Sector

2025-03-27 08:00:51Advik Capital, a microcap player in the electric equipment industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 11.34 and a price-to-book value of 0.87, indicating a relatively low valuation compared to its peers. Its enterprise value to EBITDA stands at 12.96, while the enterprise value to sales is notably low at 0.30, suggesting efficient revenue generation relative to its market valuation. In terms of performance metrics, Advik Capital's return on capital employed (ROCE) is recorded at 4.18%, and return on equity (ROE) is at 1.63%. These figures provide insight into the company's operational efficiency and profitability. When compared to its industry peers, Advik Capital's valuation metrics appear more favorable, particularly against companies like Concord Control and Artemis Electrical, ...

Read More

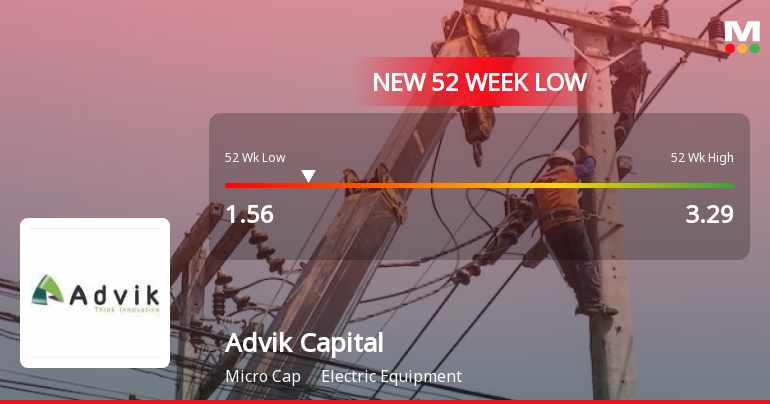

Advik Capital Faces Significant Volatility Amid Broader Market Decline and Financial Concerns

2025-03-26 15:40:50Advik Capital, a microcap in the electric equipment sector, has faced notable volatility, reaching a new 52-week low and marking its fourth consecutive day of decline. The company's recent financial results show a significant drop in net sales and high reliance on non-operating income, raising concerns about its outlook.

Read More

Advik Capital Faces Significant Volatility Amid Declining Sales and Earnings Concerns

2025-03-26 15:40:41Advik Capital, a microcap in the electric equipment sector, has faced notable volatility, reaching a new 52-week low. The company reported its lowest quarterly net sales and high interest expenses, raising concerns about earnings sustainability. Despite long-term growth in net sales and operating profit, its technical indicators reflect a bearish outlook.

Read More

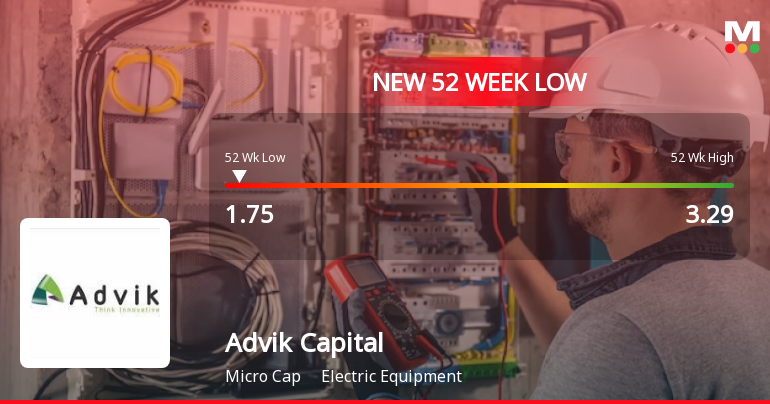

Advik Capital Faces Significant Volatility Amid Broader Market Trends and Small-Cap Gains

2025-03-06 15:36:28Advik Capital, a microcap in the electric equipment sector, has hit a new 52-week low, underperforming its sector and trading below key moving averages. Despite a significant annual decline, the company reports strong long-term growth metrics, raising concerns about its stock performance relative to broader market trends.

Read MoreAdvik Capital Adjusts Valuation Amidst Significant Stock Decline and Competitive Metrics

2025-03-06 08:01:16Advik Capital, a microcap player in the electric equipment sector, has recently undergone a valuation adjustment. The company's current price stands at 1.85, reflecting a slight increase from the previous close of 1.79. Over the past year, Advik Capital has faced challenges, with a notable decline of nearly 40% in stock value, contrasting sharply with a marginal gain in the Sensex. Key financial metrics for Advik Capital include a price-to-earnings (PE) ratio of 12.87 and an EV to EBITDA ratio of 13.78. The company's return on capital employed (ROCE) is reported at 4.18%, while the return on equity (ROE) is at 1.63%. These figures indicate a competitive position within its industry, although they suggest room for improvement. In comparison to its peers, Advik Capital's valuation metrics appear more favorable than those of companies like Concord Control and Artemis Electrical, which exhibit significantly h...

Read More

Advik Capital Hits 52-Week Low Amid Broader Market Decline and Rising Interest Expenses

2025-03-04 10:24:34Advik Capital, a microcap in the electric equipment sector, reached a new 52-week low amid a broader market decline. Over the past year, the company has seen a significant drop in stock value, despite strong long-term growth metrics and a notable return on capital employed.

Read More

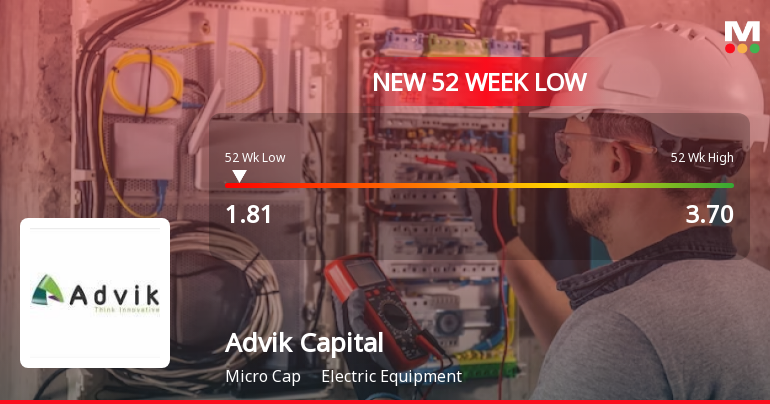

Advik Capital Faces Significant Challenges Amidst Electric Equipment Sector Volatility

2025-03-03 11:35:41Advik Capital, a microcap in the electric equipment sector, has hit a new 52-week low, reflecting significant volatility. Over the past year, its stock has dropped substantially, underperforming the benchmark Sensex. Currently, it trades below key moving averages, indicating ongoing challenges for the company.

Read More

Advik Capital Faces Sustained Decline Amid Broader Electric Equipment Sector Challenges

2025-02-18 13:05:57Advik Capital, a microcap in the electric equipment sector, has hit a new 52-week low, reflecting significant volatility and a 9.22% decline over four days. The stock is trading below all major moving averages and has dropped 47.50% over the past year, underperforming compared to the broader market.

Read MoreClosure of Trading Window

29-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Integrated Filing (Financial)

03-Mar-2025 | Source : BSEUn -Audited Financial (Standalone and Consolidated) Results of the company for the Quarter ended December 31 2024.

Disclosure Under Regulation 30 Read With Para A Of Part A Of Schedule III Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

18-Feb-2025 | Source : BSEDisclosure under Regulation 30 read with Para A of Part A of Schedule III of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Advik Capital Ltd has announced 1:10 stock split, ex-date: 14 Dec 17

No Bonus history available

Advik Capital Ltd has announced 14:30 rights issue, ex-date: 12 Sep 24