Ami Organics Displays Mixed Technical Trends Amid Strong Yearly Performance

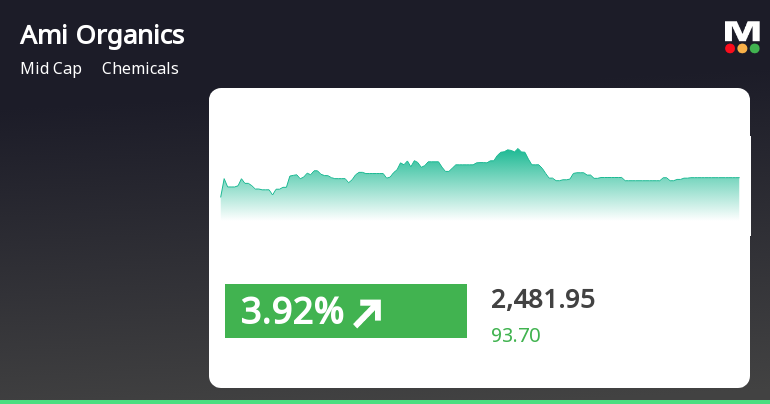

2025-04-03 08:06:22Ami Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,480.00, having seen fluctuations with a previous close of 2,525.90. Over the past year, Ami Organics has demonstrated significant performance, achieving a remarkable return of 117.98%, compared to a modest 3.67% return from the Sensex. In terms of technical indicators, the company shows a mixed picture. The MACD indicates a mildly bearish trend on a weekly basis, while the monthly outlook is bullish. The Bollinger Bands and On-Balance Volume (OBV) both suggest a bullish stance, indicating positive momentum. However, the KST and Dow Theory present a more cautious view with mildly bearish signals on a weekly basis. Ami Organics has also shown resilience in its recent performance, with a one-week return of 4.61% against a decline of ...

Read More

Ami Organics Reports Strong Financial Growth Amid Mixed Technical Indicators

2025-04-02 08:40:22Ami Organics, a midcap chemicals company, has recently adjusted its evaluation amid strong financial performance, including a 22.61% increase in operating profit for Q3 FY24-25. The company reported record net sales of Rs 274.99 crore and maintains a favorable low debt-to-equity ratio, supported by solid institutional holdings.

Read MoreAmi Organics Shows Mixed Technical Trends Amidst Strong Market Performance

2025-04-02 08:09:56Ami Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,525.90, showing a notable increase from the previous close of 2,424.40. Over the past week, the stock reached a high of 2,550.10 and a low of 2,404.30, indicating some volatility in its trading range. The technical summary reveals a mixed outlook, with the MACD indicating a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands and daily moving averages suggest a bullish sentiment, contrasting with the KST, which shows a mildly bearish trend weekly but bullish monthly. The Dow Theory presents a mildly bullish stance on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. In terms of performance, Ami Organics has demonstrated significant returns compar...

Read More

Ami Organics Shows Strong Momentum Amid Broader Market Gains and Sector Outperformance

2025-03-28 10:50:26Ami Organics, a midcap chemicals company, has demonstrated strong trading momentum, gaining 5.94% on March 28, 2025. The stock is nearing its 52-week high and has outperformed its sector. It has shown consistent gains over the past two days and is trading above key moving averages.

Read MoreAmi Organics Opens Strong with 5.59% Gain, Reflecting Market Momentum

2025-03-24 14:35:19Ami Organics, a midcap player in the chemicals industry, has shown remarkable performance today, opening with a gain of 5.59%. The stock is currently trading just 4.78% below its 52-week high of Rs 2643.5, reflecting strong momentum in the market. Over the past week, Ami Organics has consistently gained, accumulating a total return of 15.57%, significantly outperforming its sector by 3.15% today. The stock reached an intraday high of Rs 2549.95, showcasing its robust trading activity. In terms of moving averages, Ami Organics is positioned favorably, trading above its 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating a positive trend. In the broader market context, Ami Organics has outperformed the Sensex, with a 1-day performance of 4.68% compared to the Sensex's 1.46%, and an impressive 11.59% rise over the past month against the Sensex's 4.80%. With a beta of 1.26, the stock is classifi...

Read More

Ami Organics Reports Strong Financial Performance, Boosting Investor Confidence and Institutional Holdings

2025-03-19 08:12:28Ami Organics, a midcap chemicals company, has recently adjusted its evaluation following strong third-quarter results for FY24-25. The firm reported significant growth in operating profit and net sales, alongside an impressive operating profit to net sales ratio and a low debt-to-equity ratio, indicating robust financial health.

Read MoreAmi Organics Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-19 08:05:06Ami Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2266.60, showing a notable increase from the previous close of 2189.00. Over the past year, Ami Organics has demonstrated impressive performance, with a return of 104.71%, significantly outpacing the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the company exhibits a mixed picture. The MACD shows a mildly bearish trend on a weekly basis while indicating bullish momentum on a monthly scale. The Bollinger Bands and moving averages suggest a bullish stance, particularly on a daily and monthly basis. However, the KST and OBV metrics reflect a more cautious outlook on a weekly timeframe. Ami Organics has also shown resilience in its returns compared to the Sensex over various periods....

Read More

Ami Organics Reports Strong Financial Performance Amidst Market Challenges

2025-03-13 08:08:56Ami Organics, a midcap chemicals company, has recently adjusted its evaluation following strong third-quarter FY24-25 results, including net sales of Rs 274.99 crore and a 22.61% increase in operating profit. The firm maintains a solid balance sheet and effective cost management, despite facing some valuation challenges.

Read MoreAmi Organics Shows Mixed Technical Trends Amidst Market Fluctuations and Strong Yearly Performance

2025-03-13 08:02:48Ami Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,183.00, down from a previous close of 2,264.50. Over the past year, Ami Organics has demonstrated significant resilience, with a remarkable return of 103.77%, contrasting sharply with the Sensex's modest gain of 0.49% during the same period. In terms of technical indicators, the company shows a mixed picture. The MACD indicates a mildly bearish trend on a weekly basis, while the monthly outlook remains bullish. The Bollinger Bands and moving averages suggest a mildly bullish sentiment on a daily basis, with the KST also reflecting a mildly bullish stance. Despite recent fluctuations, including a 9.79% decline over the past week, Ami Organics has managed to maintain a positive year-to-date return of 1.51%, outperforming the Sense...

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

03-Apr-2025 | Source : BSEPress Release titled Ami Organics celebrates Full Commissioning of 10.8 MW Solar Power Plant Driving Sustainability and Cost Savings as per letter enclosed.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECompliance Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018 is enclosed.

Intimation Of Record Date For The Purpose Of Sub-Division / Split Of The Face Value Of The Equity Shares Of The Company

28-Mar-2025 | Source : BSEBoard fixed April 25 2025 as the record date for the purpose of sub-division/split of the face value of the equity shares of the Company as per details attached.

Corporate Actions

No Upcoming Board Meetings

Ami Organics Ltd has declared 30% dividend, ex-date: 18 Sep 23

Ami Organics Ltd has announced 5:10 stock split, ex-date: 25 Apr 25

No Bonus history available

No Rights history available