Apollo Pipes Shows Resilience with Notable Gains Amid Broader Market Decline

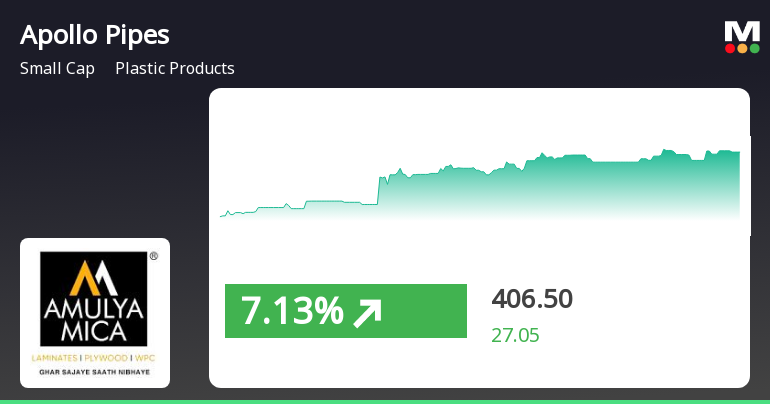

2025-04-01 12:20:23Apollo Pipes has experienced notable trading activity, gaining 7.33% on April 1, 2025, and outperforming its sector amid a broader market decline. The stock has shown a positive short-term trend with a 19.36% increase over the past month, despite a significant year-over-year decline.

Read MoreApollo Pipes Faces Mixed Technical Indicators Amidst Market Volatility and Strong Long-Term Returns

2025-04-01 08:03:05Apollo Pipes, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 379.45, showing a notable increase from the previous close of 362.35. Over the past year, Apollo Pipes has experienced significant volatility, with a 52-week high of 703.00 and a low of 313.05. In terms of technical indicators, the weekly MACD and KST remain bearish, while the monthly RSI indicates a bullish stance. The Bollinger Bands and moving averages suggest a mildly bearish outlook on a weekly basis, with the Dow Theory showing a mildly bullish trend in the short term. These mixed signals highlight the complexities of the stock's performance. When comparing the company's returns to the Sensex, Apollo Pipes has shown a 3.24% return over the past week and an impressive 11.72% return over the last month. However, the ye...

Read MoreApollo Pipes Faces Technical Trend Shifts Amid Market Volatility and Diverging Signals

2025-03-26 08:04:09Apollo Pipes, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 369.35, down from a previous close of 381.60, with a notable 52-week high of 703.00 and a low of 313.05. Today's trading saw a high of 386.35 and a low of 360.00, indicating some volatility. The technical summary for Apollo Pipes reveals a bearish sentiment across several indicators. The MACD shows bearish trends on both weekly and monthly scales, while the moving averages also reflect a bearish stance. The Bollinger Bands indicate a mildly bearish trend on both timeframes, and the KST aligns with the overall bearish outlook. Interestingly, the RSI presents a bullish signal on a monthly basis, suggesting some divergence in short-term versus long-term momentum. In terms of performance, Apollo Pipes has experienced varied re...

Read MoreApollo Pipes Faces Volatility Amid Mixed Technical Signals and Sector Underperformance

2025-03-25 15:35:12Apollo Pipes, a small-cap player in the plastic products industry, has experienced significant volatility today, opening with a loss of 5.66%. This decline marks a trend reversal after five consecutive days of gains. The stock's performance today underperformed the sector by 1.82%, with an intraday low of Rs 360. In terms of moving averages, Apollo Pipes is currently positioned higher than its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day moving averages, indicating mixed signals in its short to medium-term performance. Over the past month, the stock has shown a modest gain of 0.37%, contrasting with the Sensex's 4.58% increase. Technical indicators present a mixed outlook; the MACD shows a mildly bullish trend on a weekly basis but is bearish monthly. The Relative Strength Index (RSI) indicates no signal weekly and bullish monthly. Additionally, the stock's high beta of 1.3...

Read MoreApollo Pipes Shows Mixed Technical Trends Amid Strong Short-Term Performance

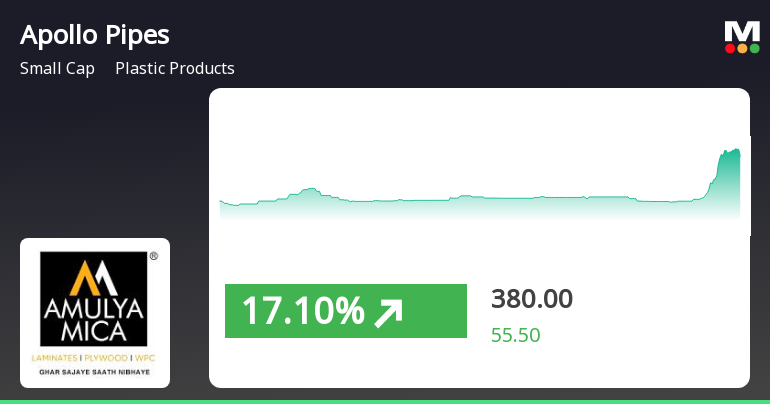

2025-03-25 08:05:12Apollo Pipes, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 381.60, showing a notable increase from the previous close of 367.55. Over the past week, Apollo Pipes has demonstrated a strong performance with a return of 18.42%, significantly outpacing the Sensex's return of 5.14% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook remains bearish. The Relative Strength Index (RSI) indicates no signal on a weekly basis but shows bullish tendencies monthly. Bollinger Bands and moving averages reflect a mildly bearish trend, indicating some caution in the market. Despite a challenging year-to-date return of -17.76%, Apollo Pipes has shown resilience over a five-year period, boasting a remarkable return ...

Read More

Apollo Pipes Faces Significant Volatility Amidst Ongoing Market Challenges

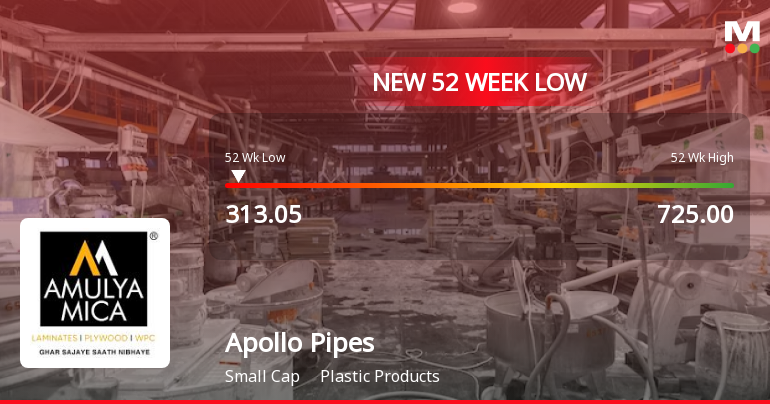

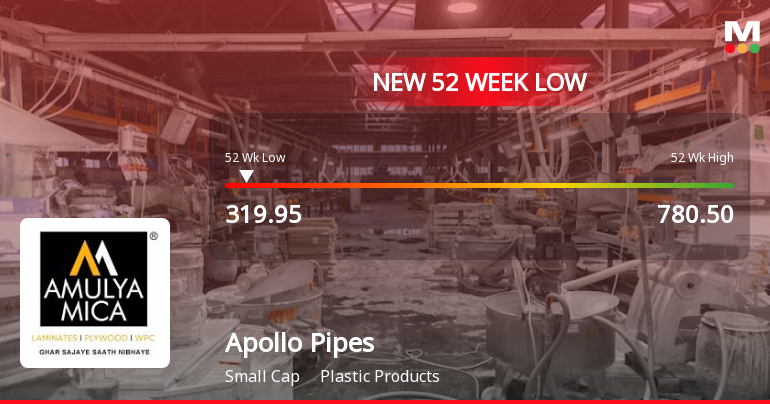

2025-03-03 11:05:36Apollo Pipes, a small-cap company in the plastic products sector, has hit a new 52-week low amid significant volatility, trailing its sector performance. The stock has declined 14.2% over four days and has underperformed considerably over the past year compared to broader market indices.

Read More

Apollo Pipes Shows High Volatility Amidst Broader Market Decline and Sector Outperformance

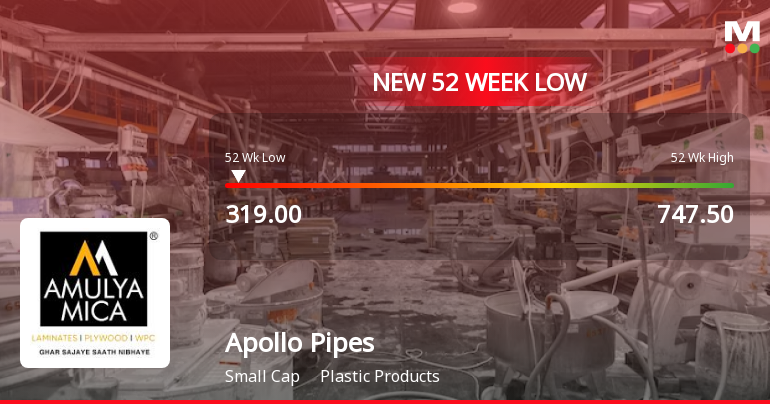

2025-02-24 14:50:21Apollo Pipes has shown notable trading activity, achieving a significant gain while reaching a new 52-week low earlier in the day. The stock exhibited high volatility, with substantial price fluctuations, and its recent performance contrasts with the broader market trends, reflecting its current market position.

Read More

Apollo Pipes Faces Ongoing Challenges Amid Significant Stock Volatility and Decline

2025-02-24 09:36:19Apollo Pipes, a small-cap in the plastic products sector, has hit a new 52-week low, continuing a downward trend with a notable decline over the past year. The stock is trading below its moving averages, reflecting a challenging market position amid significant volatility.

Read More

Apollo Pipes Hits 52-Week Low Amid Broader Market Resilience and Sector Outperformance

2025-02-19 09:37:37Apollo Pipes, a small-cap plastic products company, has reached a new 52-week low, reflecting a significant decline over the past year. Despite this, the stock showed some resilience today, outperforming its sector and experiencing a slight intraday recovery, although it remains below key moving averages.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended on March 31 2025.

Intimation Of Grant Of Options Under Apollo Pipes Limited Employee Stock Option Scheme 2020

29-Mar-2025 | Source : BSEGrant of 51900 ESOP options to eligible employees.

Closure of Trading Window

24-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Apollo Pipes Ltd has declared 10% dividend, ex-date: 17 Sep 24

No Splits history available

Apollo Pipes Ltd has announced 2:1 bonus issue, ex-date: 02 Dec 21

No Rights history available