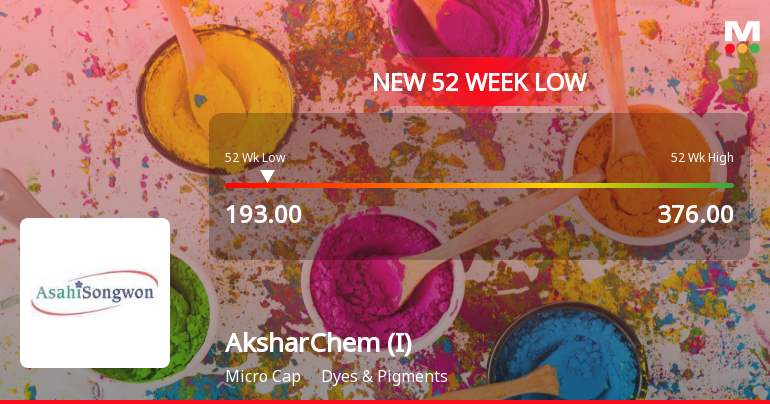

AksharChem Faces Significant Volatility Amid Broader Market Resilience and Profitability Concerns

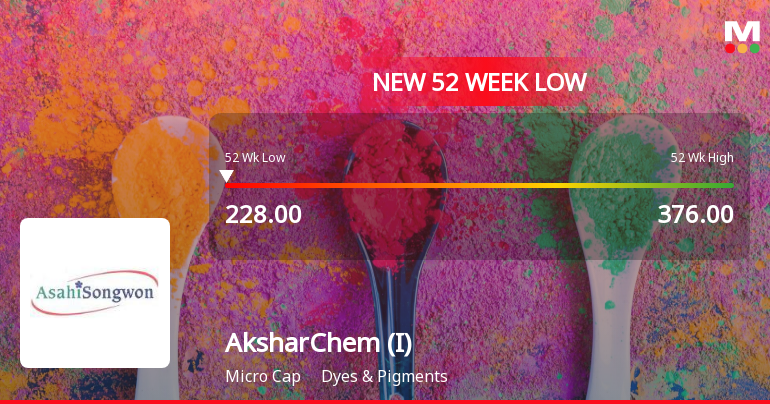

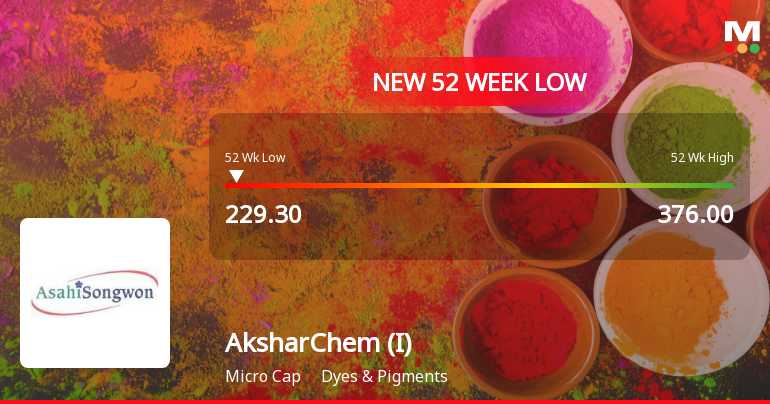

2025-03-27 15:07:15AksharChem (India), a microcap in the Dyes & Pigments sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. Despite a broader market recovery, the company faces challenges with low profitability and declining operating profit growth, although recent quarterly results indicate some operational strengths.

Read More

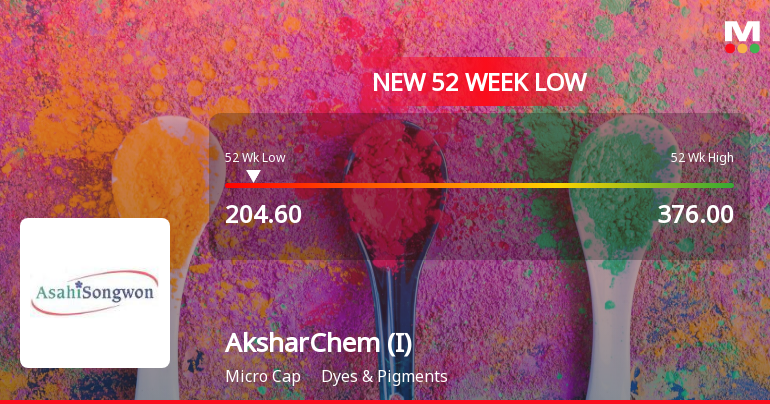

AksharChem Faces Significant Volatility Amid Declining Financial Performance and Market Trends

2025-03-17 09:42:40AksharChem (India), a microcap in the Dyes & Pigments sector, has faced notable volatility, reaching a 52-week low. The company reported a one-year return of -24.22% and declining operating profits. Despite achieving record quarterly net sales, concerns about management efficiency and profitability persist.

Read More

AksharChem Faces Significant Volatility Amid Declining Profitability and Market Performance

2025-03-17 09:42:37AksharChem (India), a microcap in the Dyes & Pigments sector, has faced notable volatility, reaching a 52-week low. The company reported a one-year return of -24.22% and a low Return on Capital Employed of 3.99%. However, it achieved record quarterly net sales and maintains a low debt-to-equity ratio.

Read More

AksharChem Hits 52-Week Low Amid Broader Market Decline and Operational Challenges

2025-03-04 09:54:01AksharChem (India), a microcap in the Dyes & Pigments sector, reached a new 52-week low amid a broader market decline. The company has struggled over the past year, with a significant drop in performance and low Return on Capital Employed, although recent quarterly results indicate some operational strengths.

Read MoreAksharChem Faces Technical Bearish Trends Amidst Market Struggles and Declining Returns

2025-02-25 10:27:37AksharChem (India), a microcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 235.25, slightly down from the previous close of 237.65. Over the past year, the stock has experienced a significant decline of 22.51%, contrasting with a modest gain of 2.05% in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish stance on a monthly basis. Moving averages further support this outlook, indicating bearish conditions. Notably, the KST presents a mixed picture, being bearish weekly but bullish monthly. In terms of returns, AksharChem has faced challenges, particularly over longer periods. The stock has seen a 32.37% decline over thr...

Read More

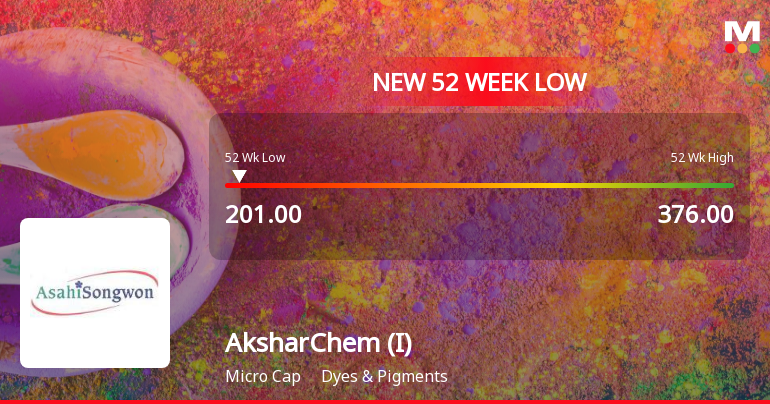

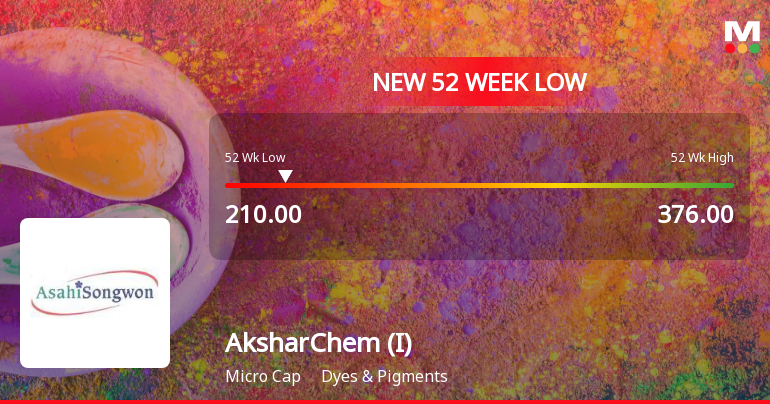

AksharChem Faces Significant Volatility Amidst Declining Stock Performance and Market Challenges

2025-02-19 09:36:13AksharChem (India), a microcap in the Dyes & Pigments sector, has faced notable volatility, hitting a new 52-week low of Rs. 210. The stock has underperformed its sector and experienced a cumulative drop of 9.76% over four days, reflecting ongoing challenges in a competitive market.

Read More

AksharChem Faces Market Scrutiny Amid Continued Decline in Stock Performance

2025-02-18 14:35:16AksharChem (India), a microcap in the Dyes & Pigments sector, has reached a new 52-week low, continuing a downward trend with an 8.65% decline over three days. Its one-year performance is down 13.13%, contrasting with the Sensex's gains, while trading below key moving averages indicates ongoing challenges.

Read More

AksharChem Faces Significant Volatility Amid Broader Dyes & Pigments Sector Decline

2025-02-17 10:35:25AksharChem (India), a microcap in the Dyes & Pigments sector, has hit a new 52-week low amid significant volatility, trailing its sector performance. The stock has declined consecutively over two days and is currently trading below multiple moving averages, indicating a bearish trend. Over the past year, it has underperformed compared to the Sensex.

Read More

AksharChem Reports Strong Q4 Results Amid Rising Interest Expenses and Debt Levels

2025-02-10 21:32:00AksharChem (India) has announced its financial results for the quarter ending December 2024, highlighting record net sales of Rs 90.69 crore and an operating profit of Rs 6.33 crore. Profit after tax reached Rs 1.19 crore, while earnings per share increased to Rs 1.48, despite rising interest expenses and a higher debt-equity ratio.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEAksharchem (India) Limited has submitted to the Exchange the Compliance Certificate under Regulation 74 (5) of SEBI (DP) Regulations 2018.

Announcement under Regulation 30 (LODR)-Credit Rating

02-Apr-2025 | Source : BSEAksharchem (India) Limited has informed the Exchange regarding detailed rationale as provided by M/s. CARE ratings Limited (CARE) for the recent ratings on the bank facilities of the Company.

Closure of Trading Window

27-Mar-2025 | Source : BSEAksharchem (India) Limited has informed the Exchange about Closure of Trading Window.

Corporate Actions

No Upcoming Board Meetings

AksharChem (India) Ltd has declared 5% dividend, ex-date: 23 Sep 24

No Splits history available

No Bonus history available

No Rights history available