Alpine Housing Development Adjusts Valuation Amidst Mixed Financial Performance Indicators

2025-03-05 08:00:14Alpine Housing Development Corporation, a microcap player in the construction and real estate sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 46.04 and a price-to-book value of 2.28, indicating a premium valuation relative to its assets. Additionally, the EV to EBIT stands at 28.51, while the EV to EBITDA is recorded at 24.44, suggesting a robust earnings potential despite the elevated valuation. The company's return on capital employed (ROCE) is at 6.52%, and the return on equity (ROE) is 4.96%, reflecting its operational efficiency. However, the dividend yield is relatively low at 0.48%, which may influence investor sentiment. When compared to its peers, Alpine Housing's valuation metrics appear higher, particularly in the context of the construction sector. For instance, while some competitors are categorized as risky or very expensive, Alpine...

Read More

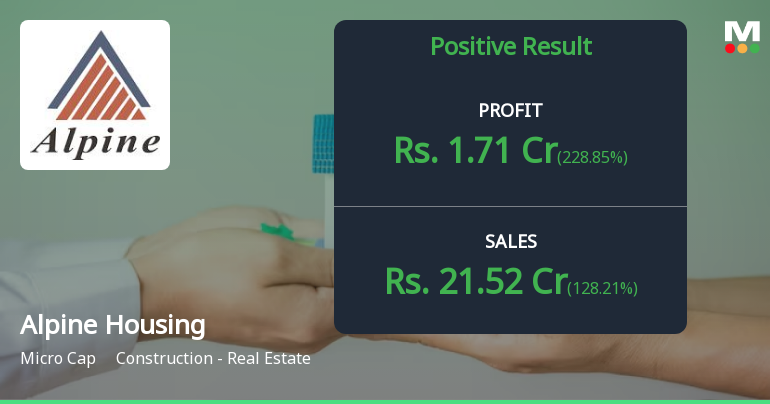

Alpine Housing Reports Strong Financial Growth in December 2024 Results

2025-02-13 22:17:03Alpine Housing Development Corporation has announced its financial results for the quarter ending December 2024, showcasing significant growth. Net sales reached Rs 22.24 crore, with profit before tax at Rs 2.09 crore and profit after tax at Rs 1.71 crore, reflecting improved performance across key metrics.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

05-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Alpine Housing Development Corporation Ltd |

| 2 | CIN NO. | L85110KA1992PLC013174 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 13.54 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: company.secretary@alpinehousing.com

Designation: Chief Financial Officer

EmailId: osman@alpinehousing.com

Date: 05/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI(DP) Reg 2018

Compliance Certificate Under Reg 7(3) Of SEBI (LODR) Reg 2015

05-Apr-2025 | Source : BSECompliance Certificate under Reg 7(3) of SEBI(LODR) Reg 2015

Corporate Actions

No Upcoming Board Meetings

Alpine Housing Development Corporation Ltd has declared 5% dividend, ex-date: 20 Sep 24

No Splits history available

Alpine Housing Development Corporation Ltd has announced 1:3 bonus issue, ex-date: 11 Oct 18

No Rights history available