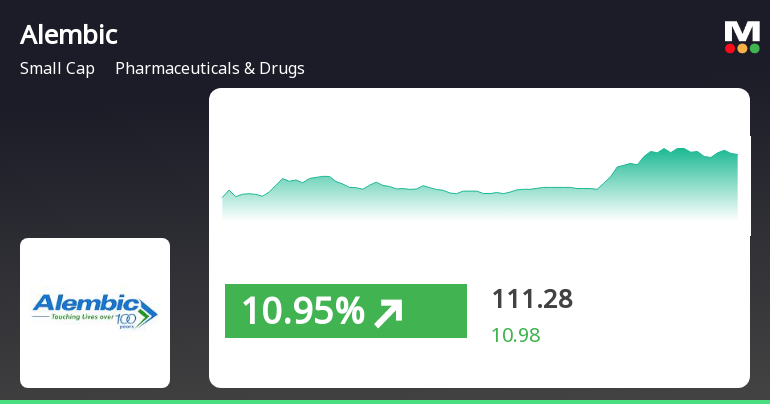

Alembic Pharmaceuticals Shows Resilience Amid Market Volatility with Notable Gains

2025-04-03 10:20:27Alembic, a small-cap pharmaceutical company, experienced notable gains on April 3, 2025, outperforming its sector. The stock has shown consecutive gains over three days and reached an intraday high. Despite broader market volatility, Alembic's performance reflects its resilience in fluctuating conditions.

Read MoreAlembic Pharmaceuticals Faces Bearish Technical Trends Amid Market Volatility

2025-04-01 08:02:57Alembic Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 98.40, down from a previous close of 101.02, with a notable 52-week high of 169.00 and a low of 80.00. Today's trading saw a high of 104.15 and a low of 98.13, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and moving averages also reflect bearish conditions. The KST presents a mixed picture with a bearish weekly trend but a bullish monthly outlook. In terms of performance, Alembic's stock return over the past week has been negative at -1.59%, contrasting with a positive return of 0.66% for the Sensex. However, over a o...

Read MoreAlembic Pharmaceuticals Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-28 08:03:08Alembic Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 101.02, showing a notable increase from the previous close of 99.00. Over the past year, Alembic has demonstrated a strong performance with a return of 25.99%, significantly outpacing the Sensex, which recorded a return of 6.32% in the same period. The technical summary indicates a mixed outlook, with various indicators reflecting differing trends. The MACD shows bearish signals on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting some volatility in momentum. Additionally, Bollinger Bands and moving averages indicate a mildly bearish trend, while the KST presents a bullish monthly outlook. In terms of...

Read MoreAlembic Pharmaceuticals Faces Technical Trend Shifts Amid Market Volatility

2025-03-27 08:03:02Alembic Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 99.00, down from a previous close of 102.41, with a 52-week high of 169.00 and a low of 80.00. Today's trading saw a high of 103.80 and a low of 98.19, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, the Bollinger Bands and moving averages also reflect bearish conditions. The KST presents a mixed picture, being bearish weekly but bullish monthly, while the Dow Theory indicates a mildly bullish weekly trend contrasted by a mildly bearish monthly perspective. In terms of performance, Alembic's stock return over the past year stands at 22.59%, signific...

Read More

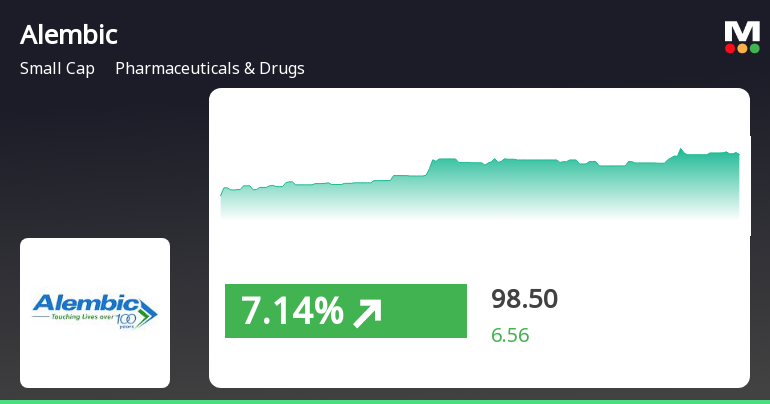

Alembic Pharmaceuticals Shows Strong Short-Term Gains Amid Broader Small-Cap Rally

2025-03-19 11:50:27Alembic, a small-cap pharmaceutical company, has shown notable performance, gaining 7.1% today and achieving a total return of 9.35% over the past two days. The stock is currently above its short-term moving averages, while the broader market, led by small-cap stocks, is also experiencing gains.

Read MoreAlembic Pharmaceuticals Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-19 08:03:59Alembic Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 91.94, showing a slight increase from the previous close of 90.05. Over the past year, Alembic has experienced a stock return of 13.32%, outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) is bullish on a weekly basis but shows no signal for the monthly evaluation. Bollinger Bands reflect a bearish trend weekly and mildly bearish monthly, while moving averages indicate a bearish sentiment on a daily basis. The company's performance over various time frames reveals a mixed picture. Year-to-date, Alem...

Read More

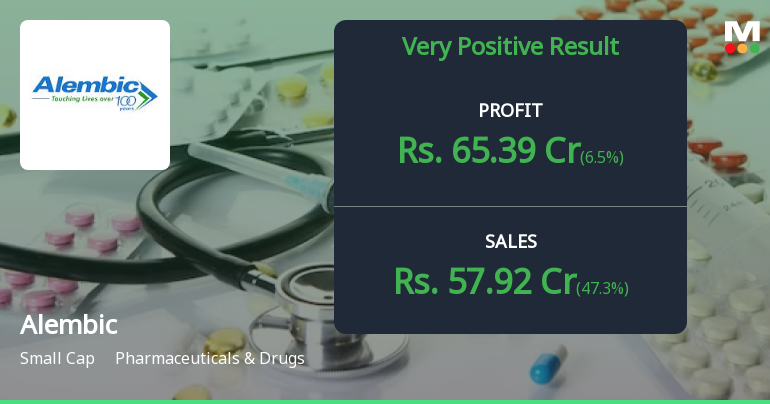

Alembic Reports Strong Q3 FY24-25 Profit Growth Amid Long-Term Outlook Concerns

2025-02-11 19:10:07Alembic, a small-cap pharmaceutical company, recently reported a significant increase in net profit for Q3 FY24-25, with net sales reaching a record high. However, its long-term growth outlook appears limited, and the stock's technical position has shifted to a bearish range, despite a stable financial foundation.

Read More

Alembic Reports Strong Q3 FY24-25 Results with Significant Year-on-Year Growth

2025-02-08 08:41:04Alembic Pharmaceuticals recently announced its financial results for Q3 FY24-25, highlighting a significant year-on-year growth in Profit Before Tax and net sales, both reaching their highest levels in five quarters. The half-year Profit After Tax also showed notable growth, reflecting the company's strong performance in the sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find enclosed herewith a certificate under Regulation 74(5) of SEBI (Depositories & Participants) Regulations 2018 for the quarter ended 31st March 2025 received from M/s. MUFG Intime India Private Limited Registrar and Share Transfer Agent of our Company.

Clarification sought from Alembic Ltd

04-Apr-2025 | Source : BSEThe Exchange has sought clarification from Alembic Ltd on April 04 2025 with reference to Movement in Volume.

The reply is awaited.

Clarification On Increase In Volume

04-Apr-2025 | Source : BSEPlease find enclosed herewith clarification letter on increase in volume of security for your consideration. Kindly take the same on your records.

Corporate Actions

No Upcoming Board Meetings

Alembic Ltd has declared 120% dividend, ex-date: 05 Aug 24

Alembic Ltd has announced 2:10 stock split, ex-date: 26 Sep 06

Alembic Ltd has announced 1:1 bonus issue, ex-date: 27 Sep 13

No Rights history available