AGI Greenpac Shows Mixed Technical Trends Amid Strong Long-Term Growth Performance

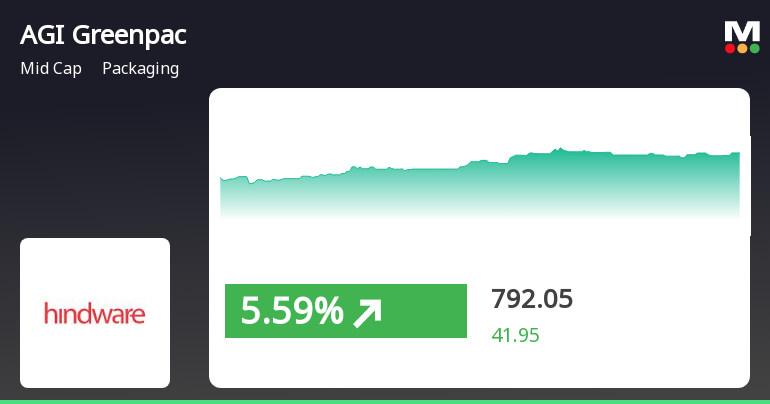

2025-04-02 08:05:17AGI Greenpac, a midcap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 785.00, showing a notable increase from the previous close of 750.10. Over the past week, AGI Greenpac has demonstrated a stock return of 5.16%, contrasting with a decline of 2.55% in the Sensex, indicating a stronger performance relative to the broader market. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish stance for both weekly and monthly assessments. Moving averages indicate a mildly bearish trend on a daily basis, while the KST remains bearish weekly and mildly bearish monthly. Notably, the Dow Theory presents a mildly bullish signal on a weekly basis, although it shifts to a mildly bearish view mon...

Read More

AGI Greenpac Outperforms Market Amid Broader Decline, Highlights Mixed Performance Trends

2025-04-01 11:40:32AGI Greenpac has demonstrated notable performance in the packaging sector, gaining 5.8% on April 1, 2025, and outperforming the broader market. The stock has shown mixed trends in moving averages and has risen 24.49% over the past month, despite a year-to-date decline of 29.54%.

Read MoreAGI Greenpac Experiences Technical Trend Shift Amid Strong Long-Term Performance

2025-03-25 08:02:53AGI Greenpac, a small-cap player in the packaging industry, has recently undergone a technical trend adjustment. The company's current price stands at 764.80, reflecting a notable shift from its previous close of 742.45. Over the past week, AGI Greenpac has shown a strong performance, with a stock return of 16.94%, significantly outperforming the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the MACD signals a bearish trend on a weekly basis, while the monthly perspective remains mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly evaluations, indicating a neutral momentum. Bollinger Bands and KST also reflect a bearish sentiment on the weekly scale, with moving averages indicating a bearish trend. Despite the recent adjustments in technical evaluations, AGI Greenpac has demonstrated resilience over longer periods. The company ...

Read MoreAGI Greenpac Experiences Technical Trend Shifts Amid Market Volatility and Mixed Outlook

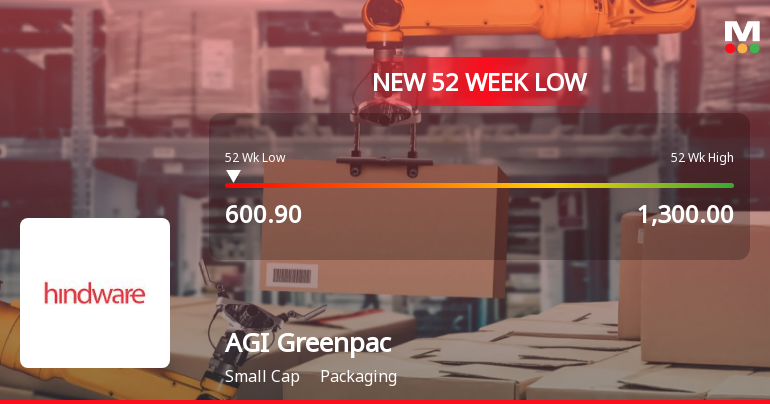

2025-03-19 08:02:33AGI Greenpac, a small-cap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 684.25, showing a notable fluctuation with a 52-week high of 1,300.00 and a low of 600.00. Today's trading saw a high of 690.90 and a low of 657.75, indicating some volatility in its performance. The technical summary reveals a mixed outlook, with various indicators suggesting a cautious stance. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans towards a mildly bearish sentiment. The Bollinger Bands and KST also reflect similar trends, indicating a cautious market environment. However, the Dow Theory presents a mildly bullish view on a weekly basis, contrasting with the overall bearish signals. In terms of returns, AGI Greenpac has faced challenges compared to the Sensex. Over the past year,...

Read MoreAGI Greenpac Faces Technical Challenges Amidst Long-Term Resilience in Packaging Sector

2025-03-05 08:01:39AGI Greenpac, a small-cap player in the packaging industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 655.60, showing a notable shift from its previous close of 631.70. Over the past year, AGI Greenpac has experienced a decline of 26.57%, contrasting with a modest 1.19% drop in the Sensex, highlighting the stock's underperformance relative to the broader market. In terms of technical indicators, the weekly MACD and KST are both bearish, while the monthly readings show a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish stance on a weekly and monthly basis. Daily moving averages indicate a bearish trend, suggesting a challenging environment for the stock. Despite recent fluctuations, AGI Greenpac has shown resilience over longer periods, with a remarkable 1168.09% return over the past five years, significantl...

Read MoreAGI Greenpac Faces Mixed Performance Amid Market Challenges and Long-Term Resilience

2025-03-04 18:00:28AGI Greenpac, a small-cap player in the packaging industry, has shown notable activity today, with its stock rising by 3.78%. This uptick comes amid a challenging performance over the past year, where the stock has declined by 26.57%, contrasting sharply with the Sensex's modest drop of 1.19%. Despite today's gains, AGI Greenpac's performance over various time frames remains under pressure. Over the past month, the stock has decreased by 13.74%, and year-to-date, it has fallen by 41.72%. In the longer term, however, AGI Greenpac has demonstrated resilience, with a remarkable 133.10% increase over the past three years and an impressive 1168.09% rise over the last five years. Key financial metrics reveal a price-to-earnings (P/E) ratio of 14.61, which is below the industry average of 20.14, indicating potential valuation considerations. Technical indicators suggest a bearish trend in the short term, with m...

Read More

AGI Greenpac Faces Significant Stock Volatility Amid Broader Market Trends

2025-03-03 10:36:05AGI Greenpac, a small-cap packaging company, has faced notable volatility, hitting a new 52-week low. The stock has declined significantly over the past four days and is trading below multiple moving averages. Over the past year, it has underperformed compared to the broader market, reflecting ongoing challenges.

Read More

AGI Greenpac Reports Strong Q3 Performance Amid Long-Term Growth Concerns and Market Underperformance

2025-02-06 18:44:13AGI Greenpac, a small-cap packaging company, recently adjusted its evaluation following a positive third-quarter performance, highlighted by a 17.89% return on capital employed. Despite a solid operational foundation, long-term growth appears challenging, with recent trends indicating a shift in stock performance. Institutional investor participation has increased, reflecting confidence in the company's fundamentals.

Read More

AGI Greenpac Reports Strong Q3 FY24-25 Performance Amidst Market Evaluation Adjustments

2025-02-01 18:32:21AGI Greenpac, a midcap packaging company, has recently adjusted its evaluation based on its financial performance, reporting a strong return on capital employed and a low debt-equity ratio. The stock has seen modest returns and increased institutional investment, indicating growing confidence in its fundamentals.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPFA herewith certificate under regulation 74(5) of SEBI (DP) Regulations 2018 for quarter ended 31.03.2025

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

05-Apr-2025 | Source : BSEPFA herewith the intimation under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Board Meeting Outcome for Outcome Of The Board Meeting Of AGI Greenpac Limited (Company) Held On Monday March 31 2025.

31-Mar-2025 | Source : BSEIn terms of Regulation 30 and other applicable provisions of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 read with related circulars and notifications if any we would like to inform you that the Board of Directors of the Company at its meeting held today i.e. March 31 2025 has inter-alia approved the setting up a new Container Glass Plant (Greenfield Project) in Madhya Pradesh.

Corporate Actions

No Upcoming Board Meetings

AGI Greenpac Ltd has declared 300% dividend, ex-date: 11 Sep 24

No Splits history available

No Bonus history available

No Rights history available