Amrutanjan Health Care Faces Mixed Technical Trends Amid Market Evaluation Revision

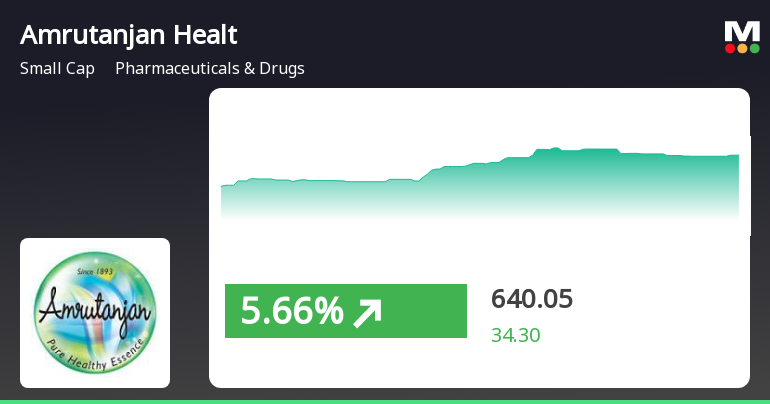

2025-04-01 08:00:14Amrutanjan Health Care, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 670.00, showing a notable increase from the previous close of 632.00. Over the past year, Amrutanjan has demonstrated a stock return of 8.30%, outperforming the Sensex, which recorded a return of 5.11% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) remains neutral, with no significant signals detected. Bollinger Bands also reflect a mildly bearish trend on both weekly and monthly scales. Moving averages indicate a mildly bearish sentiment on a daily basis, while the KST presents a mixed picture with a bearish weekly trend and a bullish monthly outlook. When co...

Read MoreAmrutanjan Health Care Faces Bearish Technical Trends Amid Market Challenges

2025-03-27 08:00:09Amrutanjan Health Care, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 610.00, down from a previous close of 642.25, with a 52-week high of 861.40 and a low of 548.05. The technical summary indicates a bearish sentiment across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while Bollinger Bands also reflect a bearish outlook on the weekly timeframe. Moving averages confirm a bearish stance, and the KST presents a mixed picture with a bearish weekly trend but a bullish monthly trend. In terms of performance, Amrutanjan's returns have been underwhelming compared to the Sensex. Over the past week, the stock has seen a decline of 0.55%, while the Sensex has gained 2.44%. Year-to-date, Amrutanjan's return stands at -15.98%, contrasting sharply...

Read MoreAmrutanjan Health Care Faces Mixed Technical Trends Amid Market Volatility

2025-03-20 08:00:16Amrutanjan Health Care, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 613.40, showing a slight increase from the previous close of 604.90. Over the past year, the stock has experienced a high of 861.40 and a low of 548.05, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly MACD shows a contrasting bullish trend. The Relative Strength Index (RSI) does not signal any clear direction on both weekly and monthly charts. Bollinger Bands indicate a mildly bearish sentiment on both timeframes, and moving averages reflect a bearish stance on a daily basis. The KST presents a mixed picture with weekly bearishness and monthly bullishness, while the Dow Theory suggests a mildly bullish outlook weekly but mildly bearish mo...

Read MoreAmrutanjan Health Care Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:00:18Amrutanjan Health Care, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 598.00, down from a previous close of 620.15, with a 52-week high of 861.40 and a low of 548.05. Today's trading saw a high of 627.25 and a low of 590.00. The technical summary indicates a bearish sentiment across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while Bollinger Bands also reflect a bearish stance on the weekly chart and a mildly bearish outlook on the monthly. Moving averages are bearish on a daily basis, and the KST presents a mixed picture with a bearish weekly trend but a bullish monthly trend. In terms of performance, Amrutanjan's stock return over the past week stands at 2.22%, outperforming the Sensex's return of 1.41%. However, over the longer term...

Read MoreAmrutanjan Health Care Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-07 08:00:40Amrutanjan Health Care, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 627.75, slightly down from the previous close of 632.05. Over the past year, Amrutanjan has experienced a stock return of -5.09%, contrasting with a modest gain of 0.34% in the Sensex. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish trend, suggesting some volatility in the stock's price movements. Meanwhile, the KST presents a bullish monthly signal, indicating potential strength in longer-term trends. In terms of price performance, Amrutanjan reached a 52-week high of 861.40 and a low of 548.05, demonstrating significant fluctuat...

Read More

Amrutanjan Health Care Outperforms Sector Amid Broader Market Recovery Trends

2025-03-05 10:55:21Amrutanjan Health Care has experienced notable activity, achieving consecutive gains over three days and outperforming its sector. The stock reached an intraday high while showing mixed trends in moving averages. In the broader market, small-cap stocks are leading, with the Sensex recovering from a flat opening.

Read More

Amrutanjan Health Care Faces Significant Market Challenges Amidst Ongoing Volatility

2025-03-03 09:35:29Amrutanjan Health Care has faced significant volatility, hitting a new 52-week low and experiencing a notable decline over the past four days. The stock is trading below key moving averages and has underperformed compared to the broader market, indicating ongoing challenges in its operational strategies and market positioning.

Read More

Amrutanjan Health Care Hits 52-Week Low Amidst Broader Sector Challenges

2025-02-28 09:35:36Amrutanjan Health Care has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is trading below key moving averages, indicating a bearish trend. Over the past year, it has seen a notable decline compared to the broader market.

Read More

Amrutanjan Health Care Hits 52-Week Low Amid Ongoing Market Volatility

2025-02-24 10:05:12Amrutanjan Health Care has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has consistently traded below key moving averages, indicating a downward trend. Over the past year, the stock has underperformed compared to the broader market, facing notable volatility.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulation 2018 for the Quarter ended 31st March 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEInitmation of Closure of Trading Window for the Quarter and Year Ended 31st March 2025

Disclosure Under Regulation 30 Of SEBI LODR 2015

03-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI LODR 2015

Corporate Actions

No Upcoming Board Meetings

Amrutanjan Health Care Ltd has declared 100% dividend, ex-date: 18 Feb 25

Amrutanjan Health Care Ltd has announced 1:2 stock split, ex-date: 13 Apr 18

No Bonus history available

No Rights history available