Apollo Hospitals Adjusts Valuation Amid Competitive Healthcare Sector Landscape

2025-04-03 08:00:14Apollo Hospitals Enterprise has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the Hospital & Healthcare Services industry. The company's current price stands at 6,722.10, showing a slight increase from the previous close of 6,629.90. Over the past year, Apollo Hospitals has delivered a return of 4.72%, outperforming the Sensex, which recorded a return of 3.67% in the same period. Key financial metrics for Apollo Hospitals include a PE ratio of 73.78 and an EV to EBITDA ratio of 34.96, indicating its market positioning relative to peers. Notably, while Apollo's PEG ratio is 1.11, other companies in the sector, such as Max Healthcare and Fortis Health, exhibit significantly higher valuations, with PE ratios of 99.78 and 63.17, respectively. In terms of return on capital employed (ROCE) and return on equity (ROE), Apollo Hospitals reported figures of 16.94% a...

Read More

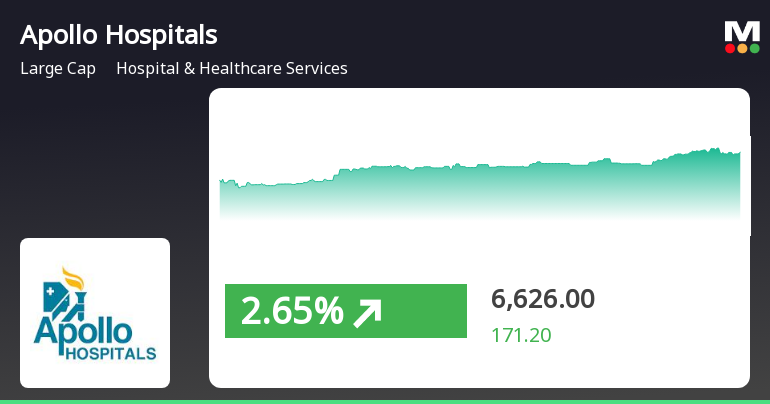

Apollo Hospitals Shows Signs of Recovery Amid Broader Market Gains

2025-03-28 15:00:23Apollo Hospitals Enterprise experienced a notable uptick on March 28, 2025, reversing a two-day decline and reaching an intraday high. The stock has outperformed its sector today and has shown mixed trends in moving averages. Over the past month, it has outperformed the Sensex, despite a negative year-to-date performance.

Read MoreSurge in Open Interest Signals Increased Trading Activity for Apollo Hospitals Enterprise Ltd.

2025-03-28 15:00:16Apollo Hospitals Enterprise Ltd. has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 23,074 contracts, up from the previous 20,799, marking a change of 2,275 contracts or a 10.94% increase. The trading volume for the day reached 16,411 contracts, contributing to a total futures value of approximately Rs 21,612.07 lakhs. In terms of price performance, Apollo Hospitals has shown resilience, gaining 2.15% today, which is in line with the sector's 2.01% return. This uptick comes after two consecutive days of decline, indicating a potential trend reversal. The stock's current price is above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Investor participation has also risen, with a delivery volume of 514,000 shares on March 27, reflecting a substantial ...

Read MoreApollo Hospitals Adjusts Valuation Grade, Highlighting Competitive Position in Healthcare Sector

2025-03-28 08:00:15Apollo Hospitals Enterprise has recently undergone a valuation adjustment, reflecting its current standing in the Hospital & Healthcare Services industry. The company boasts a price-to-earnings (PE) ratio of 70.84 and an EV to EBITDA ratio of 33.63, indicating a robust market position. Additionally, Apollo's return on capital employed (ROCE) stands at 16.94%, while its return on equity (ROE) is recorded at 15.77%. In comparison to its peers, Apollo Hospitals presents a more favorable valuation profile. For instance, Max Healthcare has a significantly higher PE ratio of 102.95, while Fortis Health and Narayana Hrudaya also exhibit elevated valuations. This positions Apollo as a competitive player within the sector, particularly when considering its PEG ratio of 1.07, which suggests a balanced growth perspective relative to its earnings. Despite a recent decline in stock price, with a current price of 6454...

Read MoreApollo Hospitals Faces Mixed Performance Amid High Volatility and Competitive Landscape

2025-03-27 09:25:24Apollo Hospitals Enterprise Ltd., a prominent player in the Hospital & Healthcare Services sector, has experienced notable activity today. The stock is currently aligned with sector performance, although it has faced a consecutive decline over the past two days, resulting in a decrease of 2.19%. Intraday volatility has been significant, with a recorded volatility of 76.12%, indicating fluctuating trading conditions. In terms of moving averages, the stock is positioned higher than its 20-day moving average but falls below the 5-day, 50-day, 100-day, and 200-day moving averages. This suggests a mixed short-term performance relative to longer-term trends. With a market capitalization of Rs 93,476.56 crore, Apollo Hospitals operates within a competitive landscape, reflected in its P/E ratio of 71.67, which is notably higher than the industry average of 53.68. Over the past year, Apollo Hospitals has deliver...

Read MoreApollo Hospitals Shows Strong Short-Term Gains Amid High Volatility and Mixed Long-Term Performance

2025-03-26 09:25:29Apollo Hospitals Enterprise Ltd., a prominent player in the Hospital & Healthcare Services sector, has shown notable activity today, outperforming its sector by 0.51%. The stock has been on a positive trajectory, gaining for the last two days with a total return of 0.8% during this period. However, it has experienced high volatility, with an intraday volatility rate of 274.13%, indicating significant price fluctuations. Currently, Apollo Hospitals has a market capitalization of Rs 95,618.23 crore, categorizing it as a large-cap stock. The company's price-to-earnings (P/E) ratio stands at 72.91, notably higher than the industry average of 54.80. In terms of moving averages, the stock is trading above its 5-day, 20-day, and 50-day moving averages, yet remains below its 100-day and 200-day moving averages. Over the past year, Apollo Hospitals has delivered a performance of 5.20%, while the broader Sensex ha...

Read MoreApollo Hospitals Shows Mixed Performance Amidst Sector Trends and Premium Valuation

2025-03-25 09:20:28Apollo Hospitals Enterprise Ltd., a prominent player in the Hospital & Healthcare Services sector, has shown notable activity today, underperforming the sector by 0.4%. The stock opened at Rs 6,625.6 and has maintained this price throughout the trading session. In terms of moving averages, Apollo Hospitals is currently above its 5-day, 20-day, and 50-day averages, yet it remains below the 100-day and 200-day moving averages, indicating mixed short- to medium-term trends. The company's market capitalization stands at Rs 94,774.22 crore, categorizing it as a large-cap entity. With a price-to-earnings (P/E) ratio of 72.61, Apollo Hospitals is trading at a premium compared to the industry average P/E of 54.69. Over the past year, the stock has gained 3.47%, while the Sensex has risen by 7.54%. In the short term, Apollo Hospitals has seen a 5.38% increase over the past week, outperforming the Sensex's 4.01% ...

Read MoreApollo Hospitals Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-24 15:00:22Apollo Hospitals Enterprise Ltd. has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 38,358 contracts, up from the previous 34,383, marking a change of 3,975 contracts or an 11.56% increase. The trading volume for the day reached 50,059 contracts, contributing to a futures value of approximately Rs 92,846.83 lakhs. In terms of performance, Apollo Hospitals has underperformed its sector by 0.81% today, despite a positive trend over the past six days, during which the stock has gained 8.76%. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Notably, the delivery volume on March 21 was 3.32 lakhs, reflecting a 29.71% increase compared to the 5-day average, indicating rising investor participation. With a market capita...

Read MoreApollo Hospitals Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-24 14:00:15Apollo Hospitals Enterprise Ltd. has experienced a notable increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 38,017 contracts, up from the previous figure of 34,383, marking a change of 3,634 contracts or a 10.57% increase. The trading volume for the day reached 46,150 contracts, contributing to a futures value of approximately Rs 78,942.67 lakhs. In terms of performance, Apollo Hospitals has underperformed its sector by 0.79% today, despite a positive trend over the past six days, during which the stock has gained 8.66%. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Additionally, delivery volume has seen a significant rise, with 3.32 lakh shares delivered on March 21, reflecting a 29.71% increase compared to the 5-day average. With a mar...

Read MoreClosure of Trading Window

24-Mar-2025 | Source : BSEas per annexure enclosed

Disclosure Pursuant To Regulation 30 Of SEBI LODR

21-Mar-2025 | Source : BSEas per annexure enclosed

Disclosure Pursuant To Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 As Amended (Listing Regulations)

14-Mar-2025 | Source : BSEas per annexure enclosed

Corporate Actions

No Upcoming Board Meetings

Apollo Hospitals Enterprise Ltd. has declared 180% dividend, ex-date: 14 Feb 25

Apollo Hospitals Enterprise Ltd. has announced 5:10 stock split, ex-date: 02 Sep 10

No Bonus history available

No Rights history available