Akzo Nobel India Faces Technical Trend Shifts Amid Market Evaluation Revision

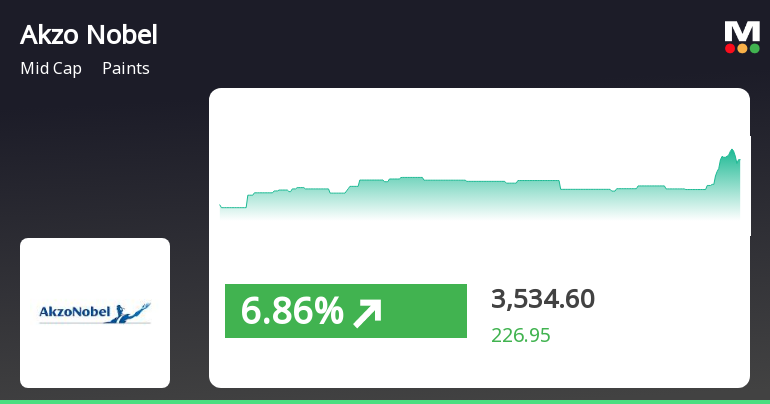

2025-04-02 08:03:04Akzo Nobel India, a prominent player in the paints industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,516.45, showing a notable decline from its previous close of 3,570.30. Over the past year, Akzo Nobel has demonstrated a strong performance with a return of 45.43%, significantly outpacing the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The moving averages indicate a mildly bearish sentiment on a daily basis. Notably, the Bollinger Bands reflect a sideways trend weekly, with a mildly bullish outlook monthly. The KST presents a mixed picture, being bearish weekly but bullish monthly. When comparing the stock's performance to the Sensex, Akzo Nobel has shown resilience over various time frames, ...

Read MoreAkzo Nobel India Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-28 08:01:01Akzo Nobel India, a prominent player in the paints industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,577.10, showing a notable increase from the previous close of 3,307.65. Over the past year, Akzo Nobel has demonstrated a robust performance, with a return of 48.62%, significantly outpacing the Sensex's return of 6.32% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD shows a bearish trend on a weekly basis while indicating bullish momentum monthly. The Bollinger Bands suggest a bullish stance on both weekly and monthly charts, while the moving averages present a mildly bearish signal on a daily basis. The KST reflects a bearish trend weekly but is bullish monthly, indicating some volatility in market sentiment. When comparing returns, Akzo Nobel has outperformed the Sens...

Read More

Akzo Nobel India's Stock Outperforms Market Amid Strong Performance Metrics

2025-03-27 14:30:22Akzo Nobel India has experienced notable stock activity, significantly outperforming the broader market. The stock has shown strong gains over the past week and month, while its year-to-date performance remains modest. Overall, it reflects resilience and strong metrics within the midcap paints industry.

Read More

Akzo Nobel India Faces Evaluation Shift Amidst Mixed Financial Performance and Growth Concerns

2025-03-26 08:06:56Akzo Nobel India has recently experienced a change in its evaluation, reflecting a shift in the stock's technical landscape. Despite strong management efficiency and a solid historical performance, the company faces challenges in long-term growth, with recent quarterly results showing flat performance and raising concerns among analysts.

Read MoreAkzo Nobel India Faces Mixed Technical Signals Amidst Market Evaluation Revision

2025-03-26 08:01:26Akzo Nobel India, a prominent player in the paints industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 3,370.00, showing a slight increase from the previous close of 3,328.00. Over the past year, Akzo Nobel has demonstrated a robust performance with a return of 37.23%, significantly outperforming the Sensex, which recorded a return of 7.12% in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics indicate a bullish outlook. The moving averages on a daily basis also reflect a bearish trend. Notably, the KST shows a bearish signal weekly but is bullish monthly, indicating mixed signals in the short and long term. When comparing the stock's performance to the Sensex over various periods, Akzo Nobel has shown resilience, particularly ove...

Read MoreAkzo Nobel India Navigates Mixed Market Trends Amid Strong Yearly Performance

2025-03-25 18:00:10Akzo Nobel India Ltd, a mid-cap player in the paints industry, has shown notable activity today, reflecting its ongoing performance trends. The company's market capitalization stands at Rs 15,068.00 crore, with a price-to-earnings (P/E) ratio of 35.71, which is significantly lower than the industry average of 48.56. Over the past year, Akzo Nobel India has delivered a robust performance of 37.23%, outperforming the Sensex, which recorded a gain of 7.12% during the same period. In the short term, the stock has increased by 1.26% today, while the Sensex saw a modest rise of 0.04%. Additionally, the stock has gained 4.05% over the past week, compared to the Sensex's 3.61% increase. However, the company's performance over longer time frames shows mixed results. Year-to-date, Akzo Nobel India is down 5.51%, while the Sensex has only dipped by 0.16%. Over three years, the stock has appreciated by 73.72%, signif...

Read MoreAkzo Nobel India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-05 08:00:54Akzo Nobel India, a midcap player in the paints industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,129.90, showing a slight increase from the previous close of 3,093.40. Over the past year, Akzo Nobel has demonstrated a notable return of 25.78%, significantly outperforming the Sensex, which recorded a return of just -1.19% during the same period. In terms of technical indicators, the company exhibits a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and KST show bearish tendencies on a weekly basis, contrasting with a bullish outlook on a monthly scale. The Bollinger Bands present a mildly bearish trend weekly but shift to bullish on a monthly basis, highlighting the volatility in the stock's performance. Despite recent challenges, including a decline in returns over shor...

Read MoreAkzo Nobel India Faces Mixed Technical Signals Amid Market Volatility

2025-03-03 08:00:36Akzo Nobel India, a midcap player in the paints industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,099.00, down from a previous close of 3,207.00, with a notable 52-week high of 4,649.00 and a low of 2,265.10. Today's trading saw a high of 3,213.75 and a low of 3,075.05. The technical summary indicates mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. The Relative Strength Index (RSI) presents no clear signal for both weekly and monthly assessments. Bollinger Bands reflect a bearish stance weekly, with a mildly bullish outlook monthly. Moving averages indicate a mildly bullish trend on a daily basis, while the KST and Dow Theory present bearish signals on a weekly scale. In terms of performance, Akzo Nobel's stock return has shown volatility compared to t...

Read MoreAkzo Nobel India's Technical Indicators Signal Mixed Market Sentiment Amid Fluctuations

2025-03-02 08:00:35Akzo Nobel India, a midcap player in the paints industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, currently priced at 3,099.00, has seen fluctuations with a previous close of 3,207.00 and a 52-week range between 2,265.10 and 4,649.00. In terms of technical indicators, the MACD shows a mixed outlook with a bearish signal on the weekly chart and a bullish signal on the monthly chart. The Relative Strength Index (RSI) indicates no clear signal for both weekly and monthly periods, while Bollinger Bands suggest a bearish trend weekly and a mildly bullish trend monthly. Moving averages present a mildly bullish stance on a daily basis, contrasting with the bearish signals from the KST and Dow Theory on a weekly basis. When comparing the company's performance to the Sensex, Akzo Nobel India has experienced a decline over various periods, including a 13.92%...

Read MoreShareholder Meeting / Postal Ballot-Scrutinizers Report

03-Apr-2025 | Source : BSEPlease find attached the voting results and scrutinizer report of the postal ballot (e-voting) concluded on 2nd April 2025

Postal Ballot Results Alongwith Scrutinizer Report

03-Apr-2025 | Source : BSEPlease find attached the voting results and scrutinizer report of the postal ballot

Postal Ballot Proceedings

02-Apr-2025 | Source : BSEPlease find attached the proceedings of postal ballot (through e-voting) concluded today.

Corporate Actions

No Upcoming Board Meetings

Akzo Nobel India Ltd has declared 700% dividend, ex-date: 19 Nov 24

No Splits history available

No Bonus history available

No Rights history available