Amba Enterprises Adjusts Valuation Grade Amid Strong Financial Performance and Competitive Metrics

2025-04-02 08:01:32Amba Enterprises, a microcap player in the engineering sector, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings ratio stands at 33.32, while its price-to-book value is recorded at 6.19. Additionally, key metrics such as the EV to EBIT and EV to EBITDA ratios are at 24.07 and 22.59, respectively. The PEG ratio is noted at 1.96, and the dividend yield is relatively modest at 0.26%. Amba's return on capital employed (ROCE) is impressive at 23.89%, alongside a return on equity (ROE) of 18.57%. In comparison to its peers, Amba Enterprises demonstrates a competitive edge, particularly in its valuation metrics. While some competitors like Axtel Industries and A B Infrabuild are categorized as very expensive, Amba's valuation reflects a more favorable position. The company's recent performance has also outpaced the Sensex over var...

Read MoreAmba Enterprises Outperforms Sensex with Strong Long-Term Returns Amid Short-Term Challenges

2025-02-20 11:57:19Amba Enterprises Ltd, a microcap player in the engineering sector, has shown significant activity today, with its stock rising by 6.58%. This performance stands in contrast to the broader market, as the Sensex experienced a slight decline of 0.29%. Over the past year, Amba Enterprises has delivered a robust return of 32.86%, significantly outperforming the Sensex, which gained only 3.64% during the same period. Despite today's gains, the stock has faced challenges in the short term, with a 14.24% decline over the past month and a year-to-date drop of 10.46%. However, the long-term outlook remains strong, with impressive three-year and five-year performance figures of 258.23% and 980.15%, respectively, compared to the Sensex's 30.93% and 83.92%. The company's current market capitalization stands at Rs 229.00 crore, with a price-to-earnings ratio of 30.27, slightly below the industry average of 32.94. Techn...

Read More

Amba Enterprises Reports Strong Q3 FY24-25 Growth Amidst Market Resilience

2025-02-10 18:48:15Amba Enterprises, a microcap engineering firm, recently experienced a score adjustment reflecting its strong financial performance. In Q3 FY24-25, the company reported a 23.26% annual growth in net sales and a 42.83% increase in operating profit, showcasing effective management and solid market positioning.

Read More

Amba Enterprises Reports Strong Q3 Growth in Profit and Sales Metrics

2025-02-07 20:38:07Amba Enterprises has announced its financial results for the quarter ending December 2024, highlighting a year-on-year growth in Profit After Tax of 23.77% and a 31.55% increase in quarterly net sales. These results reflect the company's operational strength and effective revenue enhancement strategies in the engineering sector.

Read More

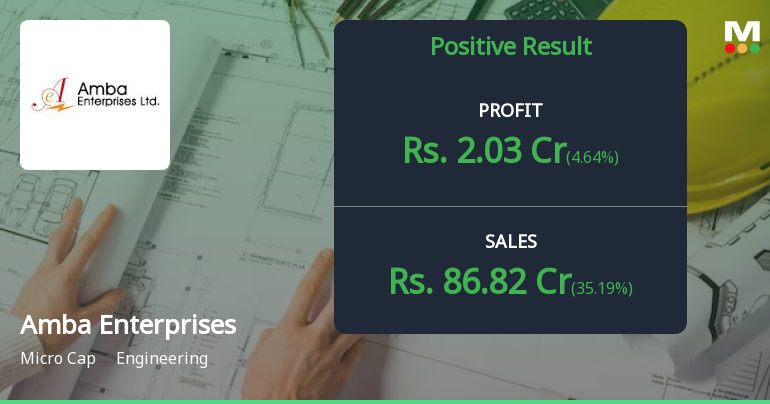

Amba Enterprises Reports Strong Q2 FY24-25 Growth Amidst Improved Operational Metrics

2025-02-03 18:27:30Amba Enterprises, a microcap in the engineering sector, has recently adjusted its evaluation, reflecting strong operational metrics. The company reported significant financial performance in Q2 FY24-25, with net sales of Rs 86.82 crore, a record PBDIT, and a high Return on Capital Employed, indicating effective management and growth potential.

Read More

Amba Enterprises Reports Strong Q2 FY24-25 Growth Amid Sideways Market Trend

2025-01-28 18:46:20Amba Enterprises, a microcap engineering firm, has recently adjusted its evaluation, reflecting strong financial performance in Q2 FY24-25. Key metrics include a 21.80% return on capital employed and a low debt to EBITDA ratio of 1.01. The company reported significant growth in net sales and operating profit, despite a sideways technical trend.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg.74(5) of SEBI(DP)Regulations

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window

Announcement Under Regulation 30(LODR)

19-Feb-2025 | Source : BSEAnnouncement under Regulation 30(LODR)

Corporate Actions

No Upcoming Board Meetings

Amba Enterprises Ltd has declared 10% dividend, ex-date: 23 Sep 24

Amba Enterprises Ltd has announced 5:10 stock split, ex-date: 09 May 16

Amba Enterprises Ltd has announced 1:5 bonus issue, ex-date: 08 Aug 16

No Rights history available