Asahi India Glass Shows Signs of Recovery Amid Broader Market Gains

2025-03-18 13:45:27Asahi India Glass experienced notable activity on March 18, 2025, reversing a three-day decline with a significant intraday gain. Despite this, the stock remains below key moving averages and has seen slight declines over the past week and month, though it has outperformed the Sensex over the past year.

Read MoreAsahi India Glass Opens Strong with 8.38% Gain, Signaling Potential Trend Reversal

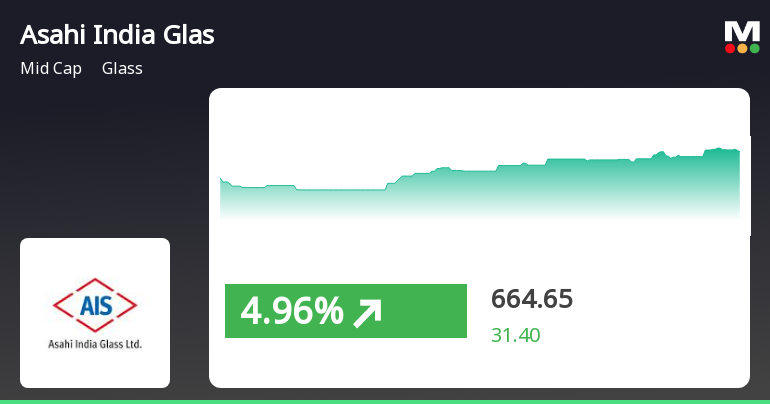

2025-03-18 09:50:19Asahi India Glass, a midcap player in the glass industry, has shown significant activity today, opening with a notable gain of 8.38%. This uptick comes after three consecutive days of decline, marking a potential trend reversal. The stock reached an intraday high of Rs 624.9, reflecting a strong performance that outpaced its sector by 0.55%. Despite today's gains, Asahi India Glass has been characterized by high volatility, with an intraday fluctuation of 6.1%. In terms of moving averages, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating a bearish trend in the short to medium term. Over the past month, Asahi India Glass has experienced a decline of 10.85%, contrasting with a smaller drop of 1.57% in the Sensex. Technical indicators suggest a bearish outlook on a weekly basis, while the monthly perspective shows a mildly bearish trend. With a beta ...

Read MoreAsahi India Glass Faces Technical Trend Adjustments Amid Mixed Market Signals

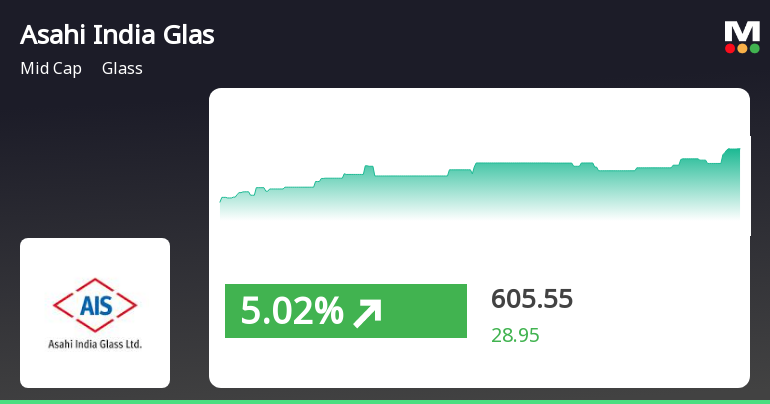

2025-03-11 08:04:26Asahi India Glass, a midcap player in the glass industry, has recently undergone a technical trend adjustment. The company's current price stands at 605.50, reflecting a decline from the previous close of 629.20. Over the past year, Asahi India Glass has shown a return of 16.26%, significantly outperforming the Sensex, which remained nearly flat at -0.01%. In terms of technical indicators, the weekly MACD and Bollinger Bands are currently bearish, while the monthly MACD shows a mildly bearish stance. The daily moving averages also indicate a bearish trend. Notably, the KST presents a mixed picture with a bearish weekly outlook but a bullish monthly perspective. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, suggesting a lack of momentum in either direction. When comparing the stock's performance to the Sensex, Asahi India Glass has experienced a challenging month w...

Read More

Asahi India Glass Outperforms Sector Amid Positive Industry Sentiment and Mixed Market Trends

2025-03-07 12:45:55Asahi India Glass has experienced notable gains, outperforming its sector and achieving a total return of 11.02% over three days. The stock is currently above its short-term moving averages but below longer-term ones. Over the past year, it has significantly outperformed the broader market, showcasing strong growth.

Read MoreAsahi India Glass Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:03:11Asahi India Glass, a midcap player in the glass industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 633.25, showing a notable increase from the previous close of 614.00. Over the past year, Asahi India Glass has demonstrated a return of 21.74%, significantly outperforming the Sensex, which recorded a mere 0.34% return in the same period. The technical summary indicates a mixed outlook, with various indicators reflecting different trends. The MACD shows bearish signals on a weekly basis while leaning mildly bearish on a monthly scale. The Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish stance monthly. Additionally, the moving averages indicate bearish conditions daily, while the KST presents a bullish trend monthly. In terms of stock performance, Asahi India Glass has faced challenges in the short...

Read MoreAsahi India Glass Faces Stock Volatility Amid Broader Market Trends and Technical Signals

2025-03-03 10:28:41Asahi India Glass, a mid-cap player in the glass industry, has seen significant fluctuations in its stock performance today. The company, with a market capitalization of Rs 14,658.32 crore, currently has a price-to-earnings (P/E) ratio of 45.72, which is slightly below the industry average of 47.89. Over the past year, Asahi India Glass has outperformed the Sensex, delivering a return of 12.89% compared to the Sensex's decline of 1.19%. However, recent trends indicate a downturn, with the stock experiencing a 2.58% drop today, while the Sensex fell by 0.37%. In the past week, the stock has decreased by 11.88%, significantly underperforming the Sensex's 2.05% decline. Looking at longer-term performance, Asahi India Glass has shown resilience, with a 35.25% increase over three years and an impressive 148.76% rise over five years. Despite these gains, the year-to-date performance reflects a decline of 20.93%...

Read MoreAsahi India Glass Faces Technical Trend Shifts Amid Bearish Market Indicators

2025-03-03 08:00:34Asahi India Glass, a midcap player in the glass industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 618.95, down from the previous close of 655.00, with a 52-week high of 833.00 and a low of 502.20. Today's trading saw a high of 650.90 and a low of 608.40. The technical summary indicates a bearish sentiment across various metrics. The MACD shows bearish trends on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect bearish conditions for both weekly and monthly assessments. Moving averages on a daily basis align with this bearish sentiment, and the KST presents a mixed picture with a bearish weekly trend but a bullish monthly outlook. The Dow Theory indicates a mildly bearish weekly trend with no discernible monthly trend. In terms of performance, Asahi India Glass has experienced a notable ...

Read MoreAsahi India Glass Experiences Technical Trend Shift Amidst Strong Long-Term Performance

2025-03-02 08:00:34Asahi India Glass, a midcap player in the glass industry, has recently undergone a technical trend adjustment. The company's current price stands at 618.95, reflecting a notable shift from its previous close of 655.00. Over the past year, Asahi India Glass has experienced a 15.46% return, significantly outperforming the Sensex, which recorded a return of 1.24% in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands are currently bearish, while the monthly MACD shows a mildly bearish trend. The daily moving averages also indicate a bearish sentiment. The KST presents a mixed picture, with a bearish weekly trend contrasted by a bullish monthly outlook. The On-Balance Volume (OBV) shows a mildly bullish weekly trend, but no clear signal on the monthly scale. When comparing the company's performance to the Sensex, Asahi India Glass has demonstrated resilience over longer peri...

Read MoreAsahi India Glass Faces Technical Trend Shifts Amid Bearish Indicators

2025-03-01 08:00:33Asahi India Glass, a midcap player in the glass industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 618.95, down from a previous close of 655.00, with a notable 52-week high of 833.00 and a low of 502.20. The technical summary indicates a bearish sentiment across various metrics. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect bearish conditions for both weekly and monthly assessments. Daily moving averages align with this trend, indicating a bearish stance. The KST presents a mixed picture, being bearish weekly but bullish monthly, while the Dow Theory suggests a mildly bearish trend on a weekly basis with no clear direction monthly. In terms of performance, Asahi India Glass has experienced a decline in stock return over the year-to-date p...

Read MoreDisclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

02-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on April 02 2025 for Sanjay Labroo

Announcement under Regulation 30 (LODR)-Cessation

31-Mar-2025 | Source : BSEMs. Shradha Suri has completed her second term of five years as an Independent Director and consequently ceased to be a Director of the Company w.e.f. the closure of business hours on 31st March 2025

Announcement under Regulation 30 (LODR)-Resignation of Director

31-Mar-2025 | Source : BSEDr. Satoshi Ishizuka Non-Executive Director of the Company has vide his letter dated 22nd March 2025 tendered his resignation from the Board w.e.f. closure of business hours of 31st March 2025 due to his permanent return to Japan.

Corporate Actions

No Upcoming Board Meetings

Asahi India Glass Ltd has declared 200% dividend, ex-date: 28 Aug 24

No Splits history available

No Bonus history available

Asahi India Glass Ltd has announced 13:25 rights issue, ex-date: 26 Jul 13