Alkyl Amines Chemicals Faces Mixed Technical Trends Amid Market Evaluation Shift

2025-04-02 08:01:05Alkyl Amines Chemicals, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,673.65, showing a notable shift from its previous close of 1,617.30. Over the past week, the stock has experienced fluctuations, reaching a high of 1,720.60 and a low of 1,618.30. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective remains bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly evaluations. Bollinger Bands indicate a mildly bearish trend on both timeframes, and moving averages reflect a bearish stance on a daily basis. The KST presents a mildly bullish outlook weekly, contrasting with its monthly bearish trend. When comparing the stock's performance to the Sensex, Alkyl Amines has faced challenges...

Read More

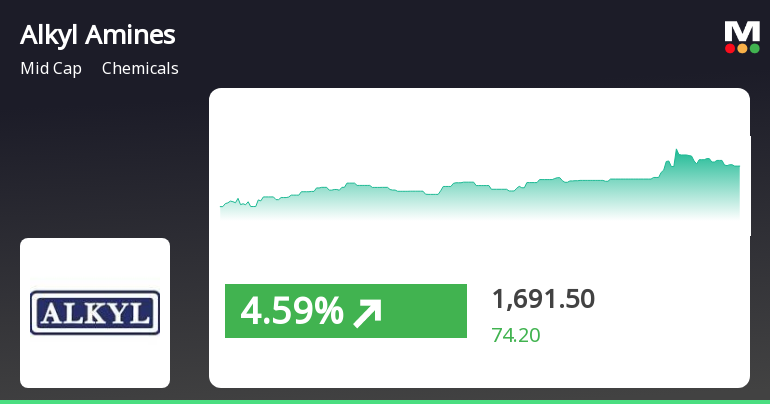

Alkyl Amines Chemicals Shows Resilience Amid Broader Market Declines and Sector Trends

2025-04-01 12:30:18Alkyl Amines Chemicals experienced significant activity on April 1, 2025, gaining 5.36% despite broader market declines. The stock has outperformed its sector today and shows a mixed performance in moving averages. Over the past month, it has increased by 6.76%, though it remains down year-to-date and over three years.

Read MoreAlkyl Amines Faces Bearish Technical Trends Amid Market Underperformance

2025-03-27 08:00:16Alkyl Amines Chemicals, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,681.75, down from a previous close of 1,742.20. Over the past year, the stock has experienced a decline of 10.83%, contrasting with a 6.65% gain in the Sensex, highlighting a notable underperformance relative to the broader market. The technical summary indicates a bearish sentiment across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while moving averages also reflect a bearish stance. Bollinger Bands are mildly bearish on both timeframes, suggesting a cautious outlook. The KST and OBV indicators present a mixed picture, with weekly readings showing mild bullishness, yet monthly assessments remain bearish. In terms of returns, Alkyl Amines has shown a 5.24% gain over the past week,...

Read MoreAlkyl Amines Chemicals Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:00:33Alkyl Amines Chemicals, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1774.60, showing a notable increase from the previous close of 1612.25. Over the past year, the stock has experienced fluctuations, with a 52-week high of 2,497.95 and a low of 1,509.20. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands and moving averages indicate a mildly bearish trend, aligning with the overall cautious sentiment reflected in the market. When comparing the stock's performance to the Sensex, Alkyl Amines has demonstrated a strong return over the past week, outperforming the index significantly with a retur...

Read More

Alkyl Amines Chemicals Outperforms Sector Amid Broader Market Gains and Mixed Trends

2025-03-24 15:00:18Alkyl Amines Chemicals has experienced notable activity, gaining 8.36% on March 24, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, while the broader market, represented by the Sensex, has also risen significantly, reflecting positive trends in the financial landscape.

Read More

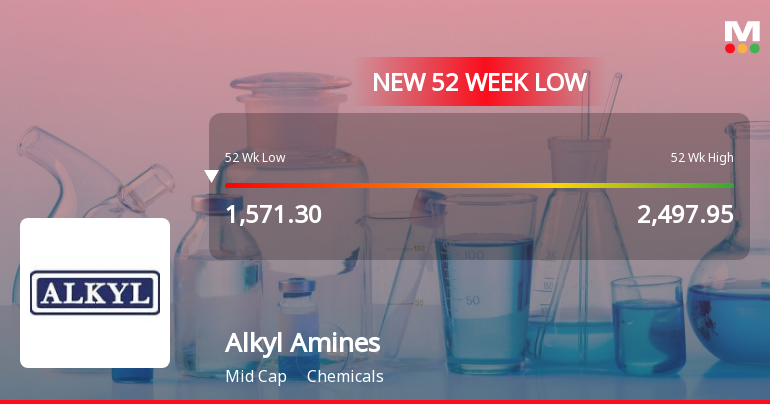

Alkyl Amines Chemicals Faces Ongoing Challenges Amidst Sustained Stock Decline

2025-03-03 11:15:28Alkyl Amines Chemicals has faced notable challenges, with its stock price declining significantly and reaching a new 52-week low. The company has underperformed over the past month and is trading below key moving averages, indicating ongoing difficulties in the current market environment.

Read More

Alkyl Amines Chemicals Hits 52-Week Low Amid Sustained Downward Trend

2025-03-03 09:35:17Alkyl Amines Chemicals has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is trading below multiple moving averages. Over the past year, it has seen a notable decrease, contrasting with the minor decline of the Sensex.

Read More

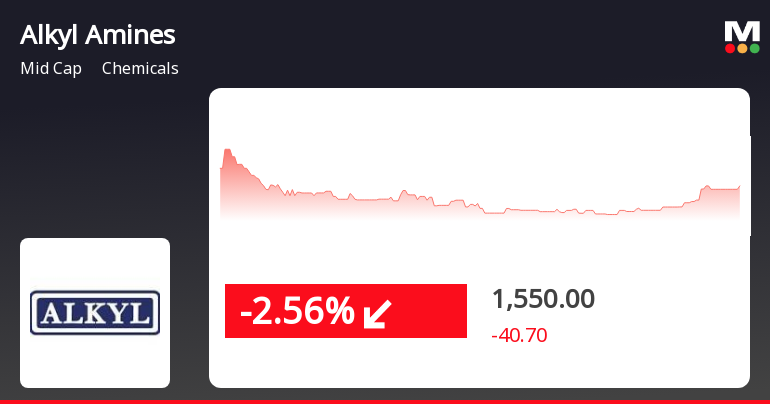

Alkyl Amines Chemicals Faces Significant Decline Amidst Broader Market Gains

2025-02-18 11:52:17Alkyl Amines Chemicals has faced notable volatility, hitting a new 52-week low and experiencing a 13.23% decline over the past week. The stock is trading below all key moving averages, reflecting a bearish trend, and has declined 28.75% over the past year, contrasting with the Sensex's gains.

Read More

Alkyl Amines Chemicals Faces Ongoing Challenges Amid Significant Stock Volatility

2025-02-17 10:05:17Alkyl Amines Chemicals has faced notable volatility, reaching a new 52-week low of Rs. 1606 amid a series of consecutive losses over the past six days. The stock is trading below key moving averages and has declined significantly over the past year, contrasting with broader market gains.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg.74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window

Announcement Under Regulation 30 (LODR) - Grant Of Esops

20-Mar-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) - Grant of Employees Stock Option (ESOPs)

Corporate Actions

No Upcoming Board Meetings

Alkyl Amines Chemicals Ltd has declared 500% dividend, ex-date: 25 Jun 24

Alkyl Amines Chemicals Ltd has announced 2:5 stock split, ex-date: 11 May 21

No Bonus history available

No Rights history available