Anupam Rasayan Faces Decline Amid Broader Market Resilience and Mixed Performance Indicators

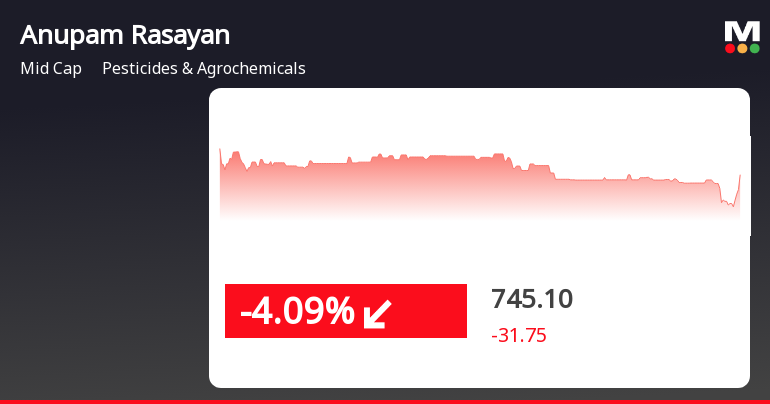

2025-03-27 14:20:27Anupam Rasayan India, a midcap in the Pesticides & Agrochemicals sector, saw a significant decline on March 27, 2025, underperforming its sector. While the stock's short-term performance is mixed, it has shown positive growth over the past month, contrasting with broader market trends reflected by the Sensex.

Read MoreAnupam Rasayan Faces Mixed Technical Signals Amidst Market Evaluation Changes

2025-03-25 08:06:12Anupam Rasayan India, a midcap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 768.70, slightly down from the previous close of 768.95. Over the past year, Anupam Rasayan has faced challenges, with a return of -13.51%, contrasting with a 7.07% gain in the Sensex during the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) is bearish on a weekly basis, with no signal on the monthly chart. Bollinger Bands reflect a similar pattern, with a mildly bullish weekly trend and a bearish monthly outlook. Moving averages indicate a mildly bearish stance on a daily basis, while the KST presents a mildly bullish weekly tren...

Read MoreAnupam Rasayan's Technical Indicators Show Mixed Signals Amid Market Challenges

2025-03-19 08:05:05Anupam Rasayan India, a midcap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 791.15, showing a notable increase from the previous close of 765.75. Over the past year, Anupam Rasayan has faced challenges, with a return of -13.17%, contrasting with a 3.51% gain in the Sensex during the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly evaluations. Bollinger Bands suggest a bullish stance weekly, yet the monthly outlook remains mildly bearish. Moving averages indicate a mildly bearish trend on a daily basis, while the KST reflects a mildly bullish weekly tren...

Read MoreAnupam Rasayan's Technical Indicators Signal Mixed Market Sentiment Amidst Recent Price Fluctuations

2025-03-18 08:04:37Anupam Rasayan India, a midcap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 765.75, down from a previous close of 779.85, with a 52-week high of 945.05 and a low of 600.95. Today's trading saw a high of 781.25 and a low of 761.00. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Similarly, Bollinger Bands reflect a mildly bullish stance weekly but shift to mildly bearish monthly. Moving averages indicate a mildly bearish trend on a daily basis, while the KST presents a mildly bullish weekly outlook but is bearish monthly. The On-Balance Volume (OBV) shows no trend weekly, yet is bullish on a monthly basis. In terms of performance, Anupam Rasayan's stoc...

Read MoreAnupam Rasayan Shows Mixed Technical Trends Amidst Market Resilience in Agrochemicals Sector

2025-03-12 08:03:24Anupam Rasayan India, a midcap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 792.50, showing a slight increase from the previous close of 787.00. Over the past week, the stock has demonstrated a notable performance with a return of 7.82%, significantly outperforming the Sensex, which returned 1.52% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments, indicating a neutral stance. Bollinger Bands reflect a bullish trend on a weekly basis, contrasting with a mildly bearish monthly view. The daily moving averages indicate a mildly bearish trend, while the On-Balance Volume (OB...

Read More

Anupam Rasayan Faces Significant Decline Amid Broader Market Weakness in Agrochemicals Sector

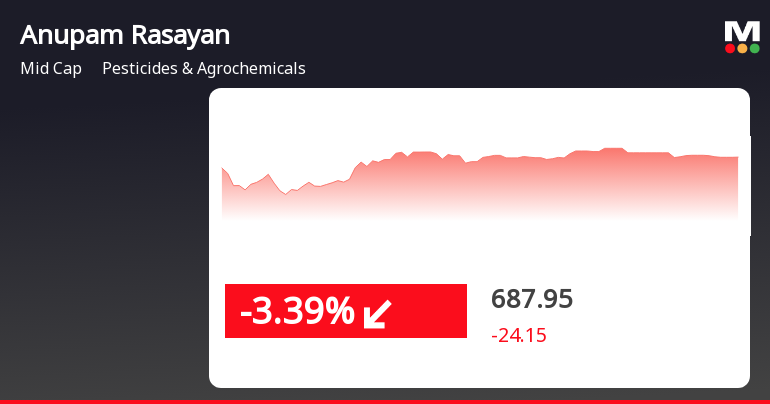

2025-03-04 09:35:26Anupam Rasayan India, a midcap player in the pesticides and agrochemicals sector, saw its shares decline significantly today, underperforming against its sector. The stock is currently above its 5-day moving average but below longer-term averages. The broader market also faced negative trends, with the Sensex nearing its 52-week low.

Read More

Anupam Rasayan's Strong Performance Highlights Resilience Amid Broader Market Weakness

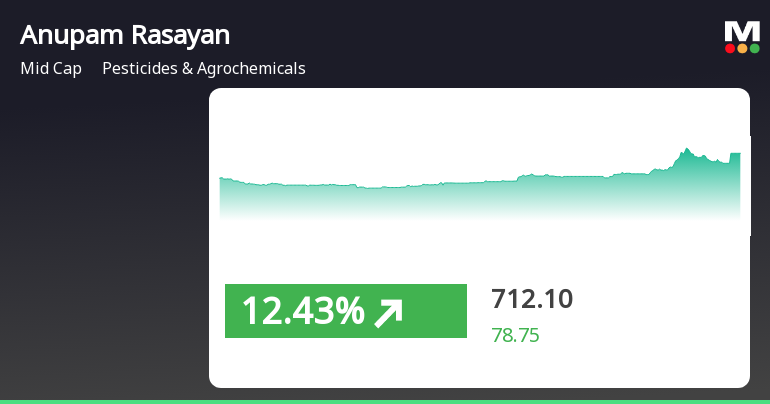

2025-03-03 18:25:32Anupam Rasayan India, a midcap player in the pesticides and agrochemicals sector, has experienced notable trading activity, achieving a significant gain today. The stock has shown an upward trend over the past three days, with high volatility and fluctuations, while remaining above several short-term moving averages.

Read More

Anupam Rasayan India Faces Significant Volatility Amid Agrochemical Sector Challenges

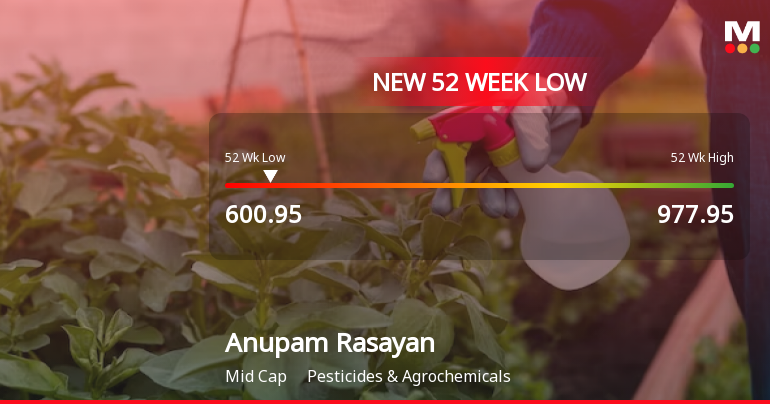

2025-02-28 10:35:44Anupam Rasayan India, a midcap in the Pesticides & Agrochemicals sector, has hit a 52-week low, showing significant volatility and underperformance compared to its sector. The stock has declined notably over the past year, contrasting with the overall market trend, indicating ongoing challenges in the agrochemical industry.

Read MoreAnupam Rasayan Shows Short-Term Momentum Amid Broader Market Volatility

2025-02-20 13:55:18Anupam Rasayan India Ltd, a midcap player in the Pesticides & Agrochemicals industry, has shown significant activity today, opening with a notable gain of 5.8%. The stock's performance has outpaced its sector by 3.41%, reflecting a positive trend amid broader market conditions. Over the past two days, Anupam Rasayan has recorded a cumulative return of 3.36%, indicating a short-term upward momentum. Today, the stock reached an intraday high of Rs 664.15, marking a 5.8% increase from its previous close. However, it is important to note that Anupam Rasayan is currently trading below its moving averages across various time frames, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. In terms of broader market performance, Anupam Rasayan's one-day performance stands at 2.95%, contrasting with the Sensex, which has seen a decline of 0.24%. Over the past month, the stock has experienced a decline...

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEThe trading window shall remain closed from Tuesday April 01 2025 till the end of 48 hours after the declaration of the Audited Financial Results (Standalone and Consolidated) of the Company for the quarter and year ended March 31 2025.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

10-Mar-2025 | Source : BSEIntimation of Press Release titled Anupam Rasayan signs 106 million dollar (approx. INR 922 crores) LOI with a Leading Korean MNC

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

05-Mar-2025 | Source : BSESchedule of Analysts visit on March 10 2025.

Corporate Actions

No Upcoming Board Meetings

Anupam Rasayan India Ltd has declared 7% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available