Ashoka Buildcon's Technical Indicators Signal Mixed Market Sentiment Amid Fluctuating Performance

2025-04-01 08:00:18Ashoka Buildcon, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 192.60, down from a previous close of 200.80, with a notable 52-week range between 148.00 and 319.00. Today's trading saw a high of 203.95 and a low of 191.00. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a clear direction monthly. Bollinger Bands and KST also reflect a mildly bearish stance in both weekly and monthly assessments. In terms of performance, Ashoka Buildcon's stock return over the past year stands at 22.95%, significantly outperforming the Sensex's 5.11% return. Over a three-year period, the stock has deliver...

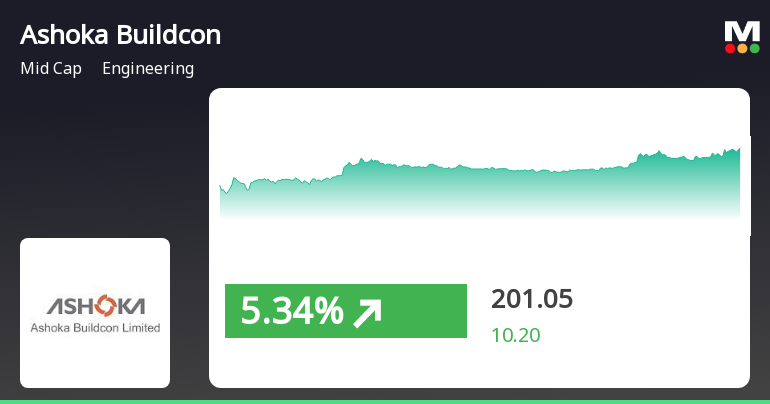

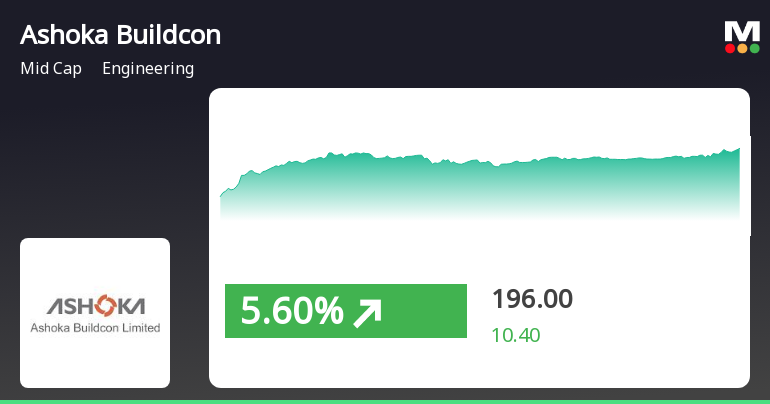

Read MoreAshoka Buildcon Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-28 08:00:13Ashoka Buildcon, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 200.80, showing a notable increase from the previous close of 190.85. Over the past year, Ashoka Buildcon has demonstrated a stock return of 25.89%, significantly outperforming the Sensex, which returned 6.32% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, but shows no signal for the monthly period. Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages indicate a bearish trend on a daily basis, while the KST reflects a bearish position weekly and mildly bearish monthly. The company's performance over...

Read More

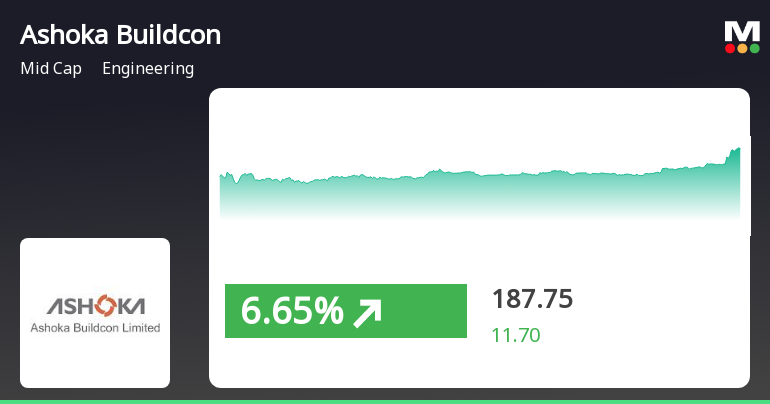

Ashoka Buildcon Shows Strong Performance Reversal Amidst Broader Market Trends

2025-03-27 14:15:16Ashoka Buildcon, a midcap engineering firm, experienced a notable rise in stock performance, reversing a two-day decline. The stock is currently above its short-term moving averages and has outperformed the Sensex over various timeframes, despite a year-to-date decline. Long-term returns remain significantly positive compared to the index.

Read MoreAshoka Buildcon Experiences Technical Trend Shift Amid Mixed Performance Indicators

2025-03-26 08:00:21Ashoka Buildcon, a midcap player in the engineering sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 194.25, reflecting a decline from the previous close of 201.35. Over the past year, Ashoka Buildcon has shown a return of 18.52%, outperforming the Sensex, which recorded a return of 7.12% in the same period. However, year-to-date performance indicates a significant drop of 37.60%, contrasting with the Sensex's slight decline of 0.16%. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates bullish momentum weekly but lacks a clear signal monthly. Bollinger Bands reflect a mildly bearish trend weekly and sideways monthly. Moving averages indicate a bearish stance on a daily basis, and the KST is bearish weekly with a mildly bearish o...

Read MoreAshoka Buildcon Experiences Mixed Technical Trends Amid Active Market Participation

2025-03-25 08:00:28Ashoka Buildcon, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 201.35, has shown notable fluctuations, with a 52-week high of 319.00 and a low of 148.00. Today's trading saw a high of 201.95 and a low of 194.00, indicating active market participation. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows bullish momentum weekly, but no significant signal on a monthly scale. Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages reflect a bearish stance daily, while the KST and Dow Theory present a mixed picture with weekly bearish and mildly bullish signals, respectively. When comparing Ashoka Buildcon's performance t...

Read More

Ashoka Buildcon Outperforms Sector Amid Broader Market Rebound and Mixed Performance Signals

2025-03-21 12:30:15Ashoka Buildcon has experienced notable activity, outperforming its sector amid a fluctuating market. The stock's current price is above short-term moving averages but below longer-term ones. While it has shown strong performance over the past week and years, it has faced a decline year-to-date. The broader market is also rebounding.

Read More

Ashoka Buildcon Shows Resilience Amid Mixed Short- and Long-Term Trends

2025-03-19 15:00:17Ashoka Buildcon Ltd. has shown notable activity, gaining 6.48% on March 19, 2025, and outperforming its sector. The stock reached an intraday high of Rs 184.2 and has seen a total return of 9.49% over two days, despite a decline over the past month and year.

Read MoreAshoka Buildcon Faces Technical Trend Shifts Amid Market Volatility and Performance Variability

2025-03-12 08:00:14Ashoka Buildcon, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 178.30, slightly down from its previous close of 178.95. Over the past year, Ashoka Buildcon has shown a return of 8.45%, outperforming the Sensex, which recorded a modest gain of 0.82% during the same period. However, the year-to-date performance indicates a decline of 42.72%, compared to the Sensex's drop of 5.17%. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling bearish trends, while the monthly indicators show a mildly bearish stance. The daily moving averages also reflect a bearish outlook. Notably, the stock has experienced significant volatility, with a 52-week high of 319.00 and a low of 141.25. Despite the recent challenges, Ashoka Buildcon has demonstrated resilience over longer period...

Read MoreAshoka Buildcon Shows Valuation Disparity Amid Mixed Market Performance Trends

2025-03-11 18:00:10Ashoka Buildcon Ltd., a mid-cap player in the engineering sector, has shown notable activity in the stock market today. With a market capitalization of Rs 4,965.00 crore, the company has a price-to-earnings (P/E) ratio of 3.46, significantly lower than the industry average of 28.86, indicating a potential valuation disparity. Over the past year, Ashoka Buildcon has outperformed the Sensex, delivering an 8.45% return compared to the index's 0.82%. However, recent performance has been mixed, with a decline of 0.36% today, while the Sensex fell by only 0.02%. In the last week, the stock gained 4.61%, contrasting with the Sensex's 1.52% increase. Despite these short-term gains, the stock has faced challenges over longer periods, with a 23% drop in the past month and a significant 42.72% decline year-to-date. In contrast, Ashoka Buildcon has shown resilience over three and five years, with returns of 96.04% an...

Read MoreDisclosure Regarding The Sale Of Shares Held By The Company In Its Wholly Owned Subsidiary

08-Apr-2025 | Source : BSEPursuant to the provisions of Regulations 30 of the SEBI (LODR) Regulations 2015 Ashoka Buildcon Limited (the Company) informs that as part of a strategic restructuring the Company has sold 51% of its shareholding (2550 equity shares) held in Prakashmaan Renewable Energy Private Limited (Prakashmaan) to Sunbreeze Renewables Private Limited (Sunbreeze). The Company informs that the Company has sold 2550 Equity Shares of Rs. 10/- each full paid-up in Prakashmaan for a consideration of Rs. 19800000/-. Subsequent to this transaction the Company will hold 2450 Equity Shares (49%) and Prakashmaan will become an Associate Company.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

31-Mar-2025 | Source : BSEThe Board of Directors had sought the approval of the Shareholders of the Company pursuant to the provisions of Section 10 of the Companies Act 2013 read with Rule 22 of the Companies (Management and Administration) Rules 2014 for the following Resolutions by way of Postal Ballot : 1) Approval for re-appointment of Mr. Mahendra Mehta (DIN : 07745442) as an independent director for 2nd term of 5 consecutive years w.e.f. April 01 2025 ; 2) Approval for divestment of entire stake held by the Company through Ashoka Concessions Limited a subsidiary in Ashoka Ankleshwar Manubar Expressway Private Limited (SPV) a material unlisted subsidiary ;

Intimation Regarding Extension Of Expected Date Of Completion Of Sale/Disposal Of Stake In Subsidiaries Of Ashoka Concessions Limited

31-Mar-2025 | Source : BSEThe Company informs regarding extension of completion date of sale or disposal of stake in subsidiaries of Ashoka Concessions Limited

Corporate Actions

No Upcoming Board Meetings

Ashoka Buildcon Ltd. has declared 16% dividend, ex-date: 27 Mar 18

Ashoka Buildcon Ltd. has announced 5:10 stock split, ex-date: 03 Jul 13

Ashoka Buildcon Ltd. has announced 1:1 bonus issue, ex-date: 12 Jul 18

No Rights history available