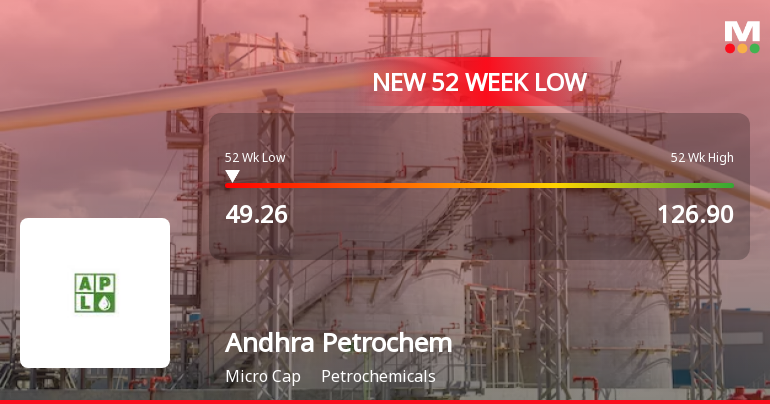

Andhra Petrochemicals Hits 52-Week Low Amid Broader Market Decline and Sector Underperformance

2025-03-28 13:07:20Andhra Petrochemicals has reached a new 52-week low, reflecting a significant decline over the past year. The stock underperformed its sector today, despite a brief intraday increase. It is currently trading below key moving averages, amidst a broader market downturn, while offering a notable dividend yield.

Read More

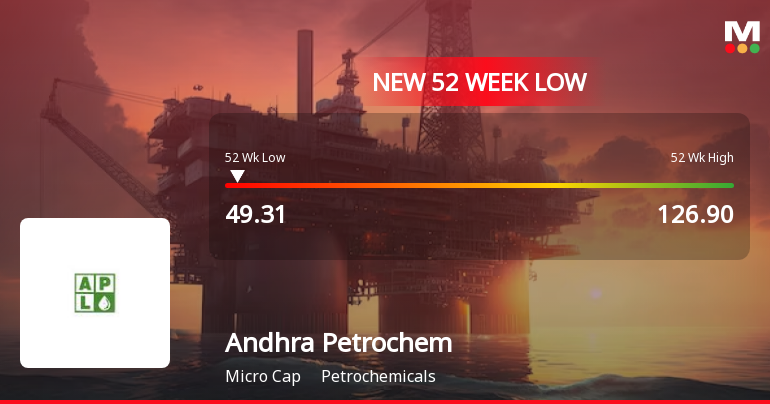

Andhra Petrochemicals Hits 52-Week Low Amidst Mixed Financial Performance Signals

2025-03-27 09:52:50Andhra Petrochemicals has reached a new 52-week low, despite a slight performance improvement today. The company has faced significant challenges, including a steep decline in profit and consecutive negative quarterly results. However, it maintains a strong return on equity and a low debt-to-equity ratio, alongside a notable dividend yield.

Read More

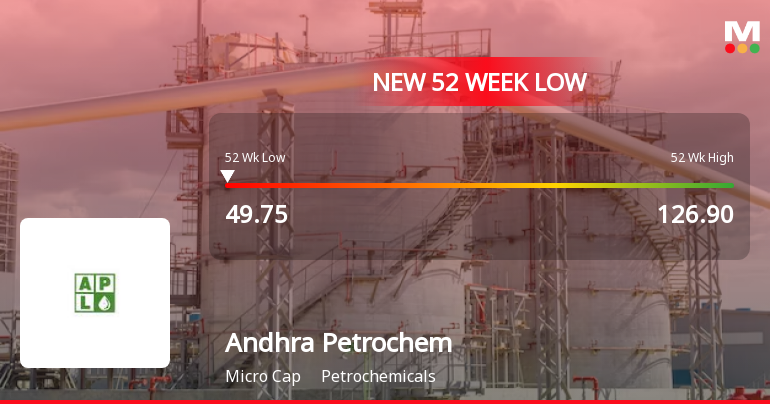

Andhra Petrochemicals Hits 52-Week Low Amidst Ongoing Financial Challenges and Market Activity

2025-03-27 09:52:47Andhra Petrochemicals has reached a new 52-week low, reflecting a 39.89% decline over the past year, contrasting with a 6.07% gain in the Sensex. The company has reported negative financial results recently, yet maintains a high return on equity and low debt-to-equity ratio, alongside a dividend yield of 3.98%.

Read More

Andhra Petrochemicals Faces Significant Volatility Amid Declining Financial Performance

2025-03-17 13:06:45Andhra Petrochemicals has faced notable volatility, reaching a new 52-week low and experiencing a decline over the past three days. The company reported a significant drop in net sales and profit after tax, while maintaining a high return on equity and low debt-to-equity ratio, alongside a notable dividend yield.

Read MoreAndhra Petrochemicals Adjusts Valuation Grade, Signaling Competitive Market Positioning

2025-03-12 08:00:18Andhra Petrochemicals has recently undergone a valuation adjustment, reflecting its financial metrics and market position within the petrochemicals industry. The company currently boasts a price-to-earnings (P/E) ratio of 10.78 and a price-to-book value of 0.80, indicating a potentially favorable valuation relative to its assets. Additionally, its enterprise value to EBITDA stands at 2.80, while the enterprise value to EBIT is recorded at 3.90, suggesting efficient operational performance. The company also demonstrates a robust return on capital employed (ROCE) of 26.85% and a return on equity (ROE) of 7.39%, highlighting effective management of its resources. With a dividend yield of 3.84%, Andhra Petrochemicals offers a return to shareholders, further enhancing its appeal. In comparison to its peers, Andhra Petrochemicals presents a more attractive valuation profile, particularly when juxtaposed with co...

Read MoreAndhra Petrochemicals Adjusts Valuation Grade Amid Competitive Market Dynamics

2025-03-05 08:00:34Andhra Petrochemicals has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the petrochemicals industry. The company's price-to-earnings ratio stands at 10.60, while its price-to-book value is notably low at 0.78. Additionally, the enterprise value to EBITDA ratio is recorded at 2.66, indicating a potentially favorable valuation compared to its peers. The company also boasts a robust return on capital employed (ROCE) of 26.85% and a dividend yield of 3.91%, which may appeal to certain segments of the market. However, when compared to its peers, Andhra Petrochemicals presents a more attractive valuation profile, particularly against companies like T N Petro Products and Multibase India, which exhibit higher valuation metrics. In terms of stock performance, Andhra Petrochemicals has faced challenges, with a year-to-date return of -31.15%, contrast...

Read More

Andhra Petrochemicals Faces Market Challenges Amid Significant Stock Volatility

2025-03-03 10:06:42Andhra Petrochemicals has faced significant volatility, recently nearing a 52-week low and underperforming its sector. The stock has declined for three consecutive days, with a notable drop over the past year. Despite these challenges, it offers a high dividend yield, appealing to income-focused investors.

Read More

Andhra Petrochemicals Faces Financial Challenges Amid Declining Sales and Profit Trends

2025-02-25 18:16:40Andhra Petrochemicals has experienced a recent evaluation adjustment amid challenges in its financial performance, including a decline in net sales and operating profit. Despite these issues, the company maintains a strong return on equity and a low debt-to-equity ratio, indicating financial stability in a volatile sector.

Read MoreAndhra Petrochemicals Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-02-24 12:57:07Andhra Petrochemicals has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the petrochemicals industry. The company, classified as a microcap, showcases a price-to-earnings ratio of 11.94 and a price-to-book value of 0.88. Its enterprise value to EBITDA stands at 3.72, while the enterprise value to sales ratio is notably low at 0.30. The company also offers a dividend yield of 3.47%, with a return on capital employed (ROCE) of 26.85% and a return on equity (ROE) of 7.39%. These metrics indicate a solid operational performance relative to its size. In comparison to its peers, Andhra Petrochemicals presents a more favorable valuation profile. For instance, T N Petro Products is positioned at a higher valuation, while companies like Vikas Lifecare and Guj. Petrosynth face challenges, including loss-making status and high risk assessments. This co...

Read MoreClosure of Trading Window

24-Mar-2025 | Source : BSEIntimation regarding closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2025 | Source : BSEPublication of Unaudited Financial Results for the Quarter ended 31.12.2024

Integrated Filing (Financial)

13-Feb-2025 | Source : BSEUnaudited Financial Results for the Quarter ended 31.12.2024 (Integrated Filing)

Corporate Actions

No Upcoming Board Meetings

Andhra Petrochemicals Ltd has declared 20% dividend, ex-date: 28 Jun 24

No Splits history available

No Bonus history available

No Rights history available