Aegis Logistics Sees High Trading Volume Amid Mixed Performance Relative to Sector

2025-04-03 10:00:14Aegis Logistics Ltd, a prominent player in the logistics industry, has emerged as one of the most active equities today, with a total traded volume of 8,593,731 shares and a total traded value of approximately Rs 69.93 crore. The stock opened at Rs 783.65 and reached a day high of Rs 831.00 before settling at a last traded price of Rs 797.85. Despite this activity, Aegis Logistics underperformed its sector, recording a 1D return of -0.87%, compared to the sector's return of -0.48% and the Sensex's return of -0.34%. The stock's performance is noteworthy as it remains above its 20-day, 50-day, 100-day, and 200-day moving averages, although it is currently below its 5-day moving average. Investor participation has seen a rise, with a delivery volume of 5.9 lakh shares on April 2, reflecting a 20.6% increase against the 5-day average delivery volume. The liquidity of Aegis Logistics is also favorable, with t...

Read MoreAegis Logistics Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:04:25Aegis Logistics, a prominent player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 801.80, showing a notable increase from the previous close of 783.05. Over the past year, Aegis Logistics has demonstrated significant resilience, with a remarkable return of 86.10%, far surpassing the Sensex's return of 3.67% during the same period. In terms of technical indicators, the weekly MACD suggests a bullish sentiment, while the monthly outlook remains mildly bearish. The Bollinger Bands indicate a mildly bullish trend on both weekly and monthly scales, suggesting some stability in price movements. However, the daily moving averages reflect a mildly bearish stance, indicating mixed signals in the short term. Aegis Logistics has shown impressive long-term performance, with a staggering 499.48% return over the past fiv...

Read MoreAegis Logistics Adjusts Valuation Grade Amid Strong Market Performance Metrics

2025-04-03 08:00:34Aegis Logistics has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the logistics industry. The company's price-to-earnings ratio stands at 48.69, while its price-to-book value is noted at 6.83. Additionally, Aegis Logistics shows an EV to EBITDA ratio of 29.98 and an EV to EBIT ratio of 35.09, indicating a robust valuation relative to its earnings. The company has demonstrated a return on capital employed (ROCE) of 14.27% and a return on equity (ROE) of 14.17%, showcasing its efficiency in generating profits from its capital and equity. Despite a modest dividend yield of 0.41%, Aegis Logistics has exhibited strong performance over various time frames, with a remarkable 86.10% return over the past year and an impressive 499.48% return over the last five years. In comparison to its peers, such as Container Corporation, Aegis Logistics maintains...

Read MoreAegis Logistics Sees Increased Trading Activity Amid Positive Market Sentiment Shift

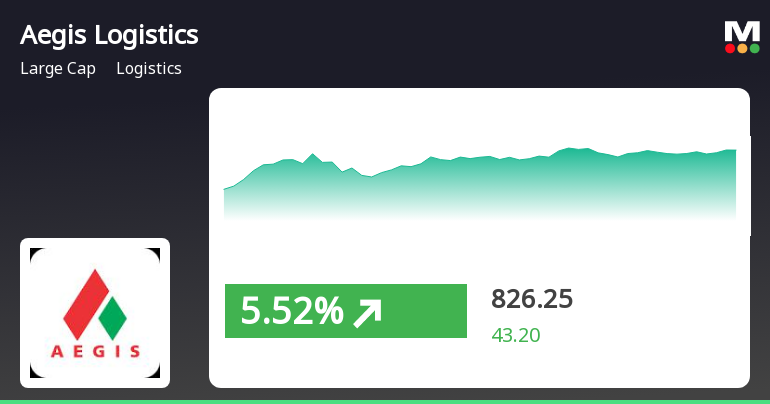

2025-04-02 11:00:07Aegis Logistics Ltd, a prominent player in the logistics industry, has emerged as one of the most active equities today, with a total traded volume of 3,636,950 shares and a total traded value of approximately Rs 29,716.79 lakhs. The stock opened at Rs 783.65 and reached an intraday high of Rs 831.0, reflecting a notable gain of 6.29% during the trading session. As of the latest update, the last traded price stands at Rs 822.3, marking a 3.52% increase for the day. Aegis Logistics has outperformed its sector by 4.13%, indicating a positive shift in market sentiment after two consecutive days of decline. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a strong upward trend. However, it is worth noting that investor participation has decreased, with delivery volume dropping by 46.09% compared to the 5-day average. With a market capitalization ...

Read More

Aegis Logistics Shows Trend Reversal Amid Broader Market Rally and Strong Growth

2025-04-02 09:35:19Aegis Logistics experienced a notable performance on April 2, 2025, reversing a two-day decline and outperforming its sector. The stock is trading above key moving averages, while the broader market, led by mega-cap stocks, continues to rise. Over the past year, Aegis Logistics has shown significant growth.

Read More

Aegis Logistics Adjusts Valuation Amid Strong Long-Term Performance and Market Position

2025-04-02 08:18:11Aegis Logistics has experienced a recent evaluation adjustment, reflecting shifts in its financial metrics and market standing. The company, a key player in the logistics sector, has shown strong long-term performance with a notable return over the past year and maintains high management efficiency.

Read MoreAegis Logistics Experiences Technical Indicator Shifts Amidst Strong Long-Term Performance

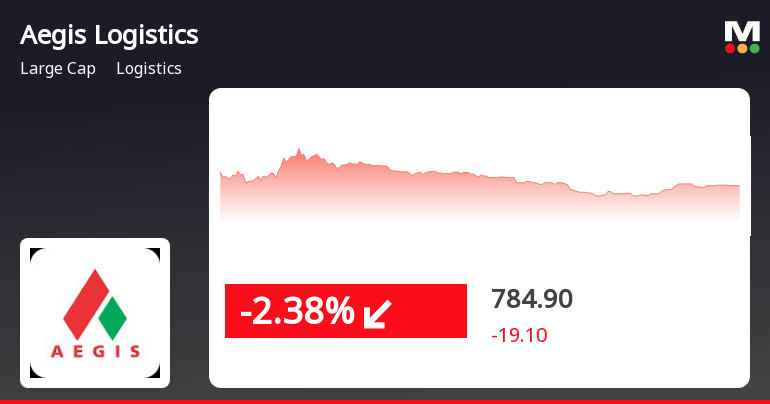

2025-04-02 08:06:33Aegis Logistics, a prominent player in the logistics industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 783.05, down from a previous close of 804.00. Over the past year, Aegis Logistics has demonstrated significant resilience, with a remarkable return of 79.33%, significantly outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical metrics, the weekly MACD indicates a bullish stance, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) remains neutral across both weekly and monthly evaluations, suggesting a lack of strong momentum in either direction. Bollinger Bands reflect a sideways movement weekly, with a mildly bullish outlook monthly. Daily moving averages indicate a mildly bearish sentiment, while the KST presents a m...

Read More

Aegis Logistics Faces Short-Term Challenges Amid Broader Market Decline

2025-04-01 11:50:19Aegis Logistics has faced a decline on April 1, 2025, marking its second consecutive day of losses and a total drop of 14.21% recently. While the stock is above some moving averages, it has struggled in the short term, with a year-to-date performance of -5.10%.

Read MoreAegis Logistics Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:02:24Aegis Logistics, a prominent player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 804.00, with a notable previous close of 903.20. Over the past year, Aegis has demonstrated significant resilience, achieving a remarkable return of 80.39%, compared to the Sensex's 5.11% during the same period. This performance is further highlighted by a staggering 488.58% return over the last five years, outpacing the Sensex's 159.65%. In terms of technical indicators, the weekly MACD shows a bullish trend, while the monthly MACD indicates a mildly bearish stance. The Bollinger Bands reflect a bullish sentiment on both weekly and monthly bases, suggesting potential volatility in the stock's price. The On-Balance Volume (OBV) also supports a bullish outlook on a weekly and monthly scale. Aegis Logistics has shown a strong re...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate pursuant to Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025 is attached.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Feb-2025 | Source : BSEIntimation of Schedule of Analyst/Institutional Investor meetings under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 is attached.

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2025 | Source : BSENewspaper Advertisement of Financial Results for the quarter and nine months ended December 31 2024 is attached.

Corporate Actions

No Upcoming Board Meetings

Aegis Logistics Ltd has declared 200% dividend, ex-date: 26 Jun 24

Aegis Logistics Ltd has announced 1:10 stock split, ex-date: 16 Sep 15

Aegis Logistics Ltd has announced 2:3 bonus issue, ex-date: 18 Aug 10

No Rights history available