Agarwal Industrial Corporation Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-03-27 08:02:37Agarwal Industrial Corporation, a small-cap player in the petrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1010.95, down from a previous close of 1036.00, with a notable 52-week high of 1,383.15 and a low of 787.70. Today's trading saw a high of 1061.25 and a low of 994.00. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish tendencies. The KST aligns with this sentiment, indicating a bearish position on the weekly scale and mildly bearish on the monthly. In terms of performance, Agarwal Industrial Corporation's returns present a mixed picture when compared to the Sensex. Over the past week, the stock has seen a decline of 4.45...

Read MoreAgarwal Industrial Corporation Faces Mixed Technical Trends Amid Strong Historical Performance

2025-03-20 08:02:32Agarwal Industrial Corporation, a small-cap player in the petrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1058.00, showing a notable increase from the previous close of 978.80. Over the past year, Agarwal Industrial has demonstrated a strong performance with a return of 33.45%, significantly outpacing the Sensex, which returned 4.77% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the KST and Dow Theory metrics align with this trend. The company's performance over va...

Read More

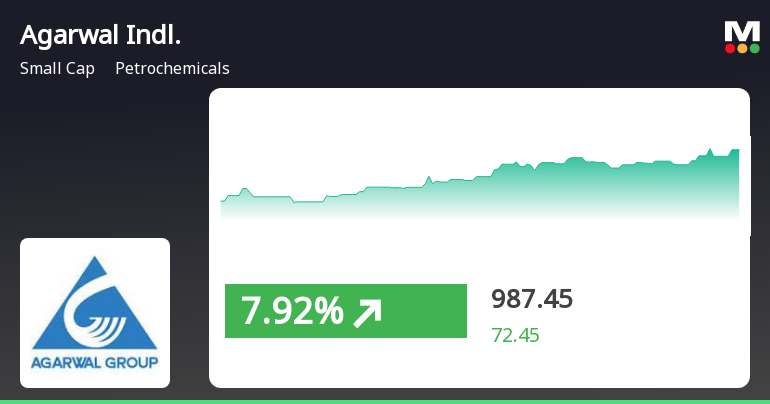

Agarwal Industrial Corporation Shows Strong Short-Term Gains Amid Long-Term Volatility

2025-03-19 13:05:22Agarwal Industrial Corporation, a small-cap petrochemicals firm, experienced a significant stock price increase today, outperforming its sector. The company has shown strong annual growth, although it has faced year-to-date challenges. Over the past three and five years, its stock has demonstrated remarkable gains.

Read More

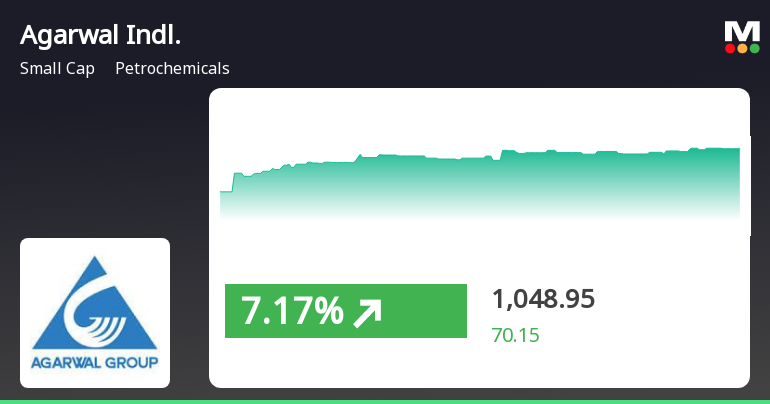

Agarwal Industrial Corporation Outperforms Sector Amid Broader Market Volatility

2025-03-06 11:35:21Agarwal Industrial Corporation, a small-cap petrochemical firm, has experienced significant activity, rising 7.1% on March 6, 2025. The stock has shown a strong upward trend over the past three days, while the broader market, including the Sensex, has faced volatility, with small-cap stocks outperforming.

Read MoreAgarwal Industrial Corporation Faces Market Pressures Amid Broader Trends in Petrochemicals

2025-02-28 10:25:06Agarwal Industrial Corporation, a small-cap player in the petrochemicals industry, has experienced significant stock activity today, reflecting broader market trends. With a market capitalization of Rs 1,324.59 crore, the company currently has a price-to-earnings (P/E) ratio of 10.96, notably lower than the industry average of 15.34. Over the past year, Agarwal Industrial Corporation's stock has declined by 6.82%, contrasting with the Sensex's gain of 1.99%. Today's performance shows a decrease of 3.31%, while the Sensex fell by 1.17%. The stock has faced challenges over the past month, with a drop of 18.50%, compared to the Sensex's decline of 2.85%. Year-to-date, the stock is down 30.41%, significantly underperforming the Sensex, which has decreased by 5.63%. Despite recent struggles, Agarwal Industrial Corporation has shown resilience over longer periods, with a remarkable 83.93% increase over three ye...

Read MoreAgarwal Industrial Corporation Faces Bearish Technical Trends Amid Market Volatility

2025-02-28 08:01:40Agarwal Industrial Corporation, a small-cap player in the petrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 915.90, down from a previous close of 932.00. Over the past year, the stock has experienced significant volatility, with a 52-week high of 1,383.15 and a low of 770.95. In terms of technical indicators, the weekly and monthly assessments show a bearish trend across several metrics, including MACD, Bollinger Bands, and moving averages. The KST and Dow Theory also indicate a bearish sentiment, while the RSI shows no signal for both weekly and monthly evaluations. When comparing the company's performance to the Sensex, Agarwal Industrial Corporation has faced challenges. Over the past week, the stock returned -3.99%, while the Sensex returned -1.48%. In the year-to-date period, the stock has declined b...

Read More

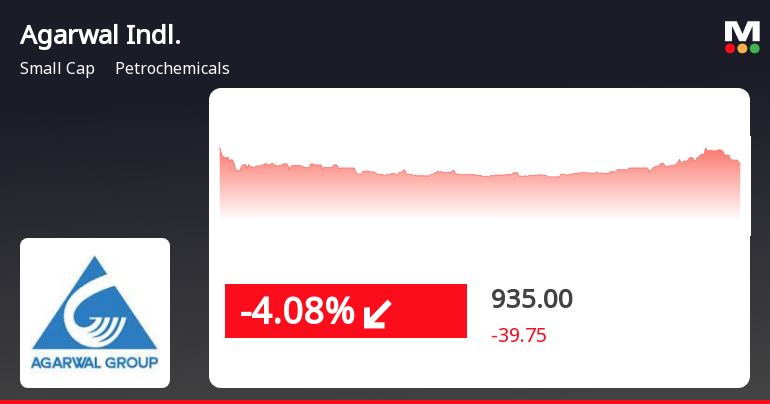

Agarwal Industrial Corporation Faces Continued Stock Decline Amid Market Volatility in February 2025

2025-02-14 12:50:29Agarwal Industrial Corporation, a small-cap petrochemicals firm, has seen its stock price decline significantly, losing 7.15% on February 14, 2025. Over the past month, the stock has dropped 21.49%, underperforming its sector and trading below multiple moving averages, reflecting ongoing challenges in a volatile market.

Read More

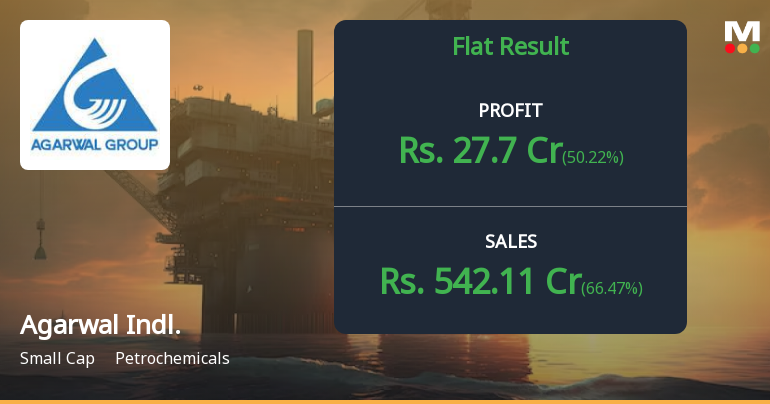

Agarwal Industrial Corporation Reports Stable Financial Performance Amid Evaluation Adjustments in February 2025

2025-02-14 10:41:00Agarwal Industrial Corporation has announced its financial results for the quarter ending December 2024, revealing steady performance and stability in operations. An adjustment in its evaluation score from -9 to -4 over the past three months suggests a revised perspective on the company's financial standing and market positioning.

Read More

Agarwal Industrial Corporation Faces Revenue Challenges Amid Strong Debt Servicing Capacity in September 2024

2025-02-13 18:46:23Agarwal Industrial Corporation, a small-cap petrochemicals firm, has recently seen a change in its evaluation, reflecting its financial status. While interest has grown, net sales have declined, posing revenue challenges. The company shows strong debt servicing capacity and healthy long-term growth trends, alongside increased institutional investor interest.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (D&P) Regulations 2018 for the quarter ended 31st March 2025 received from MUFG Intime India Private Limited Registrar and Share Transfer Agents of the Company.

Structured Digital Database (SDD) Compliance Certificate For The Quarter Ended 31St March 2025

01-Apr-2025 | Source : BSEStructured Digital Database (SDD) Compliance Certificate for the Quarter Ended 31st March 2025

Closure of Trading Window

24-Mar-2025 | Source : BSEWindow Closure Intimation for dealing in Securities of the Company will remain closed for all Directors Promotors Designated Persons and Connected Persons (including immediate relatives) with effect from April 01 2025 till the end of the 48 hours after the announcement by the Company of its Audited Financial Results (Standalone and Consolidated) for the Quarter and Year Ended March 31st 2025 in accordance with Regulation 33 of SEBI (LODR) 2015 Reference SEBI (Prohibition of Insider Trading) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Agarwal Industrial Corporation Ltd has declared 30% dividend, ex-date: 06 Sep 24

No Splits history available

No Bonus history available

No Rights history available