Amara Raja Energy & Mobility Faces Mixed Financial Indicators Amid Market Adjustments

2025-04-02 08:27:41Amara Raja Energy & Mobility has recently experienced a change in its evaluation, reflecting a nuanced view of its technical indicators. The company has shown strong stock performance over the past year, despite modest operating profit growth and a recent decline in profit after tax. Its financial health remains solid, with low debt and significant institutional holdings.

Read MoreAmara Raja Energy & Mobility Faces Mixed Technical Trends Amid Market Volatility

2025-04-02 08:07:34Amara Raja Energy & Mobility, a midcap player in the battery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1020.30, showing a notable increase from the previous close of 1003.00. Over the past year, the stock has reached a high of 1,774.90 and a low of 767.60, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and KST metrics also reflect a mildly bearish trend on both weekly and monthly bases. Notably, the daily moving averages indicate a bearish stance, which contrasts with the Dow Theory's weekly mildly bullish signal. When comparing the company's performance to the Sensex, Amara Raja Energy & Mobility has shown varied returns. Over the past week, the stock retur...

Read More

Amara Raja Energy & Mobility Faces Mixed Financial Performance Amid Market Adjustments

2025-03-28 08:05:38Amara Raja Energy & Mobility has experienced a recent evaluation adjustment due to changes in its technical indicators and market position. The company reported a decline in operating profit margins and profit after tax, while maintaining a low debt-to-equity ratio, indicating a stable financial structure amidst mixed performance metrics.

Read MoreAmara Raja Energy & Mobility Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-28 08:03:02Amara Raja Energy & Mobility, a midcap player in the battery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,024.25, down from a previous close of 1,040.90. Over the past year, the company has shown a return of 33.10%, significantly outperforming the Sensex, which recorded a return of 6.32% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish trend, while the monthly outlook leans towards a mildly bearish stance. The Relative Strength Index (RSI) indicates no signal on a weekly basis but shows bearish tendencies monthly. Bollinger Bands and moving averages also reflect bearish trends, indicating a cautious market sentiment. Despite the recent evaluation adjustment, Amara Raja has demonstrated resilience over longer periods, with a notable 125.01% return over the past five years, al...

Read MoreAmara Raja Energy & Mobility Shows Dynamic Trading Amid Sector Activity Variations

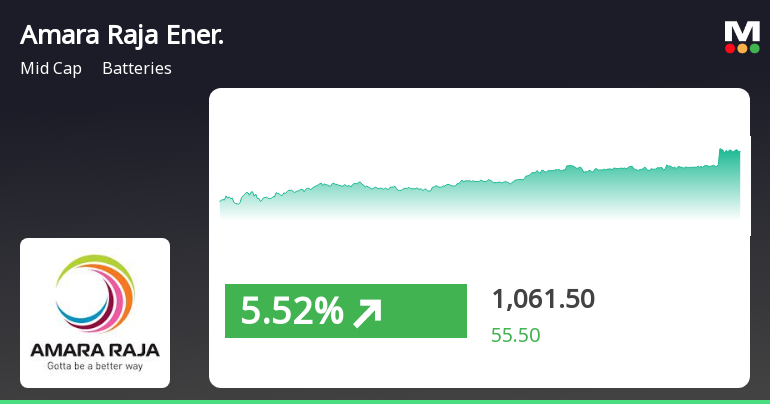

2025-03-26 10:00:16Amara Raja Energy & Mobility Ltd (ARE&M), a prominent player in the batteries industry, has emerged as one of the most active equities today, showcasing significant trading activity. The stock recorded a total traded volume of 1,114,606 shares, with a total traded value of approximately Rs 12.15 crore. Opening at Rs 1,062.0, the stock reached an intraday high of Rs 1,109.0, reflecting a gain of 5.08% during the trading session. The last traded price stood at Rs 1,075.2. In terms of performance, Amara Raja Energy & Mobility outperformed its sector by 1.13%, while the broader market, represented by the Sensex, saw a slight decline of 0.04%. The stock's performance today yielded a 1.80% return, compared to a 1.76% return for the sector. However, there has been a noted decrease in investor participation, with delivery volume on March 25 falling by 2.88% against the five-day average. Despite being above the 5-...

Read More

Amara Raja Energy & Mobility Faces Mixed Financial Performance Amid Technical Evaluation Shift

2025-03-21 08:02:59Amara Raja Energy & Mobility has recently experienced a change in its evaluation, reflecting a nuanced view of its technical indicators. The company has shown a strong annual return but faces challenges with modest operating profit growth and a decline in quarterly profit after tax, despite maintaining a low debt-to-equity ratio.

Read MoreAmara Raja Energy & Mobility Faces Mixed Technical Trends Amid Market Evaluation Shift

2025-03-21 08:02:25Amara Raja Energy & Mobility, a midcap player in the batteries industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,037.00, down from a previous close of 1,060.00, with a notable 52-week high of 1,774.90 and a low of 737.65. Today's trading saw a high of 1,074.15 and a low of 1,029.50. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signal weekly but is bearish monthly. Bollinger Bands and KST also reflect a mildly bearish stance on both weekly and monthly evaluations. Meanwhile, the Dow Theory suggests a mildly bullish outlook weekly, contrasting with its monthly bearish trend. In terms of returns, Amara Raja has shown resilience over the past year, out...

Read More

Amara Raja Energy & Mobility Shows Strong Gains Amid Midcap Market Leadership

2025-03-19 14:45:28Amara Raja Energy & Mobility has experienced notable gains, marking its third consecutive day of increases. The stock has outperformed the Sensex over various timeframes, particularly in the past week and month. Despite recent declines over three months, it currently exceeds its shorter-term moving averages.

Read More

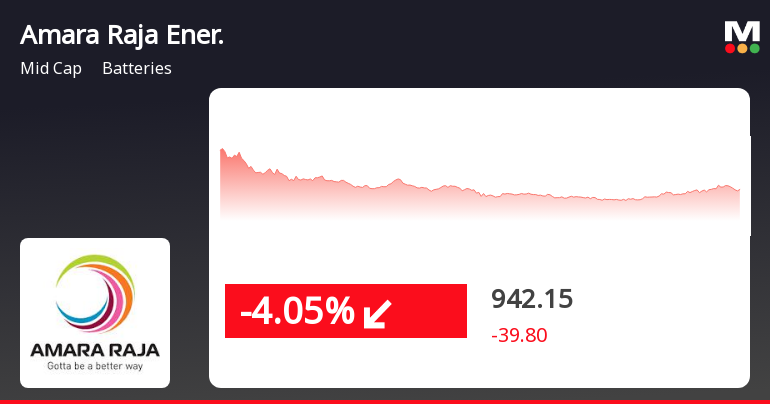

Amara Raja Energy & Mobility Faces Sustained Stock Decline Amid Broader Sector Weakness

2025-03-03 11:15:52Amara Raja Energy & Mobility's stock has declined significantly, losing 5.02% today and 10.87% over the past three days. It is trading below key moving averages and has underperformed compared to the broader market and its sector, reflecting a challenging period for the company.

Read MoreBoard Meeting Intimation for Audited Financial Results For The Financial Year Ended March 31 2025 And Recommend Final Dividend FY25 If Any.

31-Mar-2025 | Source : BSEAmara Raja Energy & Mobility Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 29/05/2025 inter alia to consider and approve Audited financial results for the financial year ended March 31 2025 and recommend final dividend FY25 if any.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

08-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for RNG Jayadev Trust & Others

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

08-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for RNG Jayadev Trust & Others

Corporate Actions

29 May 2025

Amara Raja Energy & Mobility Ltd has declared 530% dividend, ex-date: 14 Nov 24

Amara Raja Energy & Mobility Ltd has announced 1:2 stock split, ex-date: 25 Sep 12

Amara Raja Energy & Mobility Ltd has announced 1:2 bonus issue, ex-date: 14 Oct 08

No Rights history available