A.K. Capital Services Shows Mixed Technical Trends Amid Market Volatility

2025-04-03 08:00:58A.K. Capital Services, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,072.00, showing a notable increase from the previous close of 1,027.70. Over the past week, the stock has reached a high of 1,102.00 and a low of 1,050.00, indicating some volatility in its trading activity. In terms of technical indicators, the weekly MACD and KST are signaling bearish trends, while the monthly metrics show a mildly bearish stance. The Bollinger Bands present a mixed picture, with weekly readings leaning mildly bearish and monthly readings indicating bullishness. The daily moving averages also reflect a bearish sentiment. When comparing the stock's performance to the Sensex, A.K. Capital Services has shown a strong return over various periods. Notably, over the last...

Read MoreA.K. Capital Services Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:01:02A.K. Capital Services, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1060.00, showing a slight increase from the previous close of 1051.55. Over the past year, A.K. Capital has demonstrated a return of 10.57%, outperforming the Sensex, which recorded a return of 7.07% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant signal monthly. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages indicate bearish conditions on a daily basis, while the KST shows bearish trends weekly and mildly bearish monthly. ...

Read MoreA.K. Capital Services Experiences Mixed Technical Trends Amid Market Evaluation Changes

2025-03-24 08:00:23A.K. Capital Services, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1051.55, down from a previous close of 1094.90, with a 52-week high of 1,409.80 and a low of 805.00. Today's trading saw a high of 1119.00 and a low of 1049.90. The technical summary indicates a mixed performance across various metrics. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands reflect bearish conditions weekly, contrasting with a bullish stance monthly. Daily moving averages are bearish, and the KST indicates bearish trends weekly and mildly bearish monthly. Dow Theory also suggests a mildly bearish outlook for both weekly and monthly as...

Read MoreA.K. Capital Services Faces Short-Term Challenges Amid Strong Long-Term Growth Trends

2025-03-21 18:00:14A.K. Capital Services Ltd, a microcap player in the Finance/NBFC sector, has seen notable activity today, reflecting a complex performance landscape. The company's market capitalization stands at Rs 723.00 crore, with a price-to-earnings (P/E) ratio of 7.80, significantly lower than the industry average of 21.43. Over the past year, A.K. Capital Services has outperformed the Sensex, delivering a return of 16.48% compared to the index's 5.87%. However, recent trends indicate a decline, with the stock down 3.96% today, while the Sensex gained 0.73%. In the short term, the stock has experienced a 1.89% drop over the past week and a 0.80% decrease in the last month, contrasting with the Sensex's positive performance during these periods. Longer-term metrics reveal a robust performance, with a remarkable 450.55% increase over the past five years, outpacing the Sensex's 157.07% growth. Technical indicators sug...

Read MoreA.K. Capital Services Faces Technical Trend Shifts Amid Market Volatility

2025-03-05 08:00:21A.K. Capital Services, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 995.00, showing a notable increase from the previous close of 926.25. Over the past year, A.K. Capital Services has experienced a 52-week high of 1,409.80 and a low of 805.00, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, although it presents no signal for the monthly timeframe. Bollinger Bands reflect a mildly bearish trend weekly but are bullish on a monthly scale. Daily moving averages suggest a mildly bullish outlook, while the KST and Dow Theory metrics indicate a mildly bearish stance for both weekly and monthly evaluations...

Read MoreA.K. Capital Services Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-04 08:00:34A.K. Capital Services, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 6.87, while its price-to-book value is notably low at 0.65. Additionally, A.K. Capital's enterprise value to EBITDA ratio is recorded at 9.92, and its enterprise value to sales ratio is 6.92. The company also offers a dividend yield of 3.45%, with a return on capital employed (ROCE) of 8.86% and a return on equity (ROE) of 9.78%. In comparison to its peers, A.K. Capital Services demonstrates a more favorable valuation profile. For instance, Nisus Finance is positioned at a significantly higher PE ratio of 40.81, while Vardhman Holdings shows a PE of 3.84. Other competitors like Dhunseri Investments and Meghna Infracon exhibit varying valuation metrics,...

Read More

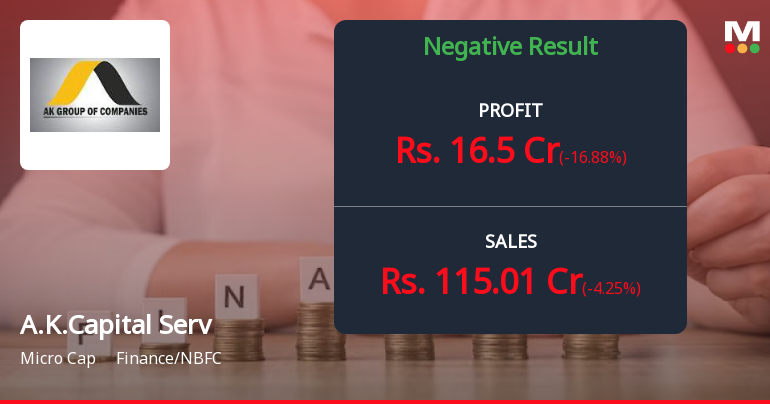

A.K.Capital Services Reports Mixed Financial Results Amidst Liquidity Improvements and Profit Declines

2025-02-10 13:03:03A.K.Capital Services has announced its financial results for the quarter ending December 2024, highlighting significant trends. The company reported its highest cash and cash equivalents in recent periods, while facing declines in profit before tax, profit after tax, net sales, and earnings per share, alongside an increased debt-equity ratio.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window for the purpose of approval of audited financial results for the quarter and year ended March 31 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

11-Mar-2025 | Source : BSEPublication of Newspaper advertisement of the Postal Ballot Notice of A. K. Capital Services Limited.

Postal Ballot Notice For Re-Appointment Of Mr. A. K. Mittal (DIN: 00698377) As Managing Director Of The Company For A Further Period Of 5 (Five) Years

10-Mar-2025 | Source : BSEPostal Ballot Notice for re-appointment of Mr. A. K. Mittal (DIN: 00698377) as Managing Director of the Company for a further period of 5 (five) years.

Corporate Actions

No Upcoming Board Meetings

A.K.Capital Services Ltd has declared 120% dividend, ex-date: 14 Feb 25

No Splits history available

No Bonus history available

No Rights history available