Anjani Synthetics Faces Financial Stability Challenges Amidst Mixed Performance Indicators

2025-02-25 18:23:58Anjani Synthetics, a microcap textile company, has recently experienced a change in evaluation amid flat Q3 FY24-25 performance. The firm faces challenges with long-term profitability and debt servicing, reflected in its operating profit CAGR and Debt to EBITDA ratio. Despite these issues, technical trends show mild bullish positioning.

Read MoreAnjani Synthetics Faces Technical Trend Shifts Amid Mixed Market Sentiment

2025-02-25 10:30:19Anjani Synthetics, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company’s current stock price stands at 39.78, slightly above the previous close of 38.99. Over the past year, Anjani Synthetics has experienced a stock return of -9.26%, contrasting with a positive return of 2.09% for the Sensex during the same period. The technical summary indicates a predominantly bearish sentiment, with both weekly and monthly MACD readings suggesting a mildly bearish trend. The Bollinger Bands also reflect a bearish outlook, while the daily moving averages show a mildly bullish position. The KST presents a mixed picture, with weekly readings indicating mild bearishness and monthly readings leaning towards bullishness. In terms of performance, Anjani Synthetics has faced challenges over the past month, with a significant decline...

Read More

Anjani Synthetics Faces Financial Challenges Amidst Market Evaluation Adjustments

2025-02-19 19:02:07Anjani Synthetics, a microcap textile company, has recently experienced a change in evaluation due to flat financial performance and declining long-term strength. The firm faces challenges with profitability and debt servicing, despite a modest Return on Equity and a notable increase in profits over the past year.

Read More

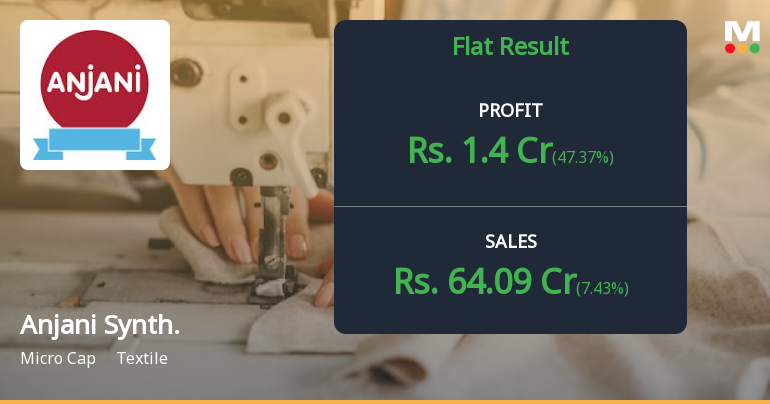

Anjani Synthetics Reports Strong Q3 FY24-25 Results with Record Net Sales and Profitability

2025-02-11 21:33:25Anjani Synthetics has announced its financial results for Q3 FY24-25, showcasing stable performance with the highest quarterly net sales in five quarters at Rs 64.09 crore. Profit before tax reached Rs 1.70 crore, and the company improved its debtor turnover ratio to 3.64 times, indicating efficient debt management.

Read More

Anjani Synthetics Faces Financial Challenges Amidst Flat Quarterly Performance and High Debt Burden

2025-02-06 18:44:57Anjani Synthetics, a microcap textile firm, has recently adjusted its evaluation amid flat financial performance for the quarter ending September 2024. The company reported a significant decline in net sales and faces long-term challenges, including high debt levels and limited profitability, despite some technical indicators suggesting a mildly bullish trend.

Read More

Anjani Synthetics Achieves 52-Week High Amid Strong Market Performance Trends

2025-01-28 13:05:14Anjani Synthetics, a microcap textile company, has reached a new 52-week high, reflecting strong market performance. With a 36.46% gain over the past year, it has significantly outperformed its sector and the Sensex. The stock is trading above key moving averages, indicating sustained positive momentum.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEAs attached.

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Feb-2025 | Source : BSEAs Attached

Board Meeting Outcome for The Standalone Unaudited Financial Results For The Quarter And Nine Months Ended On 31St December 2024 (Q3).

11-Feb-2025 | Source : BSEThe Standalone Unaudited Financial Results for the quarter and nine months ended on 31st December 2024 (Q3).

Corporate Actions

No Upcoming Board Meetings

Anjani Synthetics Ltd has declared 5% dividend, ex-date: 19 Sep 08

Anjani Synthetics Ltd has announced 10:1 stock split, ex-date: 28 Mar 12

Anjani Synthetics Ltd has announced 1:1 bonus issue, ex-date: 10 Jan 08

No Rights history available