Ahluwalia Contracts Shows Strong Short-Term Gains Amid Mixed Market Signals

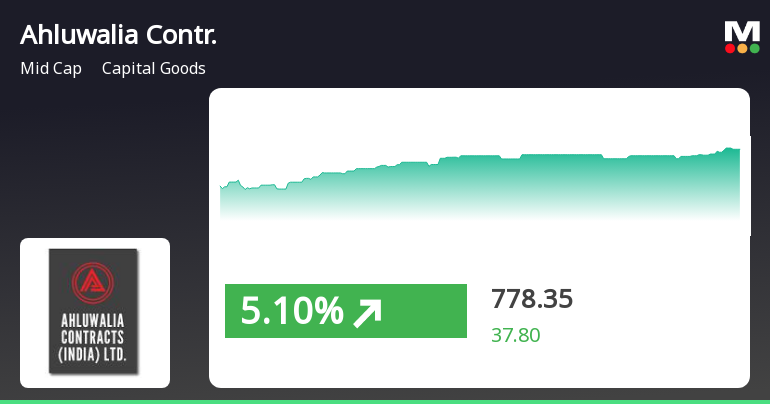

2025-03-20 14:45:14Ahluwalia Contracts (India) has experienced notable activity, achieving consecutive gains over three days and outperforming its sector. The stock is positioned above several short-term moving averages, while broader market trends indicate a positive trajectory for the Sensex, despite mixed signals in moving averages.

Read MoreAhluwalia Contracts Faces Mixed Technical Signals Amid Strong Long-Term Performance

2025-03-20 08:00:54Ahluwalia Contracts (India), a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 774.45, showing a notable increase from the previous close of 740.55. Over the past week, the stock has demonstrated a return of 5.80%, significantly outperforming the Sensex, which returned 1.92% in the same period. In terms of technical indicators, the MACD and KST suggest a bearish outlook on a weekly basis, while the monthly indicators show a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish sentiment, indicating some caution in the market. However, the Dow Theory presents a mildly bullish perspective on a weekly basis, suggesting mixed signals in the overall technical landscape. Ahluwalia Contracts has shown resilience over longer periods, with a remarkable 242.60% return over the past fiv...

Read More

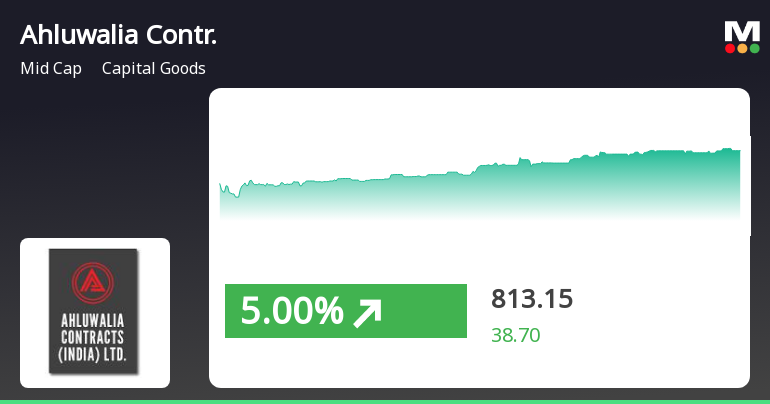

Ahluwalia Contracts Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-19 13:00:17Ahluwalia Contracts (India) has experienced notable activity, gaining 5.23% on March 19, 2025, and outperforming its sector. The stock has risen 6.38% over two days and opened significantly higher, although it remains below longer-term moving averages. Year-to-date performance shows a decline, but longer-term gains are substantial.

Read MoreAhluwalia Contracts Opens Strong with 6.32% Gain, Outpacing Sector Performance

2025-03-19 10:05:04Ahluwalia Contracts (India) Ltd, a midcap player in the capital goods sector, has shown significant activity today, opening with a gain of 6.32%. The stock's performance has outpaced its sector by 1.52%, marking a notable achievement. Over the past two days, Ahluwalia Contracts has recorded a cumulative return of 3.85%, reflecting a positive trend. The stock reached an intraday high of Rs 787.35, indicating strong market interest. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages, suggesting mixed signals in the short to medium term. In the context of broader market performance, Ahluwalia Contracts has outperformed the Sensex, with a 1-day performance of 2.73% compared to the Sensex's 0.14%. Over the past month, the stock has surged by 17.22%, while the Sensex has declined by 0.70%. Technical indicators pre...

Read MoreAhluwalia Contracts Adjusts Valuation Grade, Reflecting Resilience in Market Positioning

2025-03-10 08:00:10Ahluwalia Contracts (India), a small-cap player in the capital goods sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 27.65 and a price-to-book value of 2.88, indicating its market positioning relative to its assets. The enterprise value to EBITDA stands at 12.72, while the EV to EBIT is recorded at 16.81, reflecting its operational efficiency. In terms of profitability, Ahluwalia Contracts boasts a return on capital employed (ROCE) of 28.31% and a return on equity (ROE) of 11.68%. The company also offers a modest dividend yield of 0.07%. When compared to its peers, Ahluwalia Contracts demonstrates competitive metrics, particularly in its PE ratio and EV to EBITDA, positioning it favorably within the industry. Notably, while some competitors are loss-making or have higher valuation multiples, Ahluwalia's financial indicators suggest a...

Read MoreAhluwalia Contracts Adjusts Valuation Grade Amid Competitive Capital Goods Landscape

2025-03-04 08:00:13Ahluwalia Contracts (India), a small-cap player in the capital goods sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 25.40 and a price-to-book value of 2.64. Its enterprise value to EBITDA stands at 11.51, while the EV to EBIT is recorded at 15.21. The firm also shows a robust return on capital employed (ROCE) of 28.31% and a return on equity (ROE) of 11.68%. In comparison to its peers, Ahluwalia Contracts maintains a competitive position, particularly against companies like J Kumar Infra and Bharat Bijlee, which also hold attractive valuations. However, firms such as TD Power Systems and Indo Tech. Trans. are positioned at a higher valuation level, indicating a varied landscape within the industry. Despite facing challenges reflected in its year-to-date return of -35.68%, the company has shown resilience over longer periods, with a t...

Read MoreAhluwalia Contracts Adjusts Valuation Grade Amid Strong Operational Performance Metrics

2025-02-24 12:56:40Ahluwalia Contracts (India), a small-cap player in the capital goods sector, has recently undergone a valuation adjustment reflecting its financial performance and market position. The company currently exhibits a price-to-earnings ratio of 25.06 and a price-to-book value of 2.61, indicating a solid valuation framework. Its enterprise value to EBITDA stands at 11.33, while the EV to EBIT is recorded at 14.97, showcasing efficient operational metrics. The company's return on capital employed (ROCE) is notably high at 28.31%, and the return on equity (ROE) is at 11.68%, suggesting effective management of resources. Despite a modest dividend yield of 0.08%, these metrics position Ahluwalia Contracts favorably within its industry. In comparison to its peers, Ahluwalia Contracts demonstrates a competitive edge, particularly against companies like Hindustan Construction, which is currently loss-making, and Bhar...

Read More

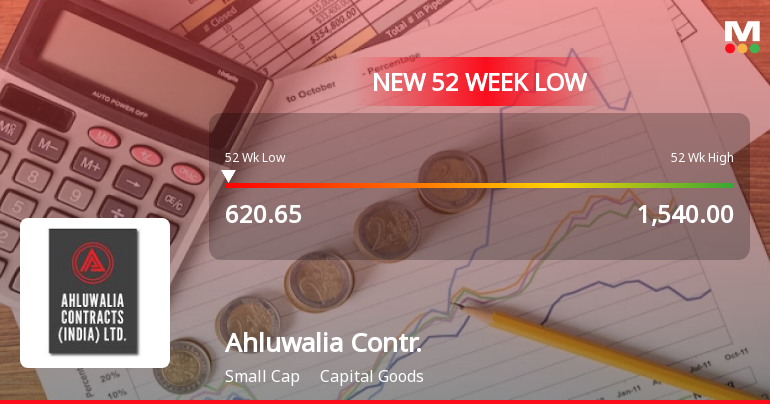

Ahluwalia Contracts Faces Significant Volatility Amidst Ongoing Market Challenges

2025-02-18 11:54:03Ahluwalia Contracts (India) has faced significant volatility, reaching a new 52-week low and experiencing a 17.34% decline over the past six days. The stock is trading below all major moving averages and has dropped 38.57% over the past year, contrasting with the Sensex's gains.

Read More

Ahluwalia Contracts Faces Market Challenges Amid Significant Capital Goods Activity

2025-02-17 10:05:47Ahluwalia Contracts (India) has seen notable fluctuations in the capital goods sector, nearing its 52-week low. The stock opened higher but faced downward pressure, marking a decline over the past week. It has underperformed relative to its sector and is trading below key moving averages, reflecting a bearish trend.

Read MoreDisclosure Made Under Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares And Takeovers) Regulation 2011.

07-Apr-2025 | Source : BSESAST Regulation 2011

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window from 01-04-2025 to 31-05-2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

18-Feb-2025 | Source : BSETranscript Investor Meeting

Corporate Actions

No Upcoming Board Meetings

Ahluwalia Contracts (India) Ltd has declared 25% dividend, ex-date: 20 Sep 24

Ahluwalia Contracts (India) Ltd has announced 2:10 stock split, ex-date: 14 Sep 07

No Bonus history available

No Rights history available