Amber Enterprises Experiences Technical Trend Shifts Amid Market Evaluation Revision

2025-04-02 08:09:20Amber Enterprises India, a prominent player in the consumer durables and electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 6,872.75, showing a notable decline from its previous close of 7,192.65. Over the past year, Amber has demonstrated significant resilience, with a return of 86.26%, outperforming the Sensex, which recorded a modest 2.72% increase during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bearish trend on a weekly basis while remaining bullish monthly. Bollinger Bands reflect a mildly bullish stance for both weekly and monthly assessments. Moving averages indicate a bullish trend on a daily basis, suggesting some short-term strength. In terms of stock performance, Amber has shown a remarkable return of 442.66% over the past five ye...

Read More

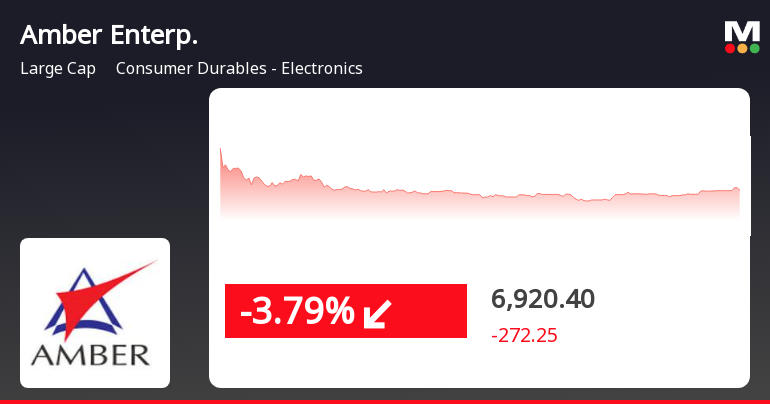

Amber Enterprises India Faces Short-Term Setback Amidst Strong Long-Term Performance Trends

2025-04-01 11:40:52Amber Enterprises India saw a decline of 4.1% on April 1, 2025, following two days of gains. Despite this short-term dip, the stock remains above several key moving averages and has shown significant growth over the past year and five years, outperforming the broader market in the long term.

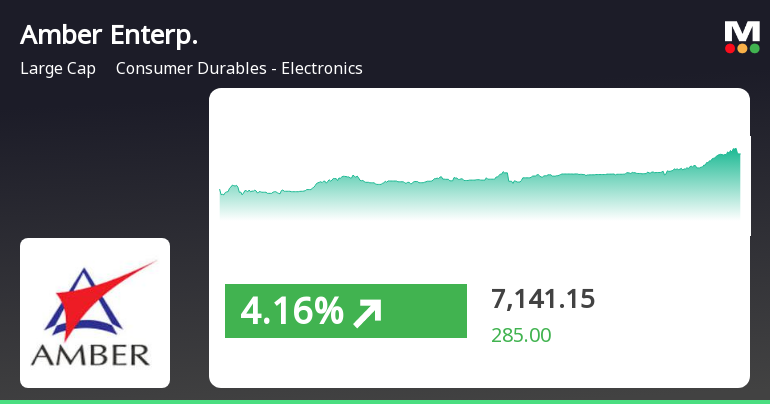

Read MoreAmber Enterprises Shows Strong Market Activity Amid Rising Investor Participation

2025-03-28 10:00:15Amber Enterprises India Ltd, a prominent player in the Consumer Durables - Electronics sector, has shown significant activity in the stock market today. The company, trading under the symbol AMBER, recorded a total traded volume of 181,606 shares, with a total traded value of approximately Rs 13,171.99 lakhs. The stock opened at Rs 7,181.00 and reached a day high of Rs 7,297.00, reflecting a 2.3% increase during the trading session. As of the latest update, Amber Enterprises is trading at Rs 7,220.15, marking a 1.89% return for the day, which outperformed the sector's return of 0.96% and contrasted with the Sensex's decline of 0.31%. The stock has been on a positive trajectory, gaining for the last two days with a cumulative return of 5.96% over this period. Additionally, the stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong performance t...

Read More

Amber Enterprises Shows Strong Recovery Amid Broader Market Gains in Consumer Durables Sector

2025-03-27 15:20:32Amber Enterprises India experienced a notable uptick on March 27, 2025, reversing two days of decline. The stock traded above all key moving averages, indicating strong performance. The broader Consumer Durables - Electronics sector also saw gains, while the Sensex recovered significantly after a negative opening.

Read MoreAmber Enterprises Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-27 08:03:47Amber Enterprises India, a prominent player in the consumer durables electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 6,856.15, slightly down from the previous close of 6,883.90. Over the past year, Amber has demonstrated significant resilience, with a remarkable return of 89.32%, far surpassing the Sensex's 6.65% during the same period. The company's performance metrics reveal a mixed technical landscape. While the MACD indicates a mildly bearish trend on a weekly basis, it shows bullish momentum on a monthly scale. The Bollinger Bands and moving averages also reflect a bullish sentiment, suggesting a positive outlook in the short to medium term. In terms of price action, Amber reached a high of 6,991.50 today, with a low of 6,750.00, indicating some volatility. The stock's 52-week range highlights its potential, ...

Read More

Amber Enterprises India Adjusts Evaluation Amid Strong Profit Growth and Technical Trends

2025-03-26 08:11:30Amber Enterprises India has recently experienced a change in its evaluation, reflecting a complex interplay of technical indicators and financial performance. The company reported a significant increase in operating profit, while also facing challenges in management efficiency, despite strong institutional investor confidence.

Read MoreAmber Enterprises Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-26 08:04:36Amber Enterprises India, a prominent player in the consumer durables and electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 6,883.90, showing a notable fluctuation with a previous close of 7,010.00. Over the past year, Amber has demonstrated impressive performance, with a return of 93.78%, significantly outpacing the Sensex's 7.12% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bearish trend, while the monthly outlook remains bullish. The Bollinger Bands indicate a mildly bullish stance on a weekly basis, complemented by a bullish signal from daily moving averages. However, the KST and Dow Theory present a mixed picture, with weekly indicators showing no clear trend. Amber's stock has experienced a 52-week high of 8,167.10 and a low of 3,320.00, highlighting its vo...

Read More

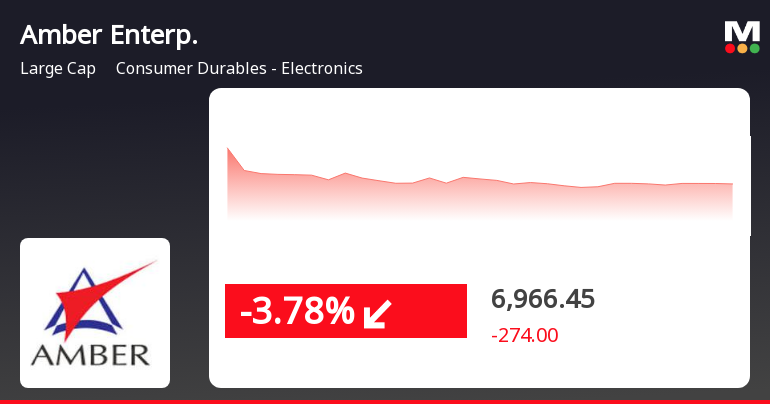

Amber Enterprises Faces Short-Term Decline Amid Strong Long-Term Growth Trends

2025-03-21 09:35:32Amber Enterprises India, a key player in consumer durables, saw a decline on March 21, 2025, following a four-day gain streak. Despite this drop, the company has shown strong performance metrics, with significant increases over various time frames, outperforming the Sensex in both short and long-term comparisons.

Read MoreAmber Enterprises Shows Strong Performance Amid Declining Investor Participation

2025-03-20 11:00:04Amber Enterprises India Ltd, a prominent player in the Consumer Durables - Electronics sector, has emerged as one of the most active equities today, with a total traded volume of 694,819 shares and a substantial traded value of approximately Rs 4,981.06 million. The stock opened at Rs 6,900.00 and reached an intraday high of Rs 7,294.80, reflecting a notable increase of 6.3% during the trading session. As of the latest update, the last traded price stands at Rs 7,235.75. Amber Enterprises has outperformed its sector by 6.2%, marking a significant achievement as it has recorded consecutive gains over the past four days, accumulating a total return of 14.43% in this period. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend. However, it is worth noting that investor participation has seen a decline, with delivery volume drop...

Read MorePursuant To Sub-Para 20 Of Para-A Of Part A Of Schedule III Of Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI LODR Regulations) As Amended We Wish To Inform You That The

09-Apr-2025 | Source : BSEPursuant to Regulation 30 of SEBI (LODR) Regulations 2015 we are hereby intimating the exchange that the Company has received a show cause notice on 08.04.2025 from the GST department.

Disclosure Under Regulation 30(13) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 As Amended

09-Apr-2025 | Source : BSEPursuant to Regulation 30(13) of SEBI (LODR) Regulations we are hereby intimating the exchange regarding the receipt of a communication from a statutory authority on 08.04.2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPursuant to Regulation 74(5) of SEBI (DP) Regulations 2018 we are hereby submitting the certificate received from KFin Technologies Limited Registrar and Share Transfer Agent of the Company for the quarter ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Amber Enterprises India Ltd has declared 16% dividend, ex-date: 26 Mar 20

No Splits history available

No Bonus history available

No Rights history available