Ashima Ltd's Stock Surge Reflects Strong Market Position Amid Active Trading Dynamics

2025-04-02 10:00:38Ashima Ltd, a microcap player in the textile industry, has made headlines today as its stock hit the upper circuit limit, closing at a high price of Rs 18.89. This marks a significant increase of Rs 1.71, translating to a 9.95% change for the day. The stock has shown strong performance, outperforming its sector by 1.01% and achieving a remarkable 10.83% return over the last two days. During today's trading session, Ashima recorded a total traded volume of 2.1022 lakh shares, resulting in a turnover of approximately Rs 0.39 crore. The stock's price fluctuated between a low of Rs 17.95 and the day's high of Rs 18.89, reflecting robust trading activity. In terms of moving averages, Ashima's stock is currently above its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day averages. Notably, investor participation has seen a decline, with delivery volume dropping by 60.05% compared t...

Read MoreAshima Ltd Sees Surge in Trading Activity Amidst Broader Market Challenges

2025-04-01 11:00:20Ashima Ltd, a microcap player in the textile industry, has experienced significant trading activity today, hitting its upper circuit limit with a notable intraday high of Rs 18.89, reflecting a 9.95% increase. The stock's last traded price also stands at Rs 18.89, marking a change of Rs 1.71. The trading session opened with a gap up of 4.71%, indicating a strong start for the stock after four consecutive days of decline. Total traded volume reached approximately 1.88 lakh shares, contributing to a turnover of Rs 0.35 crore. Notably, the stock has outperformed its sector by 10.15%, contrasting with the sector's 1D return of -1.34% and the Sensex's decline of 1.16%. Despite trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, Ashima has seen a rise in investor participation, with delivery volume increasing by 74.68% compared to the 5-day average. This uptick in activity suggests a...

Read MoreAshima Ltd Sees Notable Buying Surge Amid Broader Market Decline

2025-04-01 10:15:20Ashima Ltd, a microcap player in the textile industry, is witnessing significant buying activity today, with a notable increase of 4.52%. This performance stands in stark contrast to the Sensex, which has declined by 0.70%. Despite this positive movement, Ashima's performance over the past week shows a decrease of 5.63%, while the Sensex has gained 0.20%. Over the past month, Ashima has experienced a decline of 2.82%, compared to a 5.28% increase in the Sensex. The stock's longer-term performance reveals a challenging trend, with a 41.69% drop over the last three months, although it has shown a modest gain of 5.16% over the past year, slightly outperforming the Sensex's 4.63% increase. Today's trading session opened with a gap up, indicating strong buyer interest, and the intraday high reflects this momentum. However, Ashima is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day movin...

Read More

Ashima Faces Operational Challenges Amid Shifting Technical Indicators and Declining Sales

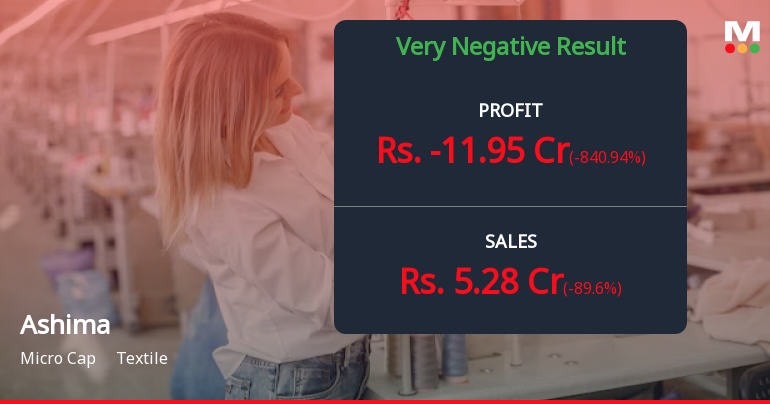

2025-03-27 08:07:29Ashima, a microcap textile company, has experienced a recent evaluation adjustment reflecting a cautious market outlook. Key technical indicators suggest bearish trends, while the company faces challenges with declining net sales and low profitability metrics. Despite these issues, Ashima shows resilience with significant long-term operating profit growth.

Read More

Ashima Faces Financial Challenges Amid Significant Sales Decline and Technical Adjustments

2025-03-25 08:15:09Ashima, a microcap textile company, has recently adjusted its evaluation due to changes in financial metrics and market position. The company reported a significant decline in net sales and profit after tax, while maintaining a low debt-to-equity ratio. Despite challenges, it has shown healthy long-term growth in operating profit.

Read MoreAshima Ltd Experiences Significant Trading Activity Amidst Strong Market Engagement

2025-03-19 14:00:36Ashima Ltd, a microcap player in the textile industry, has made headlines today by hitting its upper circuit limit. The stock reached an intraday high of Rs 20.47, reflecting a notable increase of 9.99% from the previous close. This surge comes as the company has outperformed its sector by 8.48%, showcasing strong momentum in the market. Throughout the trading session, Ashima Ltd exhibited high volatility, with an intraday range of Rs 2.17 and a calculated volatility of 5.18%. The total traded volume reached approximately 4.59 lakh shares, resulting in a turnover of around Rs 0.90 crore. Notably, the stock has been on a positive trajectory, gaining 13.16% over the last two days. Despite the fluctuations, Ashima Ltd's performance today indicates a robust interest among investors, with delivery volume increasing by 8.42% compared to the five-day average. The stock's liquidity remains favorable, allowing for...

Read MoreAshima Ltd Experiences Notable Price Surge Amid Increased Buying Activity

2025-03-19 13:40:37Ashima Ltd, a microcap player in the textile industry, is witnessing significant buying activity, with the stock rising 8.69% today, notably outperforming the Sensex, which gained only 0.27%. Over the past week, Ashima has recorded an 8.00% increase, while the Sensex rose by 1.99%. This marks the second consecutive day of gains for Ashima, accumulating a total return of 13.87% during this period. Despite a challenging month where the stock declined by 11.86%, today's performance indicates a potential shift in market sentiment. The stock opened with a gap down of 4.13% but quickly rebounded, reaching an intraday high of Rs 20.52. The day's low was Rs 18.1, reflecting high volatility with an intraday fluctuation of 6.1%. In terms of moving averages, Ashima's current price is above its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages. This performance suggests a...

Read MoreAshima Adjusts Valuation Grade Amidst Competitive Textile Industry Landscape

2025-03-10 08:00:18Ashima, a microcap player in the textile industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (P/E) ratio of 4.28 and an enterprise value to EBITDA ratio of 6.94, indicating its financial metrics are positioned within a competitive range compared to its peers. Notably, Ashima's return on capital employed (ROCE) stands at 20.54%, while its return on equity (ROE) is reported at 34.46%, reflecting a solid performance in generating returns relative to its equity base. In comparison to its industry counterparts, Ashima's valuation metrics present a varied landscape. For instance, Indo Rama Synthetic is classified as expensive, while Mafatlal Industries and Ambika Cotton are noted for their attractive valuations. Other peers like GHCL Textiles and Faze Three maintain fair valuations, showcasing a diverse range of financial health and market positioning withi...

Read More

Ashima Reports December 2024 Results, Signaling Financial Challenges Ahead

2025-02-13 16:12:42Ashima, a microcap textile company, reported its financial results for the quarter ending December 2024, revealing a decline in Profit Before Tax and a negative Profit After Tax. The company faces challenges with rising debt and interest expenses, indicating potential liquidity issues and a need for strategic financial management.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018

Sale Of Land - Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015.

29-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI(LODR) Regulations 2015 for Sale of Land.

Closure of Trading Window

25-Mar-2025 | Source : BSEPursuant to SEBI (Prohibition of Insider Trading) Regulations 2015 as amended we would like to inform you that the trading window for dealing in the securities of the company shall remain closed for all insiders including Designated Persons Connected persons and their immediate relatives covered under the code of conduct of the company adopted under SEBI (Prohibition of Insider Trading) Regulations 2015 as amended from 1st April 2025 till completion of 48 hours after the declaration of Audited Financial Results for the quarter and year ended on 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Ashima Ltd has announced 24:10 rights issue, ex-date: 30 Oct 15