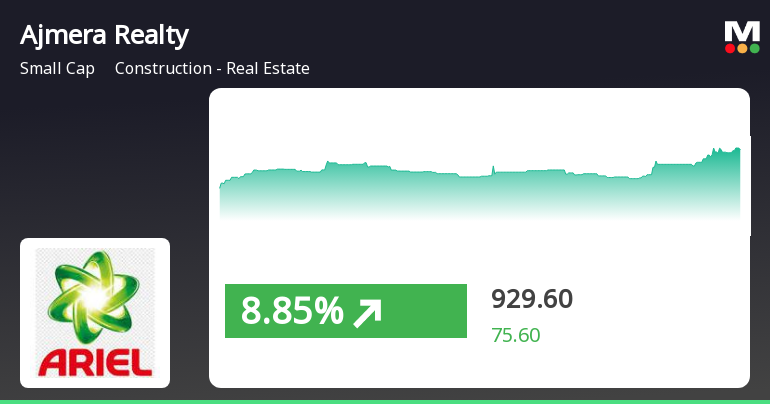

Ajmera Realty's Stock Surge Reflects Broader Market Recovery and Strong Long-Term Growth

2025-03-21 15:05:16Ajmera Realty & Infra India has experienced notable stock activity, rising significantly today and outperforming its sector. The stock is currently above several key moving averages, reflecting strong performance over the past week and impressive long-term growth, despite facing challenges year-to-date. The broader market is also recovering.

Read MoreAjmera Realty Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-03-20 08:00:11Ajmera Realty & Infra India has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the construction and real estate sector. The company currently exhibits a price-to-earnings (P/E) ratio of 26.85 and a price-to-book value of 3.78, indicating a robust valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 16.61, while the enterprise value to sales ratio is recorded at 5.15. In terms of profitability, Ajmera Realty showcases a return on capital employed (ROCE) of 15.01% and a return on equity (ROE) of 13.72%. The company's PEG ratio is noted at 0.87, suggesting a favorable growth outlook relative to its valuation. When compared to its peers, Ajmera Realty's valuation metrics position it distinctly within the market. For instance, while Ceigall India is categorized as attractive, other competitors like ...

Read More

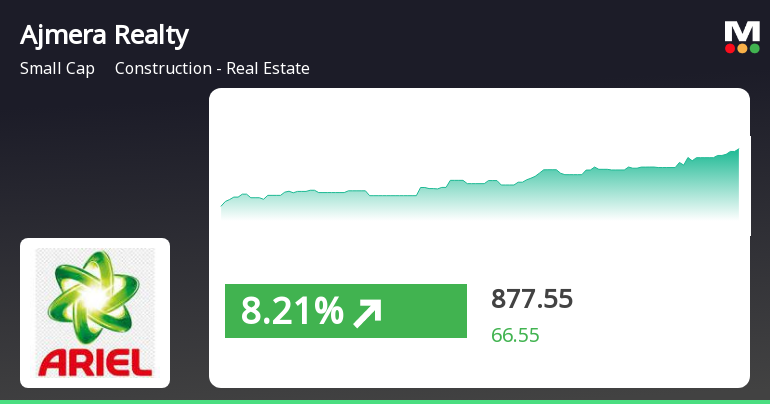

Ajmera Realty Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-19 11:15:17Ajmera Realty & Infra India has experienced notable activity, outperforming its sector and showing a consistent upward trend over the past three days. The stock is currently above several moving averages, reflecting mixed short-term and long-term trends. Year-to-date, it has declined, contrasting with significant gains over the past three years.

Read MoreAjmera Realty Exhibits Mixed Technical Signals Amid Strong Long-Term Performance

2025-03-19 08:01:19Ajmera Realty & Infra India, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 811.00, showing a notable increase from the previous close of 788.65. Over the past year, Ajmera Realty has demonstrated a return of 15.76%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates mixed signals across various indicators. While the MACD shows a bullish trend on a monthly basis, the weekly outlook remains bearish. The Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish monthly perspective. Moving averages indicate a mildly bullish trend on a daily basis, suggesting some positive momentum. In terms of stock performance, Ajmera Realty has shown resilience, particularly over longer time f...

Read MoreAjmera Realty Faces Mixed Technical Signals Amid Market Volatility and Performance Variations

2025-03-17 08:00:28Ajmera Realty & Infra India, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 784.30, has seen fluctuations with a 52-week high of 1,225.80 and a low of 566.05. Today's trading range was between 777.25 and 818.75, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) currently presents no clear signal, and Bollinger Bands indicate a bearish trend weekly but a bullish stance monthly. Moving averages suggest a mildly bullish outlook on a daily basis, contrasting with the mildly bearish signals from the KST and Dow Theory on a weekly and monthly basis. In terms of performance, Ajmera Realty's stock retu...

Read MoreAjmera Realty Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:00:48Ajmera Realty & Infra India, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 808.00, showing a notable increase from the previous close of 782.05. Over the past year, Ajmera Realty has demonstrated a robust performance with a return of 23.01%, significantly outperforming the Sensex, which recorded a mere 0.49% return during the same period. In terms of technical indicators, the company presents a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and KST metrics show a mildly bearish trend on a weekly and monthly basis. The Bollinger Bands reflect a bearish stance weekly but turn bullish on a monthly scale, suggesting volatility in the stock's performance. Ajmera Realty's performance over various time frames highlights it...

Read MoreAjmera Realty Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:00:48Ajmera Realty & Infra India, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 808.00, showing a notable increase from the previous close of 782.05. Over the past year, Ajmera Realty has demonstrated a robust performance with a return of 23.01%, significantly outperforming the Sensex, which recorded a mere 0.49% return during the same period. In terms of technical indicators, the company presents a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and KST metrics show a mildly bearish trend on a weekly and monthly basis. The Bollinger Bands reflect a bearish stance weekly but turn bullish on a monthly scale, suggesting volatility in the stock's performance. Ajmera Realty's performance over various time frames highlights it...

Read MoreAjmera Realty Faces Mixed Technical Trends Amid Market Fluctuations and Sentiment Shifts

2025-03-12 08:00:47Ajmera Realty & Infra India, a small-cap player in the construction and real estate sector, has recently undergone an evaluation adjustment reflecting its current market dynamics. The stock, which closed at 782.05, has experienced fluctuations, with a 52-week high of 1,225.80 and a low of 566.05. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics present a mixed picture with some mildly bullish signals. The moving averages indicate a mildly bullish trend on a daily basis, contrasting with the overall monthly outlook. The KST and Dow Theory metrics also reflect a mildly bearish stance over the monthly period. When comparing Ajmera Realty's performance to the Sensex, the company has shown varied returns. Over the past week, the stock returned -0.99%, while the Sensex gained 1.52%. In the one-month period, Ajmera Realty's return was -...

Read MoreAjmera Realty Faces Significant Volatility Amid Broader Market Challenges

2025-03-11 09:50:05Ajmera Realty & Infra India Ltd, a small-cap player in the construction and real estate sector, has experienced significant volatility in today's trading session. The stock opened with a notable loss of 5.43%, reflecting a broader trend of underperformance, as it lagged behind its sector by 2.34%. Over the past two days, Ajmera Realty has seen a consecutive decline, accumulating a total drop of 5.47%. During intraday trading, the stock reached a low of Rs 763.85, marking a decrease of 5.58%. This downward movement is further underscored by its position relative to key moving averages, as Ajmera Realty is currently trading below the 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. In terms of broader market performance, Ajmera Realty's one-day decline of 2.50% stands in contrast to the Sensex, which fell by only 0.42%. Over the past month, the stock has faced a more pronounced downturn, with a...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

ANNOUNCEMENT UNDER REGULATION 30 OF LODR REGULATION

31-Mar-2025 | Source : BSEANNOUNCEMENT UNDER REGULATION 30 OF LODR REGULATIONS

Disclosure Under Regulation 7(2) Of The SEBI (Prohibition Of Insider Trading) Regulations 2015

28-Mar-2025 | Source : BSEDisclosure under Regulation 7(2) of the SEBI (Prohibition of Insider Trading) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Ajmera Realty & Infra India Ltd has declared 40% dividend, ex-date: 02 Aug 24

No Splits history available

No Bonus history available

No Rights history available