Apeejay Surrendra Park Hotels Reports Strong Financial Growth Amid Market Sentiment Shift

2025-03-18 08:25:00Apeejay Surrendra Park Hotels has recently adjusted its evaluation amid positive financial results for Q3 FY24-25, with notable increases in net sales and operating profit. However, a decline in institutional investor participation and challenges in stock performance relative to the BSE 500 index have influenced market sentiment.

Read MoreApeejay Surrendra Park Hotels Faces Bearish Technical Trends Amid Market Struggles

2025-03-17 08:01:40Apeejay Surrendra Park Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 142.60, down from a previous close of 145.45, with a 52-week high of 211.95 and a low of 138.20. Today's trading saw a high of 146.50 and a low of 142.40. The technical summary indicates a bearish sentiment across several metrics. The Moving Averages and MACD on a weekly basis show bearish trends, while the KST is mildly bearish. The Bollinger Bands also reflect a bearish outlook. Interestingly, the On-Balance Volume (OBV) presents a mildly bearish trend on a weekly basis but is bullish on a monthly scale, suggesting mixed signals in trading volume. In terms of performance, Apeejay Surrendra Park Hotels has faced challenges compared to the Sensex. Over the past week, the stock has returned -8....

Read MoreApeejay Surrendra Park Hotels Faces Significant Stock Performance Challenges Amid Market Trends

2025-03-13 18:00:45Apeejay Surrendra Park Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has experienced significant fluctuations in its stock performance recently. With a market capitalization of Rs 3,085.00 crore, the company currently holds a price-to-earnings (P/E) ratio of 40.33, notably lower than the industry average of 69.54. Over the past year, Apeejay Surrendra Park Hotels has seen a decline of 17.26%, contrasting sharply with the Sensex, which has gained 1.47% during the same period. In the short term, the stock has faced challenges, with a 1-day drop of 1.96% and a weekly decline of 8.38%. The monthly performance also reflects a downturn, with a decrease of 14.20%, while the year-to-date performance shows a significant drop of 22.75%. Technical indicators suggest a bearish trend, with the MACD and Bollinger Bands signaling weakness. The stock's performance metrics indicate a challenging ...

Read More

Apeejay Surrendra Park Hotels Reports Strong Growth Amid Declining Investor Interest

2025-03-11 08:22:21Apeejay Surrendra Park Hotels has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25, with significant growth in net sales and operating profit. Despite these achievements, institutional investor participation has declined, and the stock has underperformed compared to the broader market over the past year.

Read More

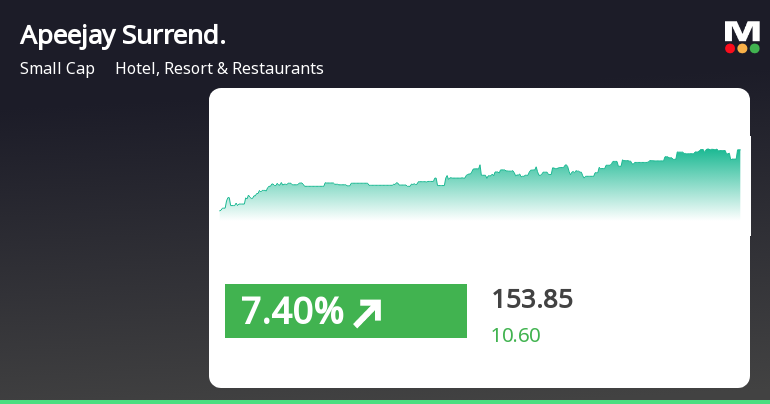

Apeejay Surrendra Park Hotels Shows Strong Short-Term Gains Amid Sector Growth

2025-03-05 16:05:25Apeejay Surrendra Park Hotels has seen a significant rise, outperforming its sector and achieving consecutive gains over two days. The stock opened strongly and reached a notable intraday high. While currently above its 5-day moving average, it remains below several longer-term averages amid broader market gains.

Read MoreApeejay Surrendra Park Hotels Faces Mixed Technical Signals Amid Market Volatility

2025-03-05 08:03:52Apeejay Surrendra Park Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 143.25, showing a slight increase from the previous close of 140.80. Over the past year, the stock has experienced significant volatility, with a 52-week high of 225.55 and a low of 138.20. In terms of technical indicators, the moving averages on a daily basis suggest a mildly bullish sentiment, while other metrics such as MACD and Bollinger Bands indicate a bearish trend on a weekly basis. The On-Balance Volume (OBV) shows a mildly bearish trend weekly but is bullish on a monthly scale, highlighting mixed signals in trading activity. When comparing the stock's performance to the Sensex, Apeejay Surrendra Park Hotels has faced challenges, with returns of -32.37% over the past year, significantly...

Read More

Apeejay Surrendra Park Hotels Reports Growth Amid Declining Institutional Investor Interest

2025-03-03 19:03:34Apeejay Surrendra Park Hotels has recently adjusted its evaluation, reflecting its current market dynamics. The company reported strong third-quarter financial results, with significant growth in net sales and operating profit. However, it faces challenges, including a decline in institutional investor participation and a complex market position.

Read More

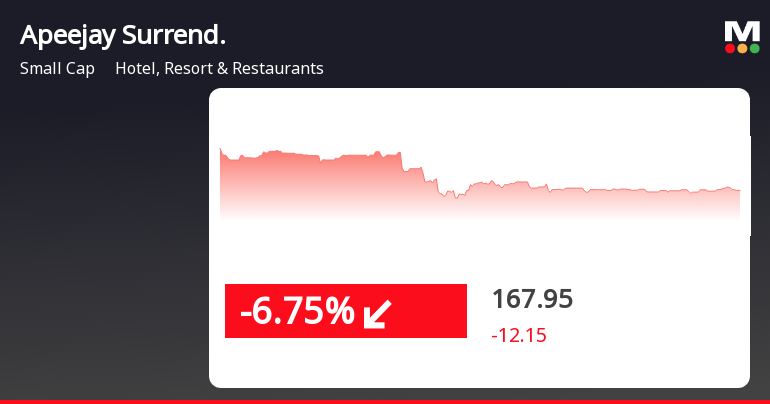

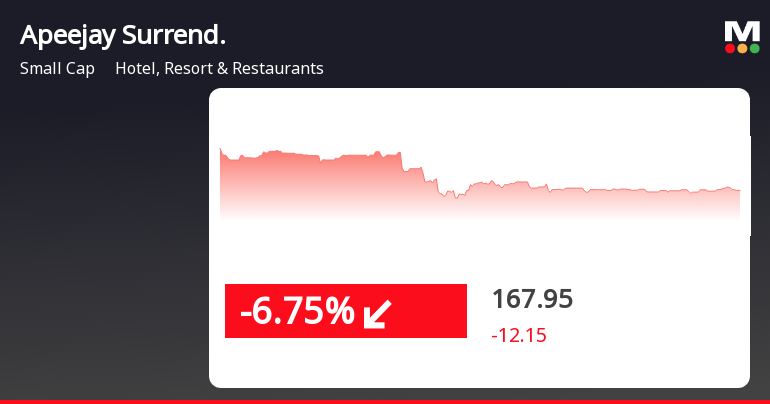

Apeejay Surrendra Park Hotels Faces Sustained Stock Decline Amid Broader Market Stability

2025-02-11 11:20:28Apeejay Surrendra Park Hotels has seen a notable decline in stock performance, dropping 7.63% today and 14.25% over the past two days. The company is trading below multiple moving averages and has underperformed compared to its sector and the broader market, reflecting ongoing challenges.

Read More

Apeejay Surrendra Park Hotels Faces Sustained Stock Decline Amid Broader Market Stability

2025-02-11 11:20:28Apeejay Surrendra Park Hotels has seen a notable decline in stock performance, dropping 7.63% today and 14.25% over the past two days. The company is trading below multiple moving averages and has underperformed compared to its sector and the broader market, reflecting ongoing challenges.

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

05-Apr-2025 | Source : BSEPublication of newspaper advertisement w.r.t. Notice of Postal Ballot by way of remote e-voting

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

04-Apr-2025 | Source : BSENotice of Postal Ballot by way of remote e-voting only

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation regarding closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available