Asian Energy Services Faces Technical Trend Shifts Amid Market Volatility

2025-04-02 08:07:12Asian Energy Services, a small-cap player in the oil exploration and refineries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 281.70, showing a notable increase from the previous close of 271.45. Over the past year, the stock has experienced a high of 444.35 and a low of 214.85, indicating significant volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting a cautious market environment. Notably, the KST indicator aligns with the bearish trend on both weekly and monthly scales. When comparing the company's performance to the Sensex, Asian Energy Services has shown resilience in the short term, with a 4.35% return over the past w...

Read MoreAsian Energy Services Opens Strong with 5.5% Gain, Outperforming Sector Trends

2025-03-24 11:20:11Asian Energy Services, a small-cap player in the oil exploration and refinery sector, has shown notable activity today, opening with a gain of 5.5%. The stock has outperformed its sector by 0.66%, reflecting a positive trend in its recent performance. Over the past two days, Asian Energy Services has recorded a cumulative return of 2.33%, indicating a consistent upward movement. Today, the stock reached an intraday high of Rs 303.95, showcasing its volatility. In terms of technical indicators, the stock is currently positioned above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. In comparison to the broader market, Asian Energy Services has performed well, with a 1-day return of 1.94% against the Sensex's 1.14%, and a 1-month return of 6.74% compared to the Sensex's 4.46%. However, technical metrics such as MACD and KST indicate a bearish...

Read More

Asian Energy Services Outperforms Sector Amid Broader Market Gains and Mixed Trends

2025-03-19 12:50:22Asian Energy Services has experienced notable gains, outperforming its industry and marking its second consecutive day of increases. The stock opened higher and reached an intraday peak, currently showing mixed trends in moving averages. In the broader market, the Sensex also opened positively, with mid-cap stocks leading.

Read More

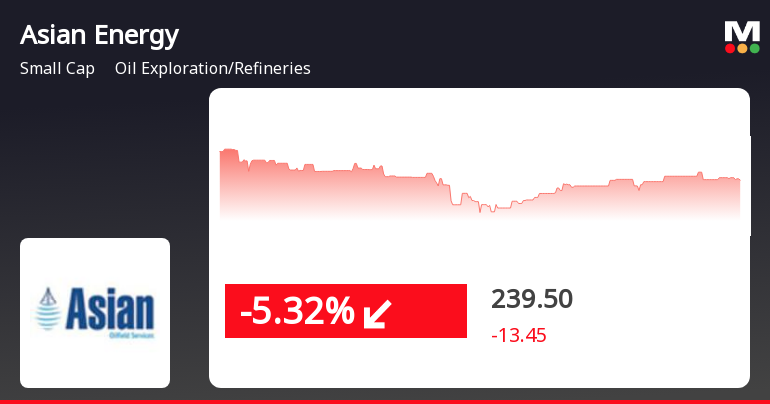

Asian Energy Services Shows Recovery Amid Broader Market Gains and Ongoing Challenges

2025-03-18 10:00:58Asian Energy Services saw a significant rebound on March 18, 2025, after six days of decline, with an intraday high of Rs 235. Despite this uptick, the stock remains below key moving averages. In the broader market, the Sensex and small-cap stocks are performing positively, contrasting with Asian Energy's recent underperformance.

Read More

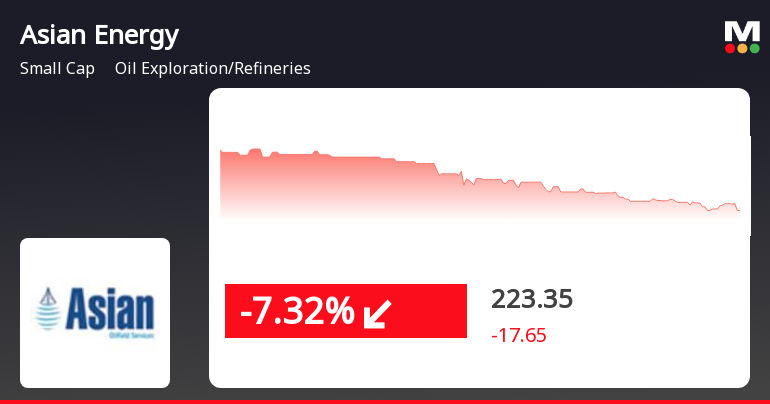

Asian Energy Services Faces Significant Stock Volatility Amidst Declining Performance Trends

2025-03-17 14:09:16Asian Energy Services is facing notable volatility, nearing its 52-week low and underperforming its sector. The stock has declined for six consecutive days, despite a significant profit increase. It maintains a low Debt to Equity ratio and reported positive results over the last six quarters, with substantial growth in net sales.

Read More

Asian Energy Services Faces Continued Decline Amid Broader Market Stability

2025-03-17 12:50:20Asian Energy Services has faced a notable decline, trading near its 52-week low and underperforming its sector over the past week. The stock has dropped for six consecutive days, reflecting a bearish trend as it trades below key moving averages, contrasting with the broader market's slight gains.

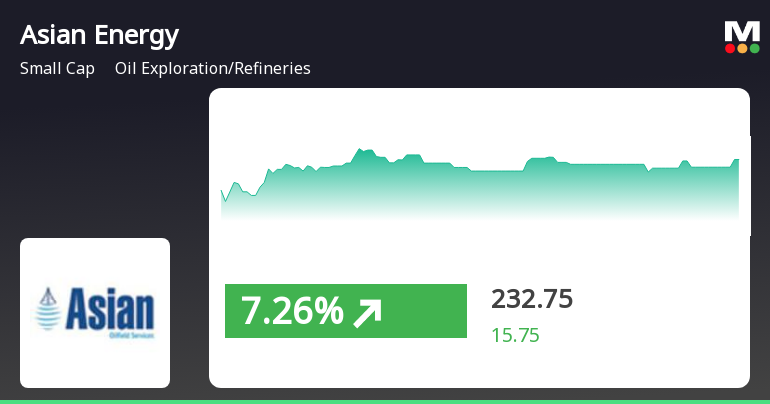

Read MoreAsian Energy Services Experiences Technical Trend Adjustments Amid Market Volatility

2025-03-12 08:02:17Asian Energy Services, a small-cap player in the oil exploration and refinery sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 244.60, down from a previous close of 255.65. Over the past year, the stock has experienced a high of 444.35 and a low of 215.05, indicating significant volatility. In terms of technical indicators, the weekly MACD reflects a bearish sentiment, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows a bullish trend on a weekly basis, but no signal is present for the monthly timeframe. Bollinger Bands indicate bearish conditions for both weekly and monthly assessments. Daily moving averages also suggest a bearish trend, while the KST presents a mixed picture with a bearish weekly and mildly bearish monthly outlook. The On-Balance Volume (OBV) shows no trend weekly but is bullish on a monthly basis. ...

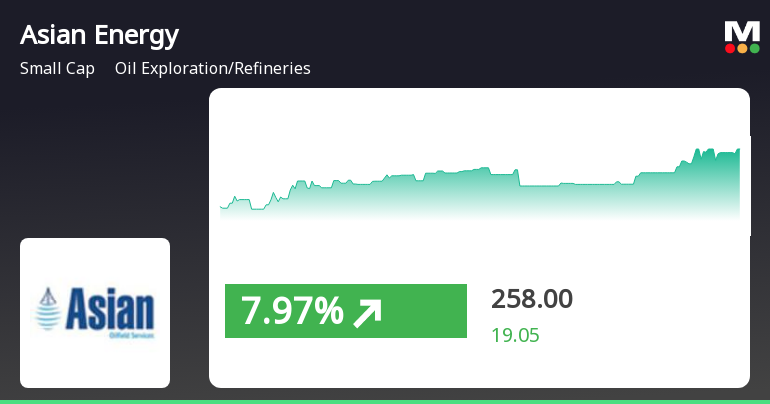

Read MoreAsian Energy Services Faces Mixed Technical Trends Amid Market Volatility

2025-03-06 08:01:58Asian Energy Services, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 258.90, showing a slight increase from the previous close of 251.00. Over the past year, the stock has experienced a high of 444.35 and a low of 215.05, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows bullish momentum on a weekly basis, but no clear signal on a monthly scale. Bollinger Bands and KST indicators also reflect a mildly bearish trend over both weekly and monthly periods. The On-Balance Volume (OBV) presents a mildly bearish stance weekly, contrasting with a bullish monthly perspective. When comparing the company's performance to the Sensex, Asian ...

Read More

Asian Energy Services Faces Sustained Decline Amid Broader Market Challenges

2025-03-03 11:50:28Asian Energy Services has faced notable volatility, with a significant decline today and a total drop over the past four days. The stock is trading below multiple moving averages and has underperformed compared to its sector and the broader market, reflecting ongoing challenges in the current environment.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEIntimation of closure of trading window under SEBI (Prohibition of Insider Trading) Regulations 2015.

Announcement under Regulation 30 (LODR)-Credit Rating

21-Mar-2025 | Source : BSEIntimation under Regulation 30 of the SEBI LODR 2015 regarding credit rating by India Ratings & Research (Ind-Ra)

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

20-Mar-2025 | Source : BSEIntimation under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 (Listing Regulations) about Schedule of Analyst / Institutional Investors meeting.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available