AMJ Land Holdings Faces Mixed Signals Amid Declining Financial Metrics and Long-Term Growth Potential

2025-03-21 08:00:42AMJ Land Holdings has recently experienced a change in its evaluation, reflecting a shift in its stock's technical landscape. The company reported flat financial performance for the quarter ending December 2024, with declines in key metrics, while still showcasing a strong long-term growth trajectory despite mixed technical indicators.

Read MoreAMJ Land Holdings Navigates Market Volatility Amid Strong Yearly Performance

2025-03-20 18:00:13AMJ Land Holdings Ltd, a microcap player in the Paper & Paper Products industry, has shown notable activity in the market today. With a market capitalization of Rs 207.00 crore, the company has a price-to-earnings (P/E) ratio of 13.80, which is above the industry average of 11.41. Over the past year, AMJ Land Holdings has delivered a robust performance, gaining 54.59%, significantly outperforming the Sensex, which rose by 5.89% during the same period. In the short term, the stock has increased by 1.64% today, compared to the Sensex's 1.19% rise. However, the stock has faced challenges in the longer term, with a year-to-date decline of 26.04%, while the Sensex has only dipped by 2.29%. Over three years, AMJ Land Holdings has still managed a respectable gain of 46.67%, outpacing the Sensex's 31.94% increase. Technical indicators present a mixed picture, with weekly metrics showing bearish trends in MACD...

Read More

AMJ Land Holdings Shows Strong Sales Growth Amid Stable Financial Performance

2025-03-11 08:04:42AMJ Land Holdings has recently adjusted its evaluation, reflecting strong growth in net sales and operating profit. Despite stable third-quarter results and a conservative debt-to-equity ratio, concerns about management efficiency persist. The company has outperformed the broader market, achieving significant returns over the past year.

Read More

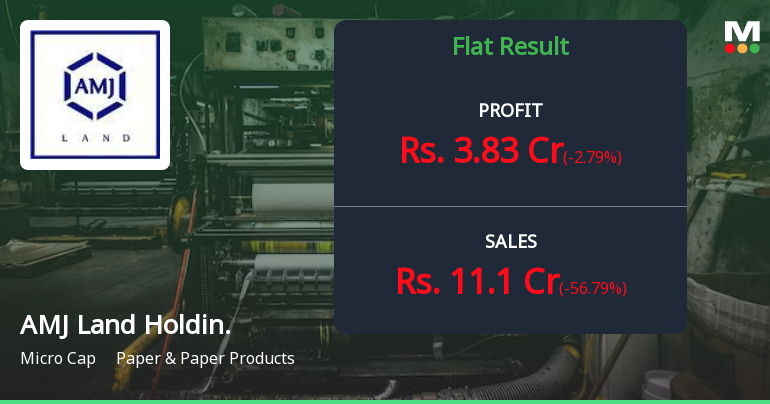

AMJ Land Holdings Faces Flat Performance Amidst Financial Metric Adjustments

2025-03-03 18:34:58AMJ Land Holdings has recently adjusted its evaluation amid a flat performance in Q3 FY24-25, with declines in key financial metrics including Profit Before Tax and Profit After Tax. Despite these challenges, the company maintains a low Debt to Equity ratio and shows healthy long-term growth in net sales and operating profit.

Read More

AMJ Land Holdings Reports Stable Q3 FY24-25 Results Amid Evaluation Shift

2025-02-05 15:31:11AMJ Land Holdings has announced its financial results for the quarter ending in 202412, revealing stable performance in the third quarter of FY24-25. However, the company's evaluation score has shifted significantly in recent months, reflecting changes in its financial standing within the microcap sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Mar-2025 | Source : BSENewspaper Publication

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

AMJ Land Holdings Ltd has declared 10% dividend, ex-date: 29 Aug 24

AMJ Land Holdings Ltd has announced 2:10 stock split, ex-date: 23 Mar 09

No Bonus history available

No Rights history available