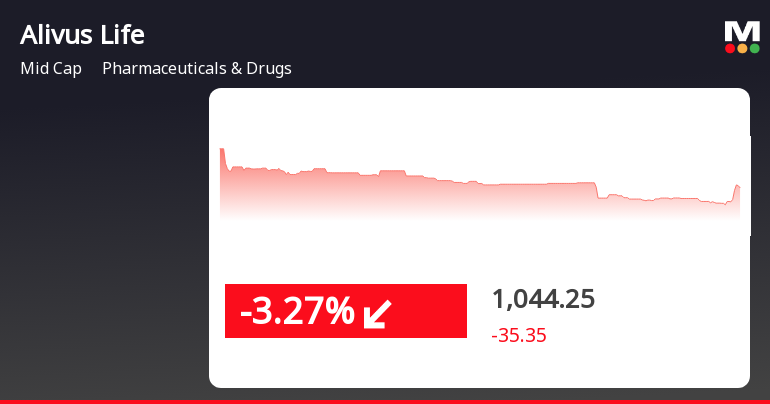

Alivus Life Sciences Faces Decline Amid Broader Market Challenges and Trend Reversal Signals

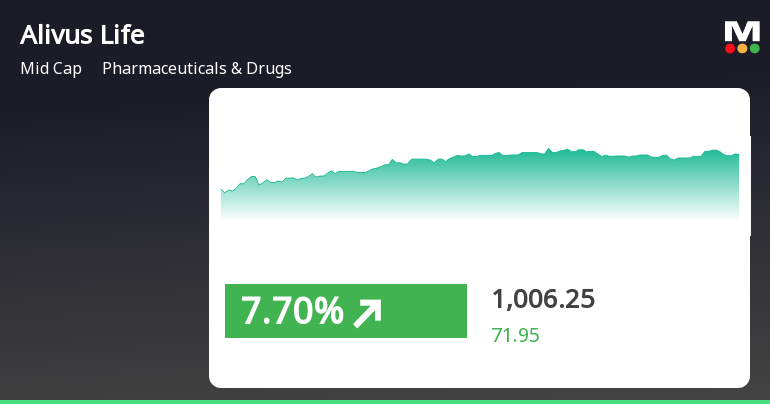

2025-04-01 15:20:29Alivus Life Sciences saw a significant decline on April 1, 2025, closing at Rs 1023.5 after two days of gains. The stock underperformed its sector amid broader market challenges, despite a strong year-to-date increase and impressive long-term growth compared to the Sensex.

Read More

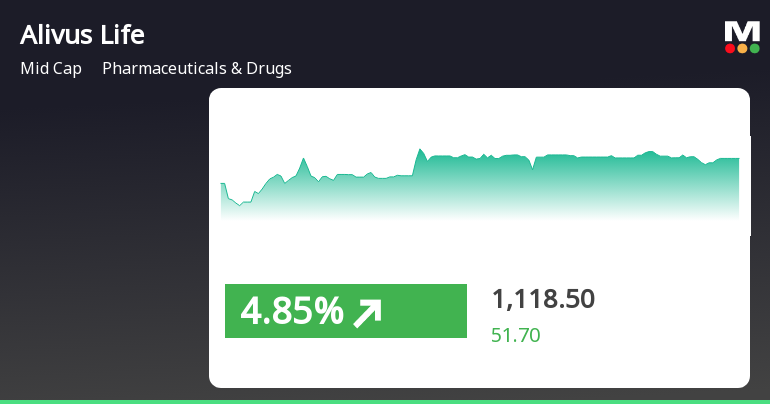

Alivus Life Sciences Demonstrates Resilience Amid Broader Market Challenges

2025-03-28 10:20:26Alivus Life Sciences has demonstrated strong performance, gaining 5.1% on March 28, 2025, and outperforming its sector. The stock has shown positive momentum with an 11.45% total return over two days and has consistently traded above key moving averages, reflecting a robust upward trend despite broader market challenges.

Read More

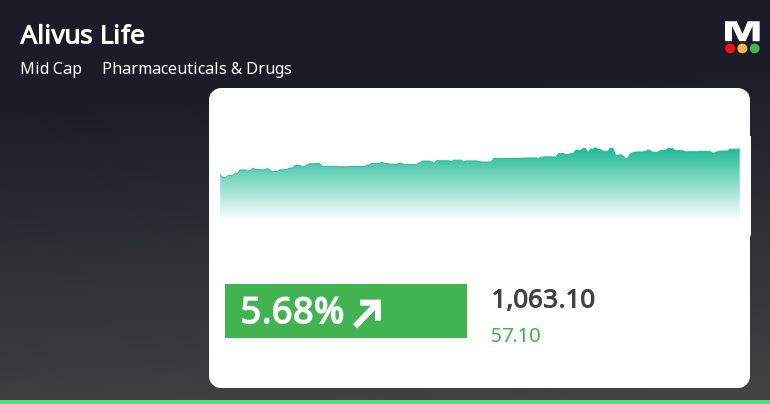

Alivus Life Sciences Shows Strong Rebound Amid Broader Market Recovery

2025-03-27 12:20:27Alivus Life Sciences has experienced a significant turnaround, gaining 5.37% after four days of decline. The stock has outperformed its sector and the Sensex over various timeframes, showing a robust year-to-date increase. It is currently trading above its 20-day and 200-day moving averages amid a market recovery.

Read MoreAlivus Life Sciences Shows Mixed Technical Trends Amidst Market Volatility

2025-03-25 08:06:16Alivus Life Sciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1066.95, down from a previous close of 1098.10, with a notable 52-week high of 1,335.00 and a low of 741.20. Today's trading saw a high of 1131.95 and a low of 1057.00, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicators show a mildly bearish trend on both weekly and monthly scales, while the Bollinger Bands suggest a mildly bullish stance weekly and bullish monthly. Moving averages indicate a mildly bullish trend on a daily basis, contrasting with the Dow Theory, which shows no trend weekly and a mildly bearish trend monthly. The KST remains bullish on both weekly and monthly evaluations, while the RSI shows no signals. In terms of performance, Alivus Life Sciences has ...

Read MoreAlivus Life Sciences Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-21 08:03:11Alivus Life Sciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1134.00, showing a notable increase from the previous close of 1075.90. Over the past year, Alivus has demonstrated strong performance, with a return of 52.77%, significantly outpacing the Sensex's return of 5.89% during the same period. The technical summary indicates a mixed outlook, with the MACD showing mildly bearish signals on both weekly and monthly charts, while Bollinger Bands and KST reflect bullish trends. Daily moving averages also suggest a positive momentum. The stock's performance metrics reveal a 52-week high of 1,335.00 and a low of 720.75, highlighting its volatility and potential for growth. In terms of returns, Alivus has outperformed the Sensex across various time frames, including a 10.1% re...

Read MoreAlivus Life Sciences Adjusts Valuation Grade Amid Strong Market Performance Indicators

2025-03-21 08:00:52Alivus Life Sciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market positioning. The company's price-to-earnings ratio stands at 31.46, while its price-to-book value is noted at 5.47. Additionally, Alivus reports an EV to EBIT of 23.77 and an EV to EBITDA of 21.52, indicating its operational efficiency relative to its enterprise value. The company has demonstrated strong returns, with a year-to-date stock return of 14.66%, significantly outperforming the Sensex, which has seen a decline of 2.29% in the same period. Over the past year, Alivus has achieved a remarkable return of 52.77%, further highlighting its robust performance compared to broader market trends. In comparison to its peers, Alivus Life Sciences maintains a competitive edge with a favorable return on capital employed (ROCE) of 26.12% ...

Read More

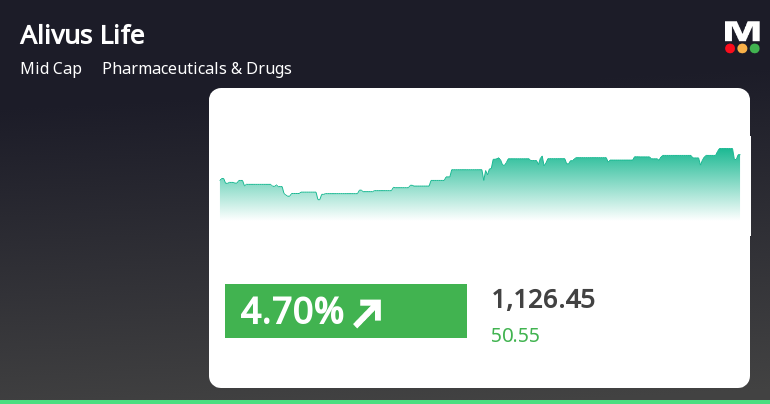

Alivus Life Sciences Shows Strong Momentum with Consecutive Gains and Outperformance

2025-03-20 13:50:24Alivus Life Sciences has demonstrated strong performance, gaining 5.35% on March 20, 2025, and achieving a total return of 10.15% over three consecutive days. The stock has consistently outperformed the Sensex and is trading above key moving averages, reflecting robust upward momentum.

Read MoreAlivus Life Sciences Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-03-07 08:01:26Alivus Life Sciences, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company’s price-to-earnings ratio stands at 29.42, while its price-to-book value is noted at 5.12. Additionally, Alivus reports an EV to EBIT of 22.18 and an EV to EBITDA of 20.08, indicating its operational efficiency relative to its enterprise value. In terms of profitability, Alivus boasts a return on capital employed (ROCE) of 26.12% and a return on equity (ROE) of 17.40%, showcasing its ability to generate returns for shareholders. The company’s performance over the past year has been notable, with a stock return of 43.83%, significantly outpacing the Sensex, which recorded a mere 0.34% return in the same period. When compared to its peers, Alivus Life Sciences maintains a competitive edge, particularly in its val...

Read More

Alivus Life Sciences Shows Resilience Amid Broader Market Decline and Mixed Signals

2025-03-04 10:26:17Alivus Life Sciences has demonstrated notable resilience, gaining 6.92% today and outperforming its sector amid a broader market decline. The stock has shown a total return of 12.32% over two days, despite mixed signals from moving averages and a challenging market environment.

Read MoreIntimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

03-Apr-2025 | Source : BSEIntimation under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Announcement under Regulation 30 (LODR)-Acquisition

02-Apr-2025 | Source : BSEIntimation of Share Purchase cum Subscription Shareholders Agreement and Power Supply Agreement between Alivus Life Sciences Limited (formerly Glenmark Life Sciences Limited) and Torrent Urja 19 Private Limited.

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

07-Mar-2025 | Source : BSEAllotment of Equity Shares under the Glenmark Life Sciences Limited - Employee Stock Option Scheme 2021.

Corporate Actions

No Upcoming Board Meetings

Alivus Life Sciences Ltd has declared 1125% dividend, ex-date: 17 Oct 23

No Splits history available

No Bonus history available

No Rights history available