Andhra Sugars Experiences Valuation Grade Change Amidst Competitive Sector Challenges

2025-04-02 08:00:54Andhra Sugars, a microcap player in the diversified industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings (PE) ratio stands at 18.98, while its price-to-book value is notably low at 0.61. Other metrics include an enterprise value to EBITDA ratio of 9.89 and a return on equity (ROE) of 3.74%. The dividend yield is recorded at 1.41%, indicating a modest return to shareholders. In comparison to its peers, Andhra Sugars presents a unique position. While it is categorized as very expensive, other companies in the sector, such as Oswal Agro Mills, also fall into the same valuation category but exhibit higher PE ratios. Conversely, firms like JP Associates and Balgopal Commercial are classified as risky, with significant losses impacting their financial metrics. Over the past year, Andhra Sugars has faced challenges, with a stock retu...

Read MoreAndhra Sugars Experiences Valuation Grade Change Amidst Competitive Market Dynamics

2025-03-24 08:00:21Andhra Sugars, a microcap player in the diversified industry, has recently undergone a valuation adjustment. The company's current price stands at 69.49, slightly down from the previous close of 70.51. Over the past year, Andhra Sugars has faced challenges, with a stock return of -27.20%, contrasting with a 5.87% gain in the Sensex. Key financial metrics reveal a PE ratio of 18.58 and a price-to-book value of 0.60, indicating a relatively low valuation compared to its peers. The company's EV to EBITDA ratio is reported at 9.65, while its EV to sales stands at 0.42. Despite these figures, the return on capital employed (ROCE) is at -0.01%, and the return on equity (ROE) is 3.74%, suggesting some operational challenges. In comparison to its peers, Andhra Sugars shows a more favorable valuation profile, particularly in terms of price-to-earnings and EV to EBITDA ratios. However, several competitors are categ...

Read MoreAndhra Sugars Opens Strong with 5.79% Gain, Outperforming Sector Amid Mixed Signals

2025-03-20 09:35:13Andhra Sugars, a small-cap player in the diversified industry, has shown significant activity today, opening with a gain of 5.79%. The stock has outperformed its sector by 1.27%, marking a notable performance amidst broader market trends. Over the past three days, Andhra Sugars has experienced a consecutive gain, accumulating a total return of 9.8%. Today, the stock reached an intraday high of Rs 74, reflecting its upward momentum. However, when examining moving averages, the stock remains higher than its 5-day moving average but lower than the 20-day, 50-day, 100-day, and 200-day averages, indicating mixed signals in its short- to medium-term performance. In terms of broader market comparison, Andhra Sugars' one-day performance stands at 2.69%, significantly outperforming the Sensex, which recorded a gain of 0.70%. Over the past month, however, the stock has declined by 10.10%, contrasting with the Sense...

Read More

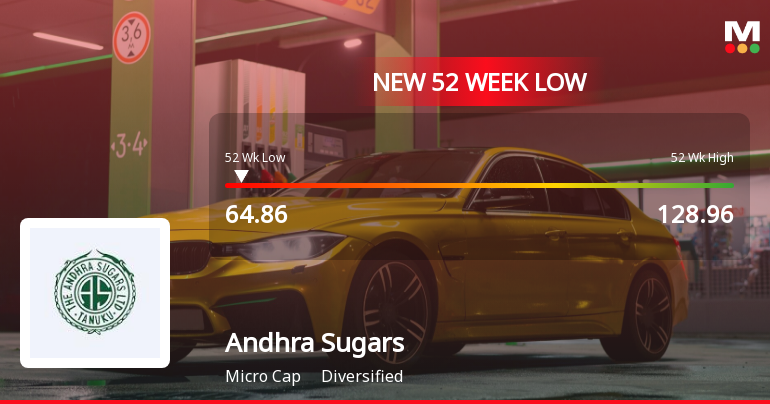

Andhra Sugars Hits 52-Week Low Amid Ongoing Financial Struggles and Market Trends

2025-03-18 09:41:26Andhra Sugars has reached a new 52-week low, with a slight intraday recovery noted. The company has struggled over the past year, showing a significant decline in performance and operating profit. It has reported negative results for eight consecutive quarters, raising concerns about its financial health.

Read More

Andhra Sugars Hits 52-Week Low Amid Ongoing Financial Struggles and Bearish Trends

2025-03-18 09:41:21Andhra Sugars has reached a new 52-week low, showing a notable intraday high but remaining below key moving averages, indicating a bearish trend. Over the past year, the company has faced significant challenges, including a substantial decline in operating profit and negative results for eight consecutive quarters.

Read MoreAndhra Sugars Experiences Valuation Grade Change Amidst Mixed Financial Performance Indicators

2025-03-18 08:00:23Andhra Sugars, a microcap player in the diversified industry, has recently undergone a valuation adjustment. The company's current price stands at 65.22, reflecting a notable decline from its previous close of 68.50. Over the past year, Andhra Sugars has experienced a stock return of -33.69%, contrasting sharply with a modest gain of 2.10% in the Sensex during the same period. Key financial metrics reveal a PE ratio of 17.43 and a price-to-book value of 0.56, indicating a relatively low valuation compared to its peers. The company's EV to EBITDA ratio is reported at 8.96, while the EV to sales ratio is at 0.39. However, the return on capital employed (ROCE) is slightly negative at -0.01%, and the return on equity (ROE) is at 3.74%. In comparison to its peers, Andhra Sugars presents a mixed picture. While some competitors are categorized as risky or very expensive, Andhra Sugars maintains a more favorable ...

Read More

Andhra Sugars Faces Significant Volatility Amidst Declining Financial Performance

2025-03-17 13:35:31Andhra Sugars has faced notable volatility, hitting a new 52-week low amid a bearish trend, trading below key moving averages. The company reported a significant decline in operating profit and profit after tax, with a substantial drop in annual growth over five years, leading to underperformance against benchmarks.

Read More

Andhra Sugars Hits 52-Week Low Amid Ongoing Financial Struggles and Bearish Trends

2025-03-04 09:45:51Andhra Sugars has hit a new 52-week low, reflecting a significant decline over the past year, contrasting with broader market trends. The company faces ongoing challenges, including a substantial drop in operating profit and consecutive quarterly losses, while maintaining a low debt level but high valuation compared to peers.

Read More

Andhra Sugars Hits 52-Week Low Amid Ongoing Performance Struggles and Market Challenges

2025-03-03 09:35:36Andhra Sugars has reached a new 52-week low, reflecting a significant decline in performance. The microcap company has consistently fallen over the past week and year, underperforming its sector and the broader market. This trend underscores the challenges faced by the company amid difficult market conditions.

Read MoreBook Closure for Dividend & AGM

13-Sep-2024 | Source : BSEAndhra Sugars Ltd has informed BSE that the Register of Members & Share Transfer Books of the Company will remain closed from September 18 2024 to September 21 2024 (both days inclusive) for the purpose of Payment of Dividend & 77th Annual General Meeting (AGM) of the Company to be held on September 21 2024.

Andhra Sugars schedules board meeting

01-Nov-2022 | Source : BSEAndhra Sugars will hold a meeting of the Board of Directors of the Company on 12 November 2022.

Andhra Sugars announces board meeting date

16-Jun-2021 | Source : BSEAndhra Sugars will hold a meeting of the Board of Directors of the Company on 30 June 2021.

Corporate Actions

No Upcoming Board Meetings

Andhra Sugars Ltd has declared 50% dividend, ex-date: 17 Sep 24

Andhra Sugars Ltd has announced 2:10 stock split, ex-date: 30 Dec 21

No Bonus history available

No Rights history available