Airan Ltd Experiences Notable Buying Activity Amid Broader Market Decline

2025-03-28 09:35:33Airan Ltd, a microcap player in the IT software industry, is witnessing notable buying activity today, with the stock gaining 0.11%. This performance stands in contrast to the Sensex, which has declined by 0.20%. Over the past two days, Airan has recorded consecutive gains, accumulating a total return of 2.67%. In terms of broader performance metrics, Airan's one-year performance shows a significant increase of 19.21%, outperforming the Sensex's 5.16% gain. However, the stock has faced challenges in the short term, with a 3.81% decline over the past week and a 17.75% drop over the last three months. Year-to-date, Airan is down 17.02%, while the Sensex has only decreased by 0.88%. Today's trading session opened with a gap up, indicating initial positive sentiment. The stock is currently trading above its 20-day moving average but remains below its 5-day, 50-day, 100-day, and 200-day moving averages. This ...

Read MoreAiran Ltd Faces Intense Selling Pressure Amid Significant Price Declines and Investor Losses

2025-03-27 09:40:37Airan Ltd, a microcap player in the IT software industry, is currently facing significant selling pressure, with today's trading session showing only sellers. The stock has experienced consecutive days of losses, reflecting a challenging trend for investors. Over the past week, Airan has declined by 0.70%, while the Sensex has gained 1.42%, indicating a notable underperformance relative to the broader market. In terms of recent performance, Airan's stock has dropped 17.96% over the past three months, contrasting sharply with the Sensex's decline of just 1.61%. Year-to-date, Airan has seen a decrease of 17.23%, compared to the Sensex's minor drop of 0.90%. However, on a one-year basis, Airan has outperformed the Sensex, with a gain of 15.53% against the Sensex's 6.08%. Today's performance shows Airan outperforming its sector by 2.06%, despite the overall negative sentiment. The stock is currently trading a...

Read MoreAiran Ltd Experiences Increased Buying Activity Amidst Market Dynamics Shift

2025-03-26 09:35:30Airan Ltd, a microcap player in the IT software industry, is witnessing significant buying activity today, with a performance increase of 0.43%. This contrasts with the Sensex, which has seen a slight decline of 0.04%. Over the past week, Airan has shown a robust gain of 4.15%, outperforming the Sensex's 3.36% increase. However, its one-month performance of 1.52% lags behind the Sensex's 4.53% rise. Despite a challenging three-month period where Airan's stock fell by 12.76%, it has managed to deliver a notable annual performance of 13.35%, compared to the Sensex's 7.61%. Year-to-date, Airan's stock is down 14.59%, while the Sensex has only dipped by 0.20%. Today's trading session opened with a gap up, indicating strong buyer sentiment. The stock is currently positioned above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. This trend suggest...

Read MoreAiran Ltd Experiences Strong Buying Activity Amid Mixed Performance and Price Trends

2025-03-25 09:35:46Airan Ltd, a microcap player in the IT software industry, is currently witnessing strong buying activity, despite a slight decline of 0.24% in its stock price today. This performance contrasts with the Sensex, which has gained 0.42% on the same day. Over the past week, Airan has shown a robust increase of 9.94%, significantly outperforming the Sensex's 3.99% rise. In the last month, the stock has risen by 6.68%, again surpassing the Sensex's 4.97% gain. However, the stock has recently experienced a trend reversal after five consecutive days of gains. It is important to note that while Airan's performance over the past year stands at a commendable 24.08%, it has faced challenges year-to-date, with a decline of 10.24% compared to the Sensex's modest increase of 0.22%. In terms of price summary, Airan opened with a gap up and has shown resilience in its short-term moving averages, being higher than the 5-day...

Read More

Airan's Evaluation Score Adjusted Amid Positive Financial Performance and Market Trends

2025-03-25 08:21:20Airan, a microcap IT software company, has recently adjusted its evaluation score, reflecting changes in the stock's technical landscape. The company reported a 42.81% increase in profit before tax for Q3 FY24-25 and maintains a low debt-to-equity ratio, indicating a strong financial position despite modest sales growth.

Read More

Airan's Financial Performance Shows Growth Amid Long-Term Challenges and Market Positioning

2025-02-28 18:31:48Airan, a microcap IT software company, has recently adjusted its evaluation based on mixed financial trends. In Q3 FY24-25, it reported significant profit growth and a high return on capital employed. However, challenges remain in long-term growth, with net sales increasing at a modest rate over five years.

Read More

Airan Reports Strong Financial Performance Amidst Long-Term Growth Challenges in IT Sector

2025-02-24 18:36:06Airan, a microcap IT software firm, recently adjusted its evaluation based on strong third-quarter FY24-25 results, including a 24.90% return on capital employed and a 42.81% increase in profit before tax. The company maintains a low debt-to-equity ratio and a solid return on equity, despite facing long-term growth challenges.

Read More

Airan's Financial Performance Shows Growth Amid Long-Term Challenges and Market Adjustments

2025-02-18 18:38:55Airan, a microcap IT software company, recently adjusted its evaluation following a strong third-quarter performance, with a profit before tax of Rs 4.07 crore and a return on capital employed of 24.90%. However, long-term growth appears limited, and the stock is currently in a bearish technical range.

Read More

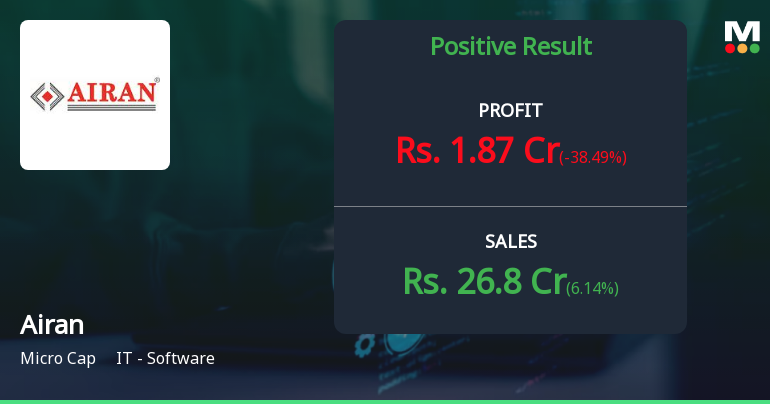

Airan Reports Mixed Financial Results, Highlighting Growth in Profit Before Tax Amid Challenges

2025-02-17 10:21:56Airan, an IT software microcap company, announced its financial results for the quarter ending December 2024 on February 14, 2025. The report shows a significant increase in Profit Before Tax (PBT) at Rs 4.07 crore, while Profit After Tax (PAT) declined to Rs 1.87 crore, indicating mixed performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under reg 74(5)

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Trading window Closure.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSENewspaper Publication for the financials for the quarter ended 31st December 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Airan Ltd has announced 2:2 stock split, ex-date: 14 Aug 18

Airan Ltd has announced 1:1 bonus issue, ex-date: 22 Apr 19

No Rights history available