ASK Automotive Experiences Technical Indicator Shifts Amid Mixed Market Performance

2025-03-28 08:04:15ASK Automotive, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 441.55, down from the previous close of 451.50, with a 52-week high of 508.95 and a low of 266.60. Today's trading saw a high of 449.45 and a low of 438.70. The technical summary indicates a mixed performance across various metrics. The Moving Averages suggest a mildly bearish stance, while the Dow Theory presents a mildly bullish outlook on a weekly basis. The MACD is also showing a mildly bearish trend on the weekly chart. Notably, the On-Balance Volume (OBV) remains mildly bullish on a weekly basis, indicating some underlying strength despite the overall bearish sentiment. In terms of performance, ASK Automotive's returns have varied significantly over different periods. Over the past week, the stock has seen a decline of ...

Read MoreASK Automotive Faces Short-Term Challenges Despite Strong Yearly Performance in Auto Ancillary Sector

2025-03-27 18:00:46ASK Automotive, a mid-cap player in the auto ancillary sector, has shown significant activity in the market today. With a market capitalization of Rs 8,759.00 crore, the company has a price-to-earnings (P/E) ratio of 36.61, which is notably higher than the industry average of 31.72. Over the past year, ASK Automotive has outperformed the Sensex, delivering a remarkable 61.03% return compared to the Sensex's 6.32%. However, today's trading session has seen a decline of 2.20% in ASK Automotive's stock price, contrasting with a modest gain of 0.41% in the Sensex. In the short term, the stock has experienced a slight dip of 0.78% over the past week, while it has gained 11.64% in the last month, outperforming the Sensex's 4.01% increase. Despite a challenging three-month period where ASK Automotive's stock fell by 5.63%, the year-to-date performance shows a decline of 6.95%, compared to the Sensex's minor drop...

Read MoreASK Automotive Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-18 08:04:51ASK Automotive, a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 410.00, slightly down from the previous close of 412.00. Over the past year, ASK Automotive has shown a remarkable return of 60.91%, significantly outperforming the Sensex, which recorded a return of just 2.10% in the same period. In terms of technical indicators, the company displays a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and KST show bearish trends on a weekly basis. The On-Balance Volume (OBV) suggests a bullish stance on a monthly scale, indicating potential underlying strength. However, the Dow Theory reflects no clear trend on a weekly basis, with a mildly bearish outlook monthly. Comparatively, ASK Automotive's performance over various time frames highl...

Read MoreASK Automotive Experiences Mixed Technical Signals Amidst Market Volatility

2025-03-11 08:05:47ASK Automotive, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 406.50, down from a previous close of 412.65, with a notable 52-week high of 508.95 and a low of 240.70. Today's trading saw a high of 431.95 and a low of 402.05, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis, while the moving averages indicate a mildly bullish stance on a daily timeframe. The Relative Strength Index (RSI) and On-Balance Volume (OBV) present no clear signals on the weekly level, with the OBV showing bullish tendencies on a monthly basis. Additionally, the Dow Theory reflects a mildly bearish trend over both weekly and monthly periods. In terms of performance, ASK Automotive has shown a strong return over the pa...

Read MoreASK Automotive Ltd Achieves Upper Circuit Limit Amid Strong Market Interest

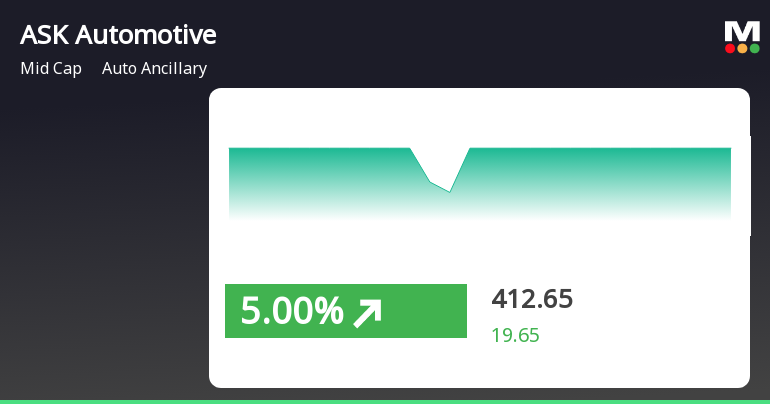

2025-03-07 10:01:23ASK Automotive Ltd, a mid-cap player in the Auto Ancillary industry, has shown remarkable performance today, hitting its upper circuit limit with an intraday high of Rs 413.6. The stock experienced a notable change of Rs 19.65, reflecting a percentage increase of 4.99%. This upward movement comes after a series of gains, with the stock rising 21.52% over the last four days. Today's trading saw a total volume of 1.82221 lakh shares, resulting in a turnover of approximately Rs 7.53 crore. The stock opened with a gap up, indicating strong market interest, and has outperformed its sector by 4.22%. Despite this positive momentum, the stock's delivery volume has seen a significant decline, falling by 84.45% compared to the five-day average. In terms of moving averages, ASK Automotive's current price is above the 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Over...

Read MoreASK Automotive Ltd Experiences Significant Buying Surge Amid Broader Market Decline

2025-03-07 09:35:41ASK Automotive Ltd is witnessing significant buying activity, with the stock rising by 5.00% today, contrasting sharply with the Sensex, which has declined by 0.19%. Over the past week, ASK Automotive has shown a robust performance, gaining 12.92%, while the Sensex managed only a 1.37% increase. Notably, the stock has been on a positive trajectory for the last four days, accumulating a total return of 21.53% during this period. The stock opened with a gap up of 5% today and reached an intraday high of Rs 412.65. In terms of moving averages, ASK Automotive is currently above its 5-day and 20-day averages, indicating short-term strength, although it remains below the 50-day, 100-day, and 200-day moving averages, suggesting mixed longer-term trends. Despite a decline of 4.91% over the past month and a year-to-date drop of 13.04%, the stock's impressive annual performance of 47.35% stands out, especially when...

Read More

ASK Automotive's Strong Performance Highlights Divergence in Auto Ancillary Sector Trends

2025-03-07 09:30:58ASK Automotive has demonstrated notable performance, achieving a significant gain today and marking its fourth consecutive day of increases. The stock has outperformed its sector and the broader market over various time frames, although it shows mixed trends when compared to longer-term moving averages.

Read MoreASK Automotive Ltd Hits Upper Circuit Limit Amid Strong Buying Interest and Market Resilience

2025-03-06 10:01:03ASK Automotive Ltd, a mid-cap player in the Auto Ancillary sector, has shown remarkable performance today, hitting its upper circuit limit with an intraday high of Rs 393.95. The stock experienced a notable change of Rs 18.75, reflecting a 5% increase from the previous trading session. This upward movement comes as the stock has outperformed its sector by 3.48%, marking a positive trend over the last three days with a cumulative gain of 15.75%. The stock opened with a gap up at Rs 393.95 and maintained this price throughout the trading session, indicating strong buying interest. Despite a total traded volume of approximately 0.07991 lakh shares and a turnover of Rs 0.3148 crore, there has been a decline in delivery volume, which fell by 76.47% compared to the five-day average. In terms of moving averages, ASK Automotive's current price is above the 5-day moving average but below the longer-term averages o...

Read MoreASK Automotive Ltd Experiences Strong Buying Activity with 5% Daily Gain and 15.74% Total Return

2025-03-06 09:35:51ASK Automotive Ltd is witnessing significant buying activity, with the stock gaining 5.00% today, contrasting sharply with the Sensex, which has seen a slight decline of 0.06%. This marks the third consecutive day of gains for ASK Automotive, accumulating a total return of 15.74% over this period. The stock opened with a notable gap up of 5% at Rs 393 and reached an intraday high of the same price, indicating strong buyer interest at this level. In terms of performance metrics, ASK Automotive has outperformed its sector by 3.24% today. However, its performance over the past month shows a decline of 10.17%, which is more pronounced than the Sensex's drop of 5.60%. Over the past year, ASK Automotive has demonstrated resilience with a 41.34% increase, while the Sensex has remained relatively flat, down 0.54%. The stock's current trading position shows it is above its 5-day moving average but below its longer...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 - Q4 FY25

Announcement under Regulation 30 (LODR)-Change in Management

02-Apr-2025 | Source : BSEResignation of Mr. Shalender Singh Birla Chief Executive Officer - Operations (ALPS & Cable Divison) of the Company

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

31-Mar-2025 | Source : BSEIntimation of schedule of Analyst/ Investor Meeting on April 03 2025

Corporate Actions

No Upcoming Board Meetings

ASK Automotive Ltd has declared 50% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available