Aries Agro Ltd Experiences Strong Buying Activity Amidst Market Outperformance

2025-03-06 12:05:06Aries Agro Ltd, a microcap player in the fertilizers industry, is witnessing significant buying activity, with the stock gaining 4.98% today. This performance notably outpaces the Sensex, which has only increased by 0.27%. Over the past week, Aries Agro has shown a positive trend, rising 3.67%, while the Sensex declined by 0.91%. The stock has been on a consecutive gain streak for the last three days, accumulating a total return of 10.38% during this period. Today's trading saw an intraday high of Rs 254, indicating strong buyer interest. Despite a challenging month where the stock is down 4.51%, it has managed to outperform the sector by 2.26% today. In terms of moving averages, Aries Agro's current price is above its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages. This mixed performance over different time frames suggests a complex market position. The s...

Read MoreAries Agro Ltd Sees Increased Investor Participation Amid Strong Trading Activity

2025-03-06 11:00:13Aries Agro Ltd, a microcap player in the fertilizers industry, has made headlines today as its stock hit the upper circuit limit, closing at an impressive high price of Rs 252.51. The stock experienced a notable change of Rs 12.02, reflecting a 5.0% increase. Throughout the trading session, Aries Agro reached an intraday high of Rs 251.98, showcasing a robust performance. The total traded volume for the day was approximately 0.04729 lakh shares, resulting in a turnover of Rs 0.117 crore. Despite underperforming its sector by 0.55%, the stock has shown resilience, gaining 6.5% over the past three days. The weighted average price indicates that more volume was traded closer to the low price of Rs 237.00. In terms of moving averages, the stock is currently higher than its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day averages. Additionally, there has been a rise in investor ...

Read MoreAries Agro Adjusts Valuation Amidst Challenging Market Conditions in Fertilizers Sector

2025-03-06 08:00:27Aries Agro, a microcap player in the fertilizers industry, has recently undergone a valuation adjustment. The company's current price stands at 241.95, reflecting a slight increase from the previous close of 232.95. Over the past year, Aries Agro has faced challenges, with a stock return of -20.67%, contrasting sharply with a marginal gain of 0.07% in the Sensex. Key financial metrics for Aries Agro include a PE ratio of 9.80 and an EV to EBITDA ratio of 4.68, indicating a competitive position within its sector. The company also boasts a robust return on capital employed (ROCE) of 19.53% and a return on equity (ROE) of 10.08%. In comparison to its peers, Aries Agro's valuation metrics reveal a diverse landscape. For instance, Zuari Agro Chem. holds a more favorable PE ratio of 3.47, while other competitors like Khaitan Chemical and Bharat Agri Fert are categorized as risky due to their financial performa...

Read MoreAries Agro Ltd Hits Upper Circuit Limit Amid Mixed Long-Term Performance Indicators

2025-03-05 13:00:27Aries Agro Ltd, a microcap player in the fertilizers industry, has shown significant activity today, hitting its upper circuit limit with an impressive intraday high of Rs 240.49, reflecting a 5% increase. The stock's last traded price stands at Rs 239.25, marking a notable change of 10.21. The trading session opened with a gap up of 2.16%, and the stock has been on a positive trajectory, gaining 4.61% over the last two days. Despite this upward movement, Aries Agro is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a mixed performance in the context of longer-term trends. Today's trading volume reached approximately 0.07636 lakh shares, with a turnover of Rs 0.1814 crore. The stock's performance aligns with the broader sector, which has seen a gain of 3.9%. However, there has been a decline in investor participation, with delivery volume dropping by 37...

Read More

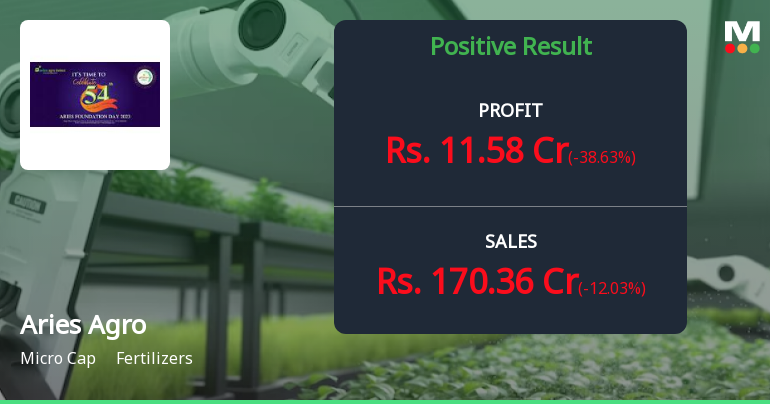

Aries Agro Reports Strong Sales Growth Amid Long-Term Growth Concerns and Market Challenges

2025-02-25 18:23:09Aries Agro, a microcap in the fertilizers sector, reported a 21% increase in net sales for Q3 FY24-25, reaching Rs 499.42 crore. The company shows strong financial health with a low debt-to-EBITDA ratio and increased institutional investor interest, despite facing challenges in long-term growth and market performance.

Read More

Aries Agro Reports Strong Financial Growth Amid Rising Interest Costs in December 2024

2025-02-14 09:55:24Aries Agro has announced its financial results for the quarter ending December 2024, showcasing significant growth in profit metrics and a peak inventory turnover ratio. Net sales for the nine-month period reached Rs 499.42 crore, while cash reserves improved, despite challenges from rising interest costs.

Read More

Aries Agro Reports Significant Profit Growth Amidst Mixed Long-Term Outlook

2025-02-12 18:46:50Aries Agro, a microcap fertilizer company, recently reported a significant increase in net profit and operating cash flow for Q2 FY24-25. The company demonstrated strong operational efficiency with a notable return on capital employed. Institutional investor interest has also risen, reflecting a positive market sentiment despite some long-term growth challenges.

Read More

Aries Agro Reports 162% Net Profit Growth Amid Mixed Financial Indicators

2025-02-06 18:44:19Aries Agro, a microcap in the fertilizers sector, recently adjusted its evaluation following a significant net profit growth of 162.01% for the quarter ending September 2024. Despite strong quarterly results and increased institutional investment, concerns remain regarding debt servicing and overall profitability, reflecting a complex financial landscape.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate Pursuant to Regulation 74(5) of SEBI (DP) Regulation 2018 as on 31.03.2025

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

26-Mar-2025 | Source : BSEMinutes of the Postal Ballot

Shareholder Meeting / Postal Ballot-Scrutinizers Report

25-Mar-2025 | Source : BSEPostal Ballot Results and the Scrutinizers Report.

Corporate Actions

No Upcoming Board Meetings

Aries Agro Ltd has declared 10% dividend, ex-date: 13 Sep 24

No Splits history available

No Bonus history available

No Rights history available