Aeroflex Industries Reports Strong Financial Performance Amid Rising Institutional Interest

2025-03-10 08:08:46Aeroflex Industries has recently adjusted its evaluation following a strong financial performance in Q3 FY24-25, with record net sales and profits. The company has maintained a low debt-to-equity ratio and has seen increased institutional investor participation, reflecting growing confidence despite broader market challenges.

Read MoreAeroflex Industries Shows Mixed Technical Trends Amidst Market Fluctuations

2025-03-10 08:02:11Aeroflex Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 176.30, showing a notable increase from the previous close of 171.50. Over the past year, Aeroflex has demonstrated a return of 28.45%, significantly outperforming the Sensex, which recorded a mere 0.29% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bearish trend, while the Relative Strength Index (RSI) indicates bullish momentum. The Bollinger Bands and Dow Theory also reflect a mildly bearish sentiment on a weekly basis. However, the daily moving averages are showing a mildly bullish trend, indicating some positive movement in the short term. Aeroflex's performance over various time frames reveals a mixed picture. While the stock has faced challenges in the las...

Read More

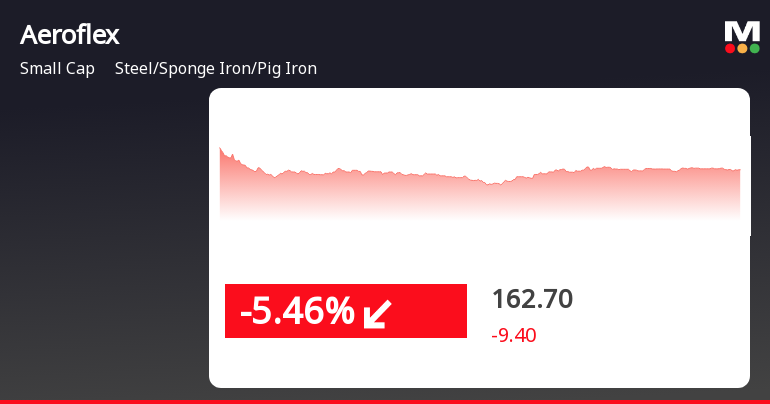

Aeroflex Industries Faces Significant Stock Decline Amid Broader Market Challenges

2025-03-03 11:50:39Aeroflex Industries, a small-cap company in the Steel sector, has seen its stock price decline significantly, with a notable drop today. The stock has faced consecutive losses over the past three days and is trading below key moving averages, indicating a sustained downward trend amid broader market challenges.

Read MoreAeroflex Industries Faces Mixed Technical Trends Amid Market Fluctuations

2025-03-03 08:01:31Aeroflex Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 172.10, down from a previous close of 183.65, with a 52-week high of 271.60 and a low of 114.40. Today's trading saw a high of 182.85 and a low of 167.70. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bearish trend on a weekly basis, while the daily moving averages suggest a mildly bullish stance. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Additionally, the Bollinger Bands and KST reflect bearish tendencies on a weekly basis. In terms of performance, Aeroflex has experienced notable fluctuations compared to the Sensex. Over the past week, the stock returned -11.79%, while the Sensex saw a ...

Read MoreAeroflex Industries Faces Mixed Technical Trends Amid Market Volatility

2025-03-02 08:01:30Aeroflex Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 172.10, has seen fluctuations with a 52-week high of 271.60 and a low of 114.40. Today's trading range was between 167.70 and 182.85, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates a mildly bearish trend on a weekly basis, while the daily moving averages suggest a mildly bullish sentiment. However, the overall technical indicators, including the Bollinger Bands and KST, lean towards a bearish outlook on a weekly basis. Notably, the Relative Strength Index (RSI) shows no significant signals, suggesting a period of consolidation. In terms of performance, Aeroflex has faced challenges recently, with a notable decline in stock returns over various periods. For instance, t...

Read MoreAeroflex Industries Faces Technical Trend Shifts Amid Market Evaluation Adjustments

2025-03-01 08:01:28Aeroflex Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 172.10, down from a previous close of 183.65. Over the past year, Aeroflex has shown a return of 17.76%, significantly outperforming the Sensex, which recorded a modest gain of 1.24% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bearish trend, while the daily moving averages indicate a mildly bullish stance. The Relative Strength Index (RSI) shows no signal on both weekly and monthly charts, indicating a neutral momentum. Additionally, the Bollinger Bands and KST metrics reflect bearish tendencies on a weekly basis. The stock has experienced notable fluctuations, with a 52-week high of 271.60 and a low of 114.40. Recent performance metrics reveal a decline of 11....

Read More

Aeroflex Industries Reports Strong Sales Growth Amidst Valuation Adjustments and Investor Interest

2025-02-28 18:34:06Aeroflex Industries, a small-cap company in the Steel sector, has recently adjusted its evaluation amid positive third-quarter financial results, including net sales of Rs 99.80 crore. Despite strong growth in sales and operating profit over five years, concerns about its valuation persist, alongside increased institutional investor participation.

Read More

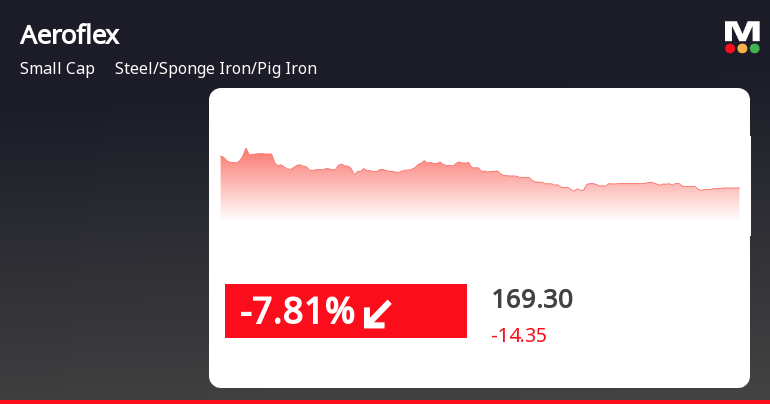

Aeroflex Industries Faces Significant Market Challenges Amid Broader Sector Declines

2025-02-28 11:05:30Aeroflex Industries, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has seen its shares decline significantly, underperforming compared to its sector. The stock has faced consecutive losses over the past two days and is trading below key moving averages, indicating a bearish trend in its performance.

Read More

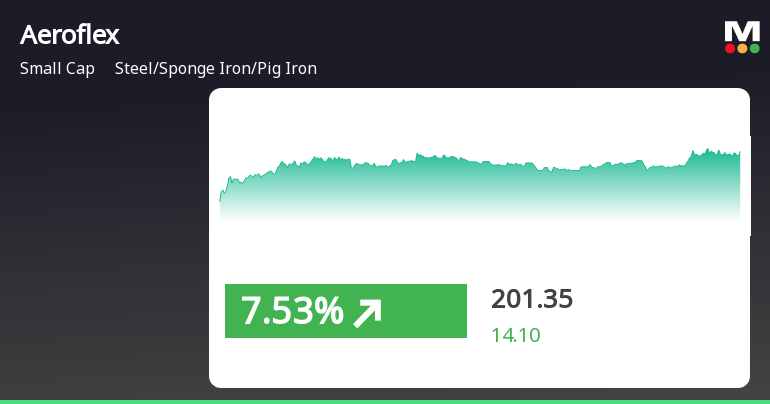

Aeroflex Industries Shows Resilience Amidst Volatile Market Conditions

2025-02-19 15:05:29Aeroflex Industries experienced a notable rebound on February 19, 2025, reversing a four-day decline with a significant intraday high. The stock outperformed its sector while facing challenges over the past month. Its moving averages indicate mixed short-term momentum amid a volatile market environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for quarter ended 31.03.2025

Closure of Trading Window

26-Mar-2025 | Source : BSEThe Trading window for trading/ dealing in securities of the company shall remain closed for all the Insiders including Designated Persons and their Immediate Relatives with effect from Tuesday April 01 2025 till the end of 48 hours after the declaration of financial results of the company for quarter and year ended March 31 2025

Intimation Under Regulation 30 Of Securities And Exchange Board Of India (SEBI) (Listing Obligations And Disclosure Requirements) Regulations 2015 - Allotment Of Equity Shares By Hyd -Air Engineering Private Limited Wholly Owned Subsidiary Of The Company

21-Mar-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we hereby inform you that our Wholly owned Subsidiary Hyd-Air Engineering Private Limited has by its letter dated March 21 2025 informed the company that it has allotted 1800 equity shares of face value of Rs. 100/- each at a price of Rs. 58853/- per share to Aeroflex Industries Limited.

Corporate Actions

No Upcoming Board Meetings

Aeroflex Industries Ltd has declared 12% dividend, ex-date: 28 Jun 24

No Splits history available

No Bonus history available

No Rights history available