Aptus Value Housing Finance Adjusts Valuation Amid Competitive Market Landscape

2025-03-24 08:01:10Aptus Value Housing Finance India has recently undergone a valuation adjustment, reflecting its current financial standing within the housing finance sector. The company reports a price-to-earnings (P/E) ratio of 21.54 and a price-to-book value of 3.80, indicating its market valuation relative to its earnings and assets. Additionally, the enterprise value to EBITDA stands at 15.16, while the enterprise value to EBIT is recorded at 15.28. In terms of profitability, Aptus showcases a return on capital employed (ROCE) of 13.35% and a return on equity (ROE) of 16.82%. The company also offers a dividend yield of 1.47%, which may appeal to income-focused investors. When compared to its peers, Aptus Value Housing Finance's valuation metrics position it distinctly within the market. For instance, Aavas Financiers and Home First Finance exhibit higher P/E ratios, while Can Fin Homes presents a more conservative v...

Read More

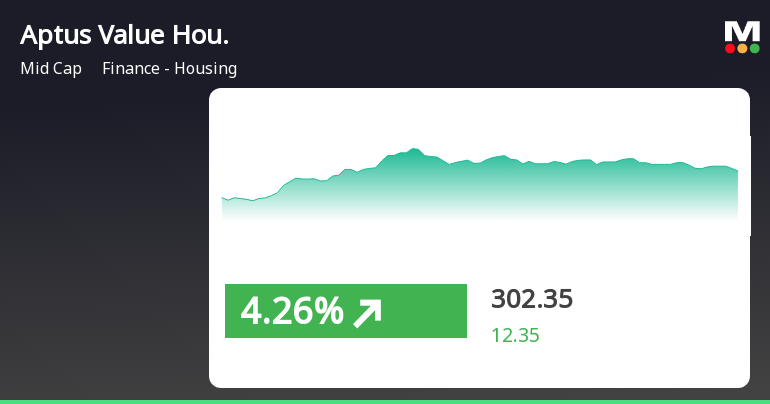

Aptus Value Housing Finance Shows Resilience Amid Broader Market Fluctuations

2025-03-18 09:50:25Aptus Value Housing Finance India experienced a notable performance on March 18, 2025, reversing a three-day decline with a significant intraday high. The stock outperformed its sector, while the broader market showed positive movement, particularly among small-cap stocks, indicating resilience amid fluctuating conditions.

Read MoreAptus Value Housing Finance Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-12 08:00:52Aptus Value Housing Finance India has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the housing finance sector. The company's price-to-earnings ratio stands at 21.57, while its price-to-book value is recorded at 3.81. Additionally, Aptus shows an EV to EBITDA ratio of 15.17 and an EV to EBIT ratio of 15.30, indicating its operational efficiency relative to its enterprise value. The company has a dividend yield of 1.47%, with a return on capital employed (ROCE) of 13.35% and a return on equity (ROE) of 16.82%, showcasing its profitability and effective use of equity. In comparison to its peers, Aptus Value Housing Finance's valuation metrics position it distinctly within the industry. For instance, Aavas Financiers and Home First Finance exhibit higher price-to-earnings ratios, while Can Fin Homes presents a more attractive valuation in terms ...

Read More

Aptus Value Housing Finance Adjusts Evaluation Amid Mixed Financial Performance and Stakeholder Sentiment

2025-03-06 08:11:34Aptus Value Housing Finance India has recently adjusted its evaluation, reflecting its financial standing amid market dynamics. The company has reported positive results for 13 consecutive quarters, with significant net sales and operating profit growth, despite facing challenges in stock performance and a slight decline in promoter confidence.

Read MoreAptus Value Housing Finance Adjusts Valuation Amid Competitive Housing Finance Landscape

2025-03-06 08:01:27Aptus Value Housing Finance India has recently undergone a valuation adjustment, reflecting its current financial standing within the housing finance sector. The company’s price-to-earnings ratio stands at 21.50, while its price-to-book value is recorded at 3.79. Other key metrics include an EV to EBIT ratio of 15.26 and an EV to EBITDA ratio of 15.14, indicating its operational efficiency. In terms of profitability, Aptus showcases a return on capital employed (ROCE) of 13.35% and a return on equity (ROE) of 16.82%. The company also offers a dividend yield of 1.48%, which may appeal to income-focused investors. When compared to its peers, Aptus Value Housing Finance positions itself favorably against companies like Aavas Financiers and Home First Finance, which are currently evaluated at higher valuation levels. Notably, Can Fin Homes presents a more attractive valuation profile with a significantly lowe...

Read MoreAptus Value Housing Finance Faces Mixed Technical Trends Amid Market Challenges

2025-03-05 08:03:36Aptus Value Housing Finance India, a midcap player in the finance and housing sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 303.25, down from a previous close of 312.65, with a 52-week high of 401.70 and a low of 267.75. Today's trading saw a high of 311.25 and a low of 301.50. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no signals for both weekly and monthly evaluations. Bollinger Bands indicate a bearish stance on the weekly chart, contrasting with a sideways trend monthly. Daily moving averages reflect a mildly bearish outlook, while the KST shows a mildly bullish trend weekly and bullish monthly. In terms of returns, Aptus Value Housing F...

Read MoreAptus Value Housing Finance Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-04 08:01:37Aptus Value Housing Finance India, a midcap player in the finance and housing sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 312.65, showing a slight increase from the previous close of 307.45. Over the past year, Aptus has experienced a decline of 8.29%, contrasting with a modest 0.98% drop in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands suggest a bullish outlook weekly, but a sideways trend monthly. Moving averages indicate a mildly bearish stance on a daily basis, while the KST reflects a mildly bullish trend weekly and a bullish trend monthly. In terms of returns, Aptus has outperformed the Sensex over the past week with a retur...

Read More

Aptus Value Housing Finance Reports Profit Growth Amid Valuation Concerns and Stakeholder Shift

2025-02-28 18:34:02Aptus Value Housing Finance India has recently adjusted its evaluation, reflecting its market position and financial metrics. The company reported a 21.5% profit increase for Q3 FY24-25, despite a decline in promoter confidence and underperformance against the BSE 500. Strong long-term fundamentals remain evident.

Read MoreAptus Value Housing Finance Adjusts Valuation Amid Competitive Housing Finance Landscape

2025-02-28 08:00:08Aptus Value Housing Finance India has recently undergone a valuation adjustment, reflecting its current financial standing within the housing finance sector. The company’s price-to-earnings ratio stands at 21.21, while its price-to-book value is recorded at 3.74. Additionally, Aptus shows an EV to EBIT ratio of 15.11 and an EV to EBITDA ratio of 14.99, indicating its operational efficiency in generating earnings relative to its enterprise value. The company has a dividend yield of 1.50% and demonstrates a return on capital employed (ROCE) of 13.35% alongside a return on equity (ROE) of 16.82%. These metrics highlight Aptus's ability to generate returns for its shareholders. In comparison to its peers, Aptus Value Housing Finance India is positioned in a competitive landscape. Aavas Financiers and Sammaan Capital are noted for their higher valuation metrics, while Can Fin Homes presents a more attractive v...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg.74 (5) of SEBI (DP) Regulations2018 for the quarter ended 31st March 2025

Announcement under Regulation 30 (LODR)-Allotment

02-Apr-2025 | Source : BSEAllotment of 15000 Secured Redeemable Rated listed Non-Convertible debentures of Rs.100000 each through Private Placement

Announcement under Regulation 30 (LODR)-Newspaper Publication

27-Mar-2025 | Source : BSENewspaper Advertisement for dispatch of Postal Ballot Notice for Appointment of Mr.Subba Rao as an independent director.

Corporate Actions

No Upcoming Board Meetings

Aptus Value Housing Finance India Ltd has declared 100% dividend, ex-date: 14 Nov 24

No Splits history available

No Bonus history available

No Rights history available