Associated Alcohols & Breweries Adjusts Valuation Grade Amid Strong Performance Metrics

2025-04-02 08:02:17Associated Alcohols & Breweries has recently undergone a valuation adjustment, reflecting its strong performance metrics within the breweries and distilleries sector. The company currently boasts a price-to-earnings (P/E) ratio of 37.54 and a price-to-book value of 6.34, indicating a robust market position. Its enterprise value to EBITDA stands at 24.71, while the enterprise value to sales ratio is 2.55, showcasing effective revenue generation relative to its valuation. The company's return on capital employed (ROCE) is reported at 15.58%, and return on equity (ROE) is at 16.88%, both of which highlight its operational efficiency and profitability. Additionally, the PEG ratio of 0.95 suggests a favorable growth outlook relative to its earnings. In comparison to its peers, Associated Alcohols & Breweries demonstrates a competitive edge, particularly against companies like Tilaknagar Industries and Sula Vin...

Read MoreAssociated Alcohols & Breweries Adjusts Valuation Amid Competitive Industry Landscape

2025-03-24 08:00:51Associated Alcohols & Breweries has recently undergone a valuation adjustment, reflecting its current standing within the breweries and distilleries sector. The company's price-to-earnings ratio stands at 38.69, while its price-to-book value is noted at 6.53. Other key metrics include an EV to EBIT ratio of 29.95 and an EV to EBITDA ratio of 25.45, indicating its operational efficiency relative to its enterprise value. The company has demonstrated a solid return on capital employed (ROCE) of 15.58% and a return on equity (ROE) of 16.88%, showcasing its profitability and effective management of shareholder equity. Despite these strengths, the valuation adjustment positions the company in a more moderate light compared to its peers. In comparison, Tilaknagar Industries is noted for its higher price-to-earnings ratio of 25.96, while Globus Spirits and Som Distilleries exhibit varying valuation metrics that h...

Read More

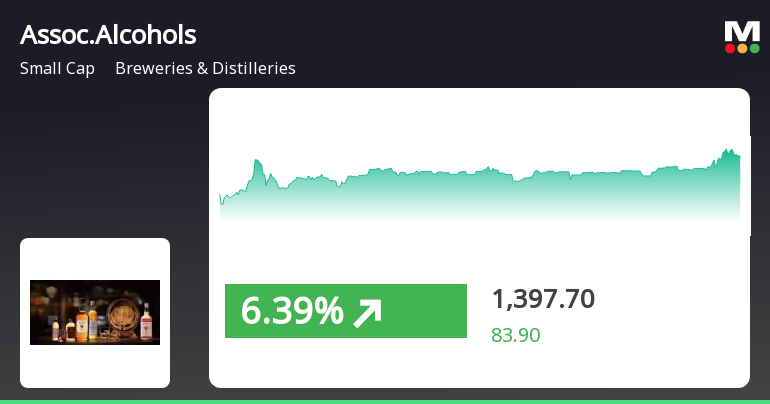

Associated Alcohols & Breweries Shows Strong Momentum Amid Broader Market Gains

2025-03-17 14:50:20Associated Alcohols & Breweries has demonstrated strong performance, gaining 7.25% on March 17, 2025, and reaching an intraday high of Rs 1409. The company has consistently traded above key moving averages and has shown remarkable growth over various time frames, highlighting its robust market position.

Read More

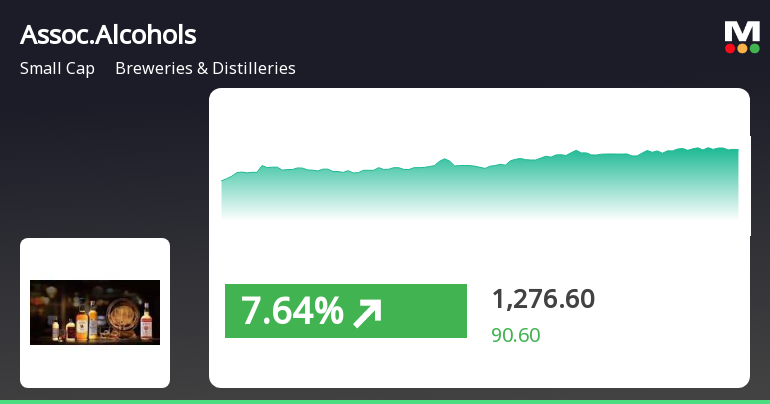

Associated Alcohols & Breweries Demonstrates Strong Market Momentum Amid Broader Small-Cap Gains

2025-03-07 10:55:52Associated Alcohols & Breweries has demonstrated strong market performance, gaining significantly on March 7, 2025. The stock has consistently risen over three days, reflecting robust momentum. It is trading above key moving averages and has delivered impressive returns over the past year, outperforming the broader market.

Read MoreTechnical Indicators Show Mixed Signals for Associated Alcohols & Breweries Amid Strong Long-Term Performance

2025-03-07 08:03:08Associated Alcohols & Breweries, a small-cap player in the breweries and distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1186.00, showing a slight increase from the previous close of 1165.00. Over the past year, the stock has demonstrated significant resilience, achieving a remarkable return of 131.53%, compared to a modest 0.34% return from the Sensex. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The Moving Averages indicate a bullish sentiment on a daily basis, while the MACD shows a bullish trend on a monthly scale. Bollinger Bands also reflect a bullish outlook for both weekly and monthly assessments. However, the On-Balance Volume (OBV) presents a mildly bearish signal on a weekly basis, contrasting with its bullish monthly performance. The compan...

Read More

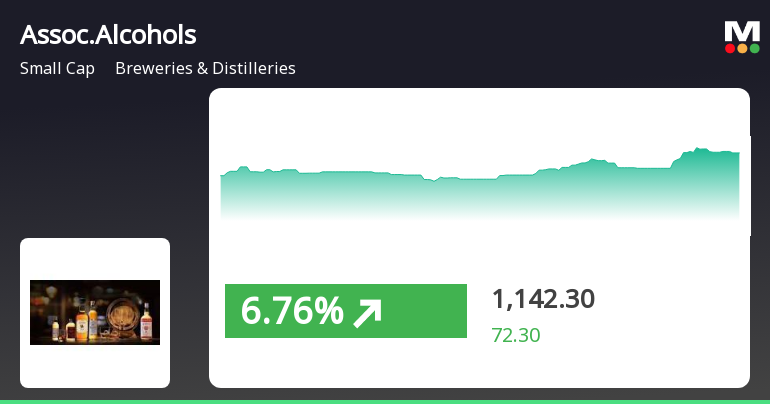

Associated Alcohols & Breweries Shows Resilience Amid Broader Market Trends

2025-03-05 11:50:23Associated Alcohols & Breweries experienced notable stock activity, reversing a three-day decline with a significant increase. The stock outperformed its sector and demonstrated resilience with a substantial year-over-year gain, while the broader market, represented by the Sensex, also saw a sharp rise despite remaining near its 52-week low.

Read MoreAssociated Alcohols & Breweries Shows Signs of Market Sentiment Shift Amid Volatility

2025-03-05 09:35:11Associated Alcohols & Breweries Ltd, a small-cap player in the Breweries & Distilleries industry, has shown significant activity today, opening with a gain of 6.54%. This marks a notable trend reversal after three consecutive days of decline, indicating a potential shift in market sentiment. The stock reached an intraday high of Rs 1139.95, outperforming its sector by 2.01%. In terms of performance metrics, Associated Alcohols & Breweries has demonstrated a 1-day gain of 3.12%, significantly surpassing the Sensex's performance of 0.63%. However, over the past month, the stock has faced challenges, with a decline of 20.33%, compared to the Sensex's drop of 6.16%. When examining moving averages, the stock is currently positioned higher than the 100-day and 200-day moving averages, yet remains below the 5-day, 20-day, and 50-day moving averages. This mixed performance highlights the stock's current volatili...

Read MoreTechnical Trends Indicate Mixed Signals for Associated Alcohols & Breweries Stock Performance

2025-03-03 08:01:31Associated Alcohols & Breweries, a small-cap player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,086.80, down from a previous close of 1,180.00, with a notable 52-week high of 1,496.30 and a low of 459.05. In terms of technical indicators, the weekly MACD shows a mildly bearish trend, while the monthly perspective remains bullish. The Bollinger Bands indicate a mildly bullish stance on both weekly and monthly charts, suggesting some stability in price movements. The daily moving averages also reflect a mildly bullish trend, while the KST and OBV metrics present a bullish outlook on a monthly basis. When examining the company's performance relative to the Sensex, Associated Alcohols & Breweries has shown significant resilience over the long term. Over the past year, the stock has returned 10...

Read MoreTechnical Trends Indicate Mixed Signals for Associated Alcohols & Breweries Amid Market Dynamics

2025-03-02 08:01:30Associated Alcohols & Breweries, a small-cap player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,086.80, down from a previous close of 1,180.00, with a notable 52-week high of 1,496.30 and a low of 459.05. Today's trading saw a high of 1,169.75 and a low of 1,078.85. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bearish trend on a weekly basis while remaining bullish monthly. Bollinger Bands reflect a mildly bullish stance in both weekly and monthly assessments. Moving averages on a daily basis also suggest a mildly bullish trend. Notably, the KST and OBV indicators are bullish on a monthly basis, indicating some underlying strength. In terms of returns, the company has shown resilience over the long term, with a remarkable 397.62% ret...

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

05-Apr-2025 | Source : BSEReceipt of order

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg 74(5) SEBI (DP) Regulations 2018 Q4 2024-25

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Associated Alcohols & Breweries Ltd has declared 20% dividend, ex-date: 26 Jul 24

No Splits history available

Associated Alcohols & Breweries Ltd has announced 1:1 bonus issue, ex-date: 10 Mar 16

No Rights history available