Alldigi Tech Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-25 08:00:53Alldigi Tech, a small-cap player in the BPO/ITeS sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 970.00, showing a notable increase from the previous close of 948.00. Over the past year, Alldigi Tech has demonstrated impressive performance, with a return of 31.36%, significantly outpacing the Sensex's 7.07% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Interestingly, Bollinger Bands indicate a bullish trend on both weekly and monthly scales, suggesting some volatility in price movements. The company's moving averages reflect a mildly bearish stance on a daily basis, while the KST and OBV metrics also indicate bearish trends on a weekly basis. Howev...

Read MoreAlldigi Tech Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:00:37Alldigi Tech, a small-cap player in the BPO/ITeS sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 948.00, showing a slight increase from the previous close of 934.95. Over the past year, Alldigi Tech has demonstrated a robust performance with a return of 32.69%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. The technical summary indicates a bearish sentiment in the weekly MACD and KST metrics, while the monthly indicators show a mildly bearish trend. The stock's moving averages also reflect a bearish outlook on a daily basis. Despite these trends, the Bollinger Bands present a mixed picture, with a mildly bearish stance weekly and a bullish outlook monthly. In terms of price movement, Alldigi Tech has experienced a 52-week high of 1,250.00 and a low of 693.35, indicating notable vol...

Read MoreAlldigi Tech Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:00:42Alldigi Tech, a small-cap player in the BPO/ITeS sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 934.95, showing a notable increase from the previous close of 909.90. Over the past year, Alldigi Tech has demonstrated a robust performance with a return of 27.89%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a similar pattern with a bearish weekly and mildly bearish monthly outlook. All...

Read MoreAlldigi Tech Faces Technical Trend Shifts Amid Mixed Market Indicators

2025-03-11 08:00:37Alldigi Tech, a small-cap player in the BPO/ITeS sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 911.75, down from a previous close of 951.65, with a notable 52-week high of 1,250.00 and a low of 691.35. Today's trading saw a high of 954.05 and a low of 896.90. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, with a bearish outlook on the weekly scale and a bullish stance monthly. The KST and OBV metrics also reflect bearish tendencies on a weekly basis, with no clear trends observed in the Dow Theory. In terms of performance, Alldigi Tech has shown resilience over the long term, with a remarkable 3468.49% return over the past decade, significantly outperforming the Sensex, which reco...

Read More

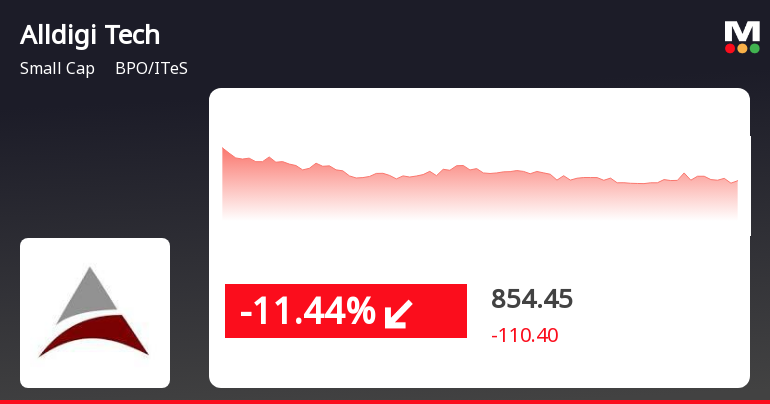

Alldigi Tech Faces Sustained Stock Decline Amid Broader Market Challenges

2025-01-27 09:50:19Alldigi Tech, a small-cap company in the BPO/ITeS sector, has faced significant stock volatility, experiencing a notable decline today. The stock has underperformed its sector and broader market indices, marking its third consecutive day of losses and trading below key moving averages, indicating ongoing challenges.

Read MoreAlldigi Tech Faces Significant Volatility Amid Broader Market Declines in BPO Sector

2025-01-27 09:50:06Alldigi Tech, a small-cap player in the BPO/ITeS sector, has experienced significant volatility today, opening with a loss of 7.26%. The stock's performance has notably underperformed its sector, which has declined by 3.22%, with Alldigi Tech recording a staggering 9.84% drop in just one day. Over the past three days, the stock has faced a consecutive decline, totaling a loss of 22.36%. During intraday trading, Alldigi Tech reached a low of Rs 854, marking an 11.49% decrease from its previous close. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. In the broader market context, the Sensex has shown a modest decline of 0.46% today, while Alldigi Tech's one-month performance reflects a decrease of 9.86%, compared to the Sensex's 3.63% drop. These metrics highlight the challenges faced by Alldigi Tech in the current market envi...

Read MoreAlldigi Tech Faces Significant Volatility Amid Broader Market Declines in BPO Sector

2025-01-27 09:50:06Alldigi Tech, a small-cap player in the BPO/ITeS sector, has experienced significant volatility today, opening with a loss of 7.26%. The stock's performance has notably underperformed its sector, which has declined by 3.22%, with Alldigi Tech recording a staggering 9.84% drop in just one day. Over the past three days, the stock has faced a consecutive decline, totaling a loss of 22.36%. During intraday trading, Alldigi Tech reached a low of Rs 854, marking an 11.49% decrease from its previous close. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. In the broader market context, the Sensex has shown a modest decline of 0.46% today, while Alldigi Tech's one-month performance reflects a decrease of 9.86%, compared to the Sensex's 3.63% drop. These metrics highlight the challenges faced by Alldigi Tech in the current market envi...

Read MoreDisclosures under Reg. 10(7) of SEBI (SAST) Regulations 2011

04-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(7) in respect of acquisition under Regulation 10(1)(d)(iii)of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Digitrade Solutions Ltd

Disclosure Under Regulation 30 Read With Schedule III Of SEBI (LODR) Regulations 2015

03-Apr-2025 | Source : BSEDisclosure under Regulation 30 read with Schedule III of SEBI (LODR) Regulations 2015

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

03-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Digitrade Solutions Ltd

Corporate Actions

No Upcoming Board Meetings

Alldigi Tech Ltd has declared 150% dividend, ex-date: 05 Jul 24

No Splits history available

No Bonus history available

No Rights history available